~reposted from pebblewriter.com...

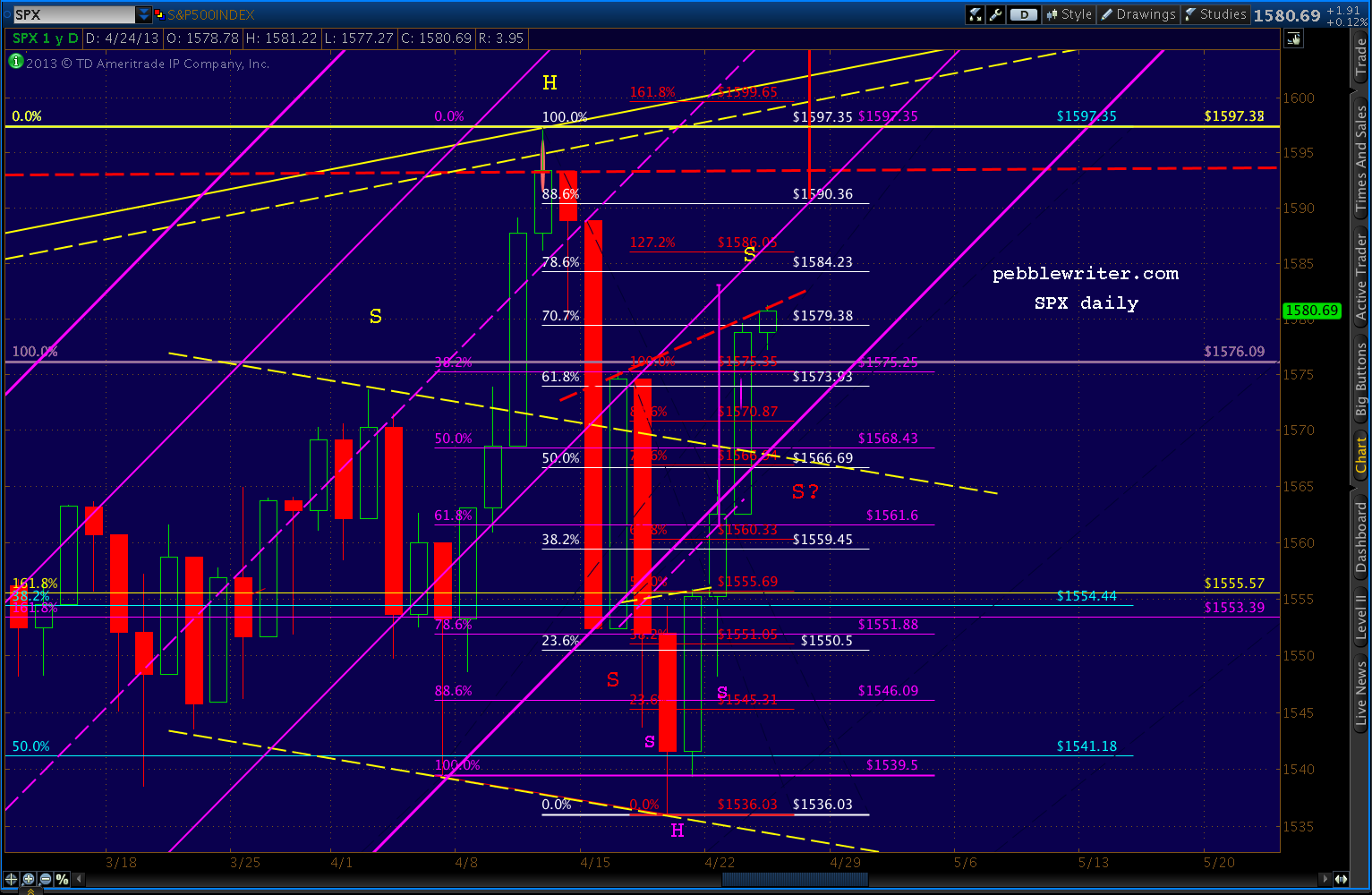

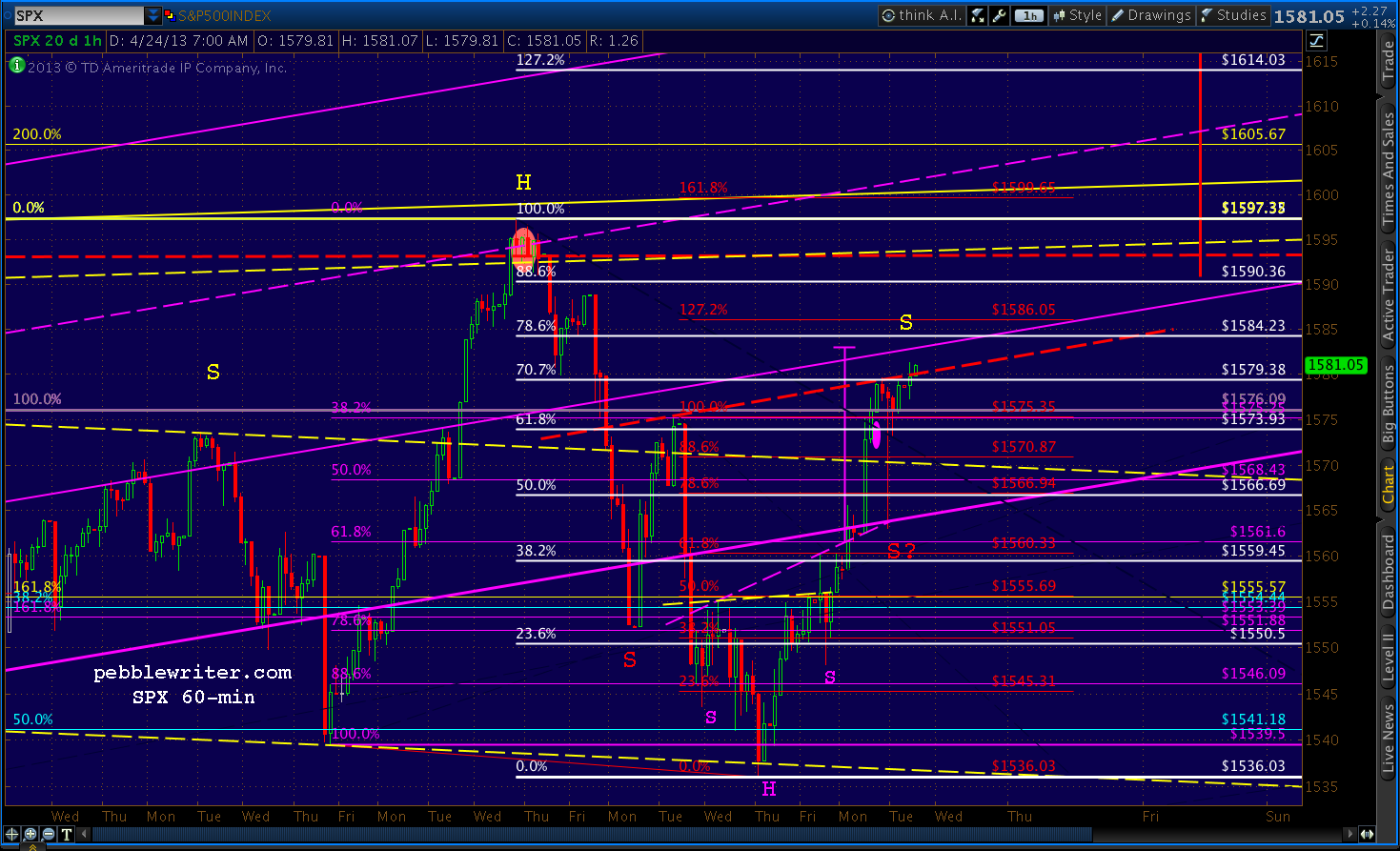

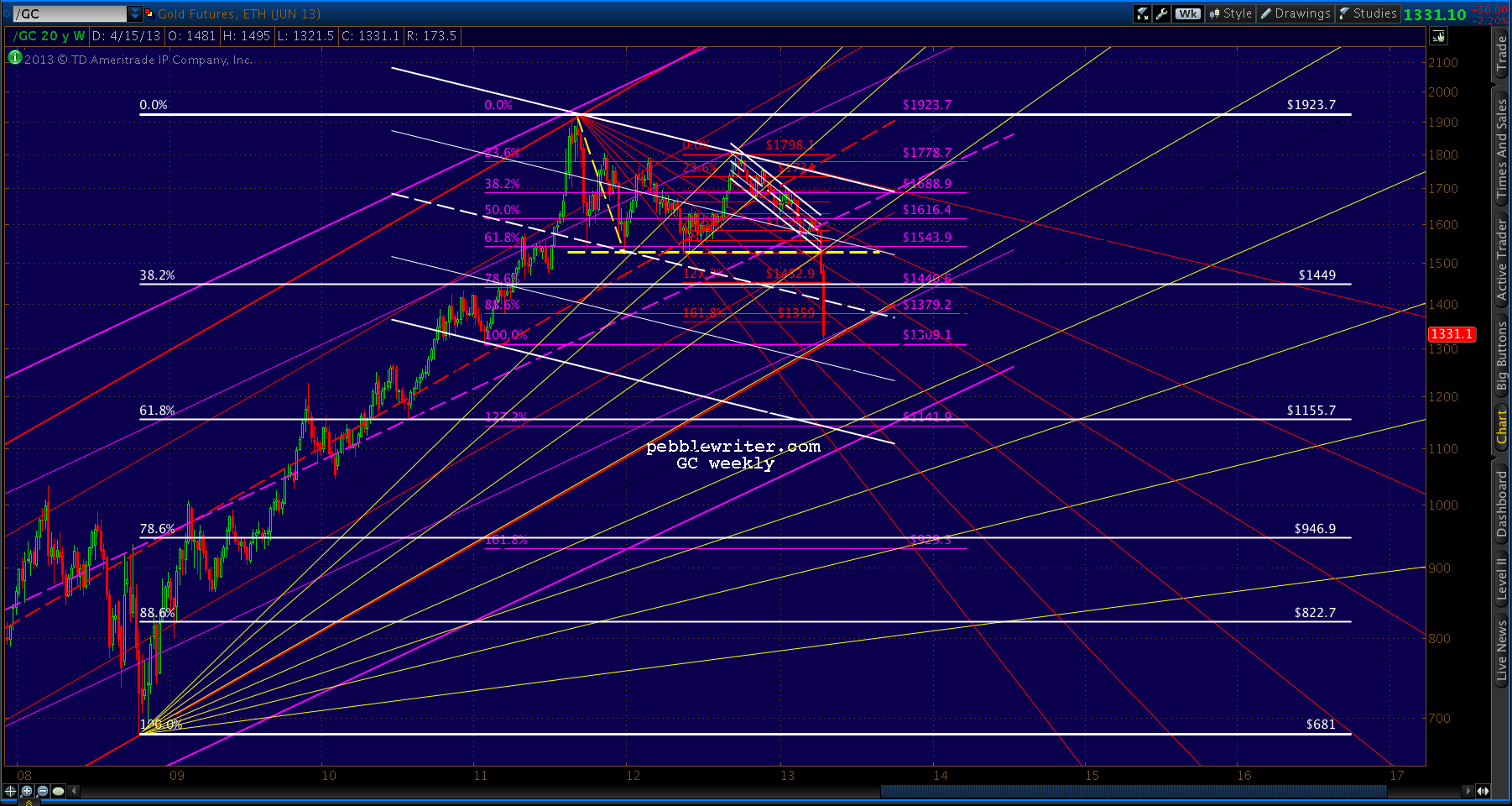

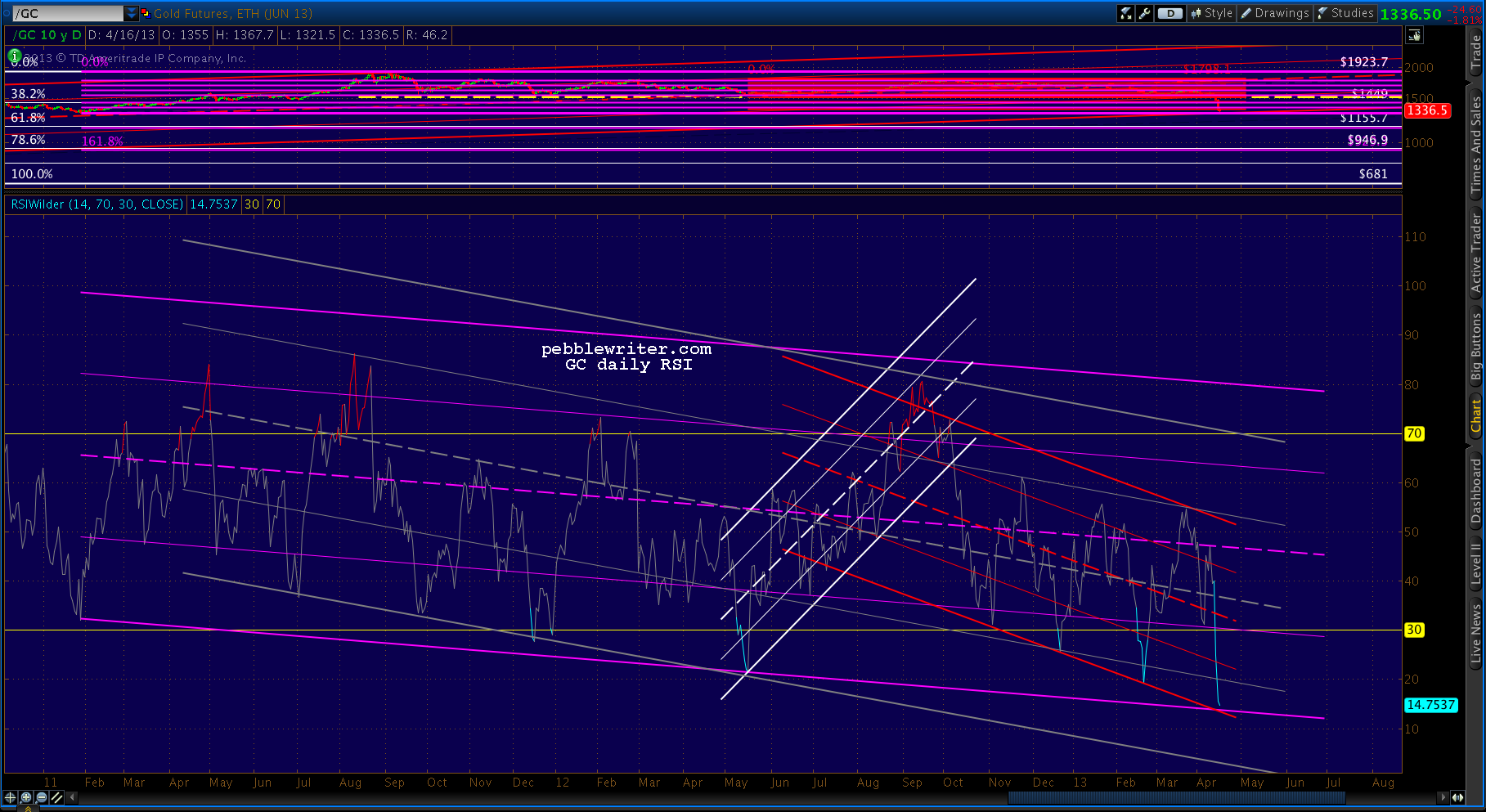

Looks like we're going to hit our downside target after all, thanks

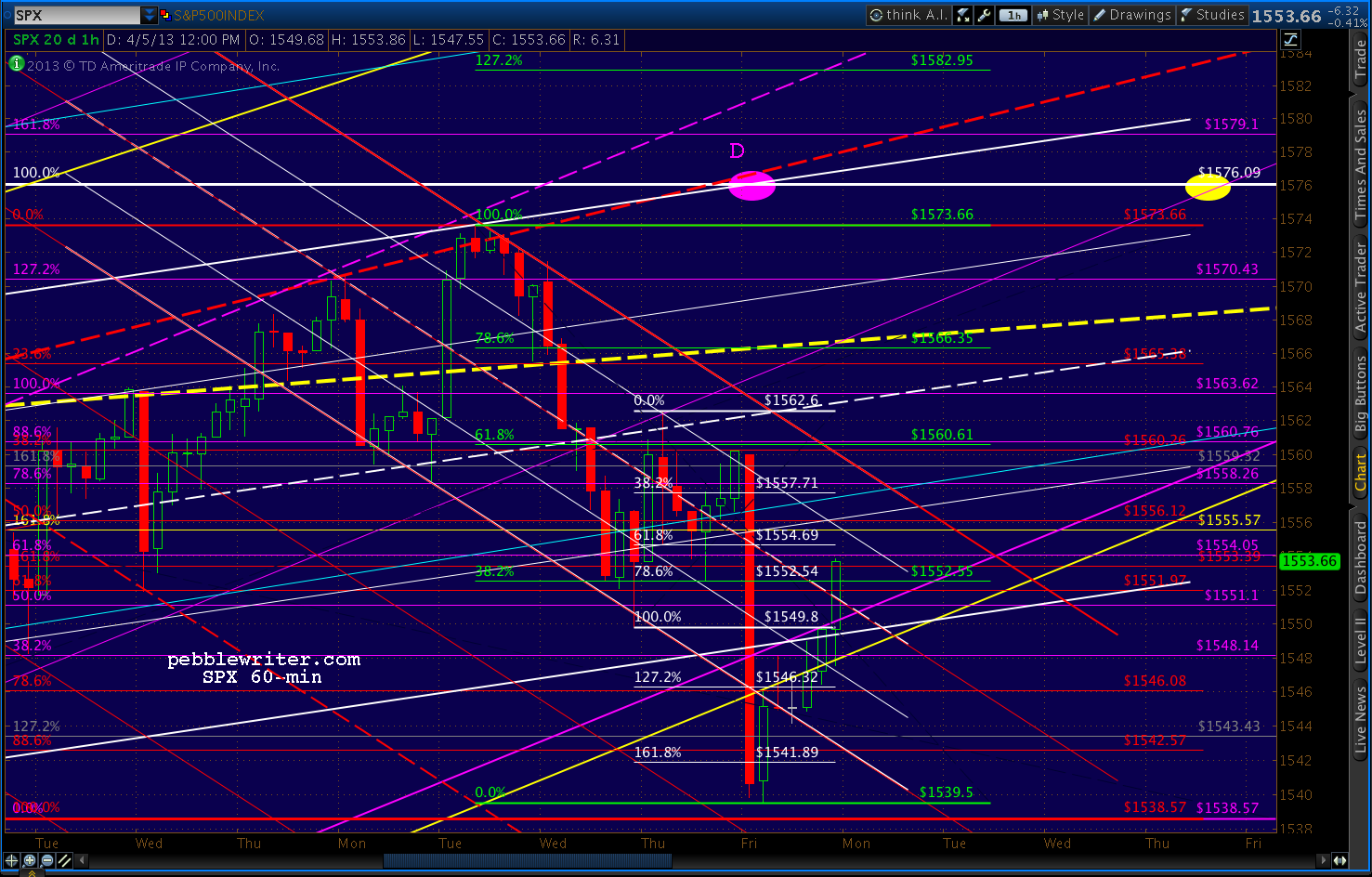

to a dismal payroll number. I've had 1546.08 as my top choice [

CIW Apr 3, 2:25 update for members.]

I’m

inclined to stay short for the purple channel bottom at 1546.08 or the

1.618 at 1549.09, with stops at 1558.47ish. But, anyone who doesn’t

mind the extra trading might consider going long here — with the

understanding we might run into trouble at the channel top (small

falling white) at 1558 or so.

But, if the downside momentum builds, 1542.57 is definitely in reach.

I'll play the downside on the opening, but be ready to bail at those levels.

A drop through 1538 opens up much lower prices and essentially busts the channel that dates all the way back to November's 1343.

UPDATE: 9:33 AM

I think it's worth taking a shot on any loss of momentum just shy of 1538.57 (lower really damages the bullish case.)

So I'll take a stab here at 1539.86. Going long again with stops at 1538.

Note

that at these prices, SPX has completed a Head & Shoulders pattern,

albeit with a very steep slope. But, it's not verified unless we close

below 1545 or so. Even then, we've had two such (normally very

reliable) bust in the past several weeks.

If drops like this morning's make you nervous, the market makers have done their jobs. Remember, this morning's plunge is

by design. The open interest on the SPY 155 weekly calls that expire

today, for instance, is 97,000 contracts.

Each

contract gives you the right to buy 100 shares of SPY at 155 through

today. It's the equivalent of SPX 1550. They're currently trading at

12 cents (probably a good deal.) But, three days ago -- when SPX nudged

into the 1570's -- market makers would have been happy to sell you all

you wanted at 2.33.

A $23,300 "investment" in 100 contracts at the

high would be worth $1,200 -- a 95% loss in 3 days. This is an example

of the typical game played by market makers who just

love optimists.

They

love pessimists, too, and just sold a boat load of puts this morning to

those expecting this morning's plunge to keep going to 1500.

It's

taken me a couple of years to come to the conclusion: if you can get

the kind of results we do without leverage and without options, why take

the risk? It's hard enough to be right on the direction and magnitude

of a move, without having to be right on timing too.

Even if we

had held long instead of shorting at 1573 on Tuesday, we'd be down a

whopping 1.7%. Beats the heck out of -95%. By shorting, we actually

made money.

* * *

I met an old friend for coffee yesterday, and we talked about pebblewriter.com and my investment strategy. He asked if

the results we got this past year weren't simply attributable to a great market. The question took me by surprise.

The

S&P 500 was up 8.75% between Mar 22, 2012 (our inception) and Feb

28, 2013 (without dividends.) That includes a 12.8% gain from Nov 16 -

Feb 28. I guess the MSM has done a bang-up job of selling this as a

"great market."

But, the question did get me to thinking. As of

Feb 28, just shy of a year since inception, we were up about 113% in a

theoretical portfolio where we bought SPX at called bottoms and shorted

at called tops.

Forty-eight percent of our gains came from long

positions and 52% from short positions. In other words, we benefited

slightly more from declines than from rallies. Unlike almost all

long-short funds, we did it by being either long

or short, depending on my outlook.

The major moves during that period were:

- Apr 2 - June 4, 2012 (1422 to 1266, an 11% decline)

- June 4 - Sep 14, 2012 (1266 to 1474, a 16.4% rally)

- Sep 14 - Nov 16, 2012 (1474 to 1343, an 8.9% decline)

- Nov 16, 2012 - Feb 28, 2013 (1343 to 1515, a 12.8% rally)

So, anyone who captured

all

of those major moves earned about 49% -- much better than the

buy-and-hold approach of 8.75%. They would have had short-term rather

than long-term capital gains; but, anyone with a marginal tax rate below

85% wouldn't have minded.

My

objective is simply to capture most of the moves most of the time. If

49% represents the most we might have earned by capturing

all the major moves

all of the time, we apparently earned about 64% by playing interim moves -- going long and short.

Shorting

the market scares some people. When I was a shiny new broker back in

the Middle Ages, all they had to say was "when shorting, you have

unlimited losses." It sure scared me -- which was the point.

But,

by using stops this past year, we limited our single biggest losing

trade to 1.5%. There's always the possibility of a 10% gap down, but by

using e-minis rather than cash markets and going to cash in precarious

situations, that risk can be greatly reduced.

What I find

really

risky is buy-and-hold investing, where investors hold long through

10-20% declines. If your name's Buffett, no big. But, if you need

money for a wedding/college education/vacation house in a few months,

and that 10% decline turns into 58% (2007-2009), 51% (2000-2003) or even

22% (May-Nov 2011)?

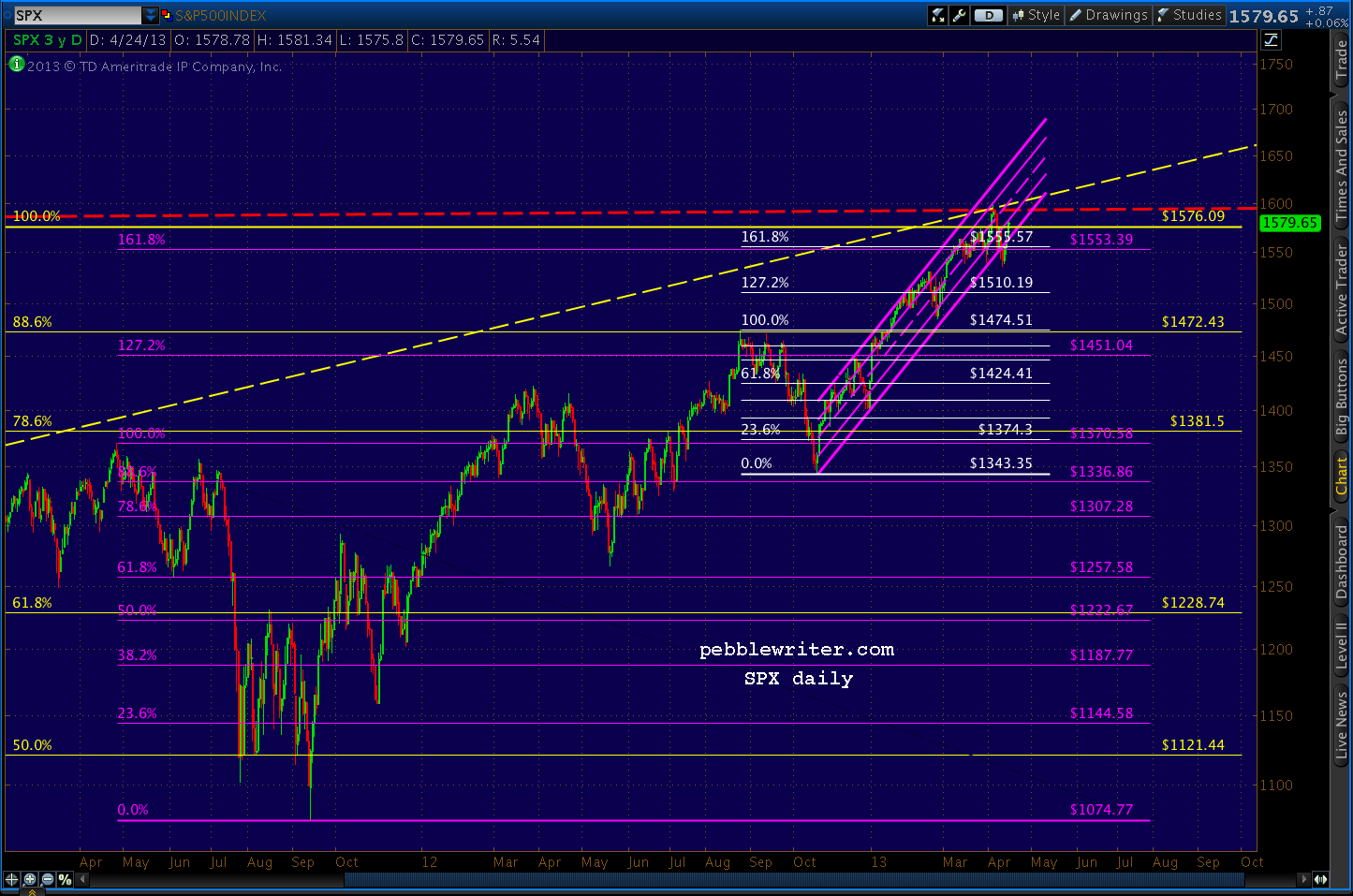

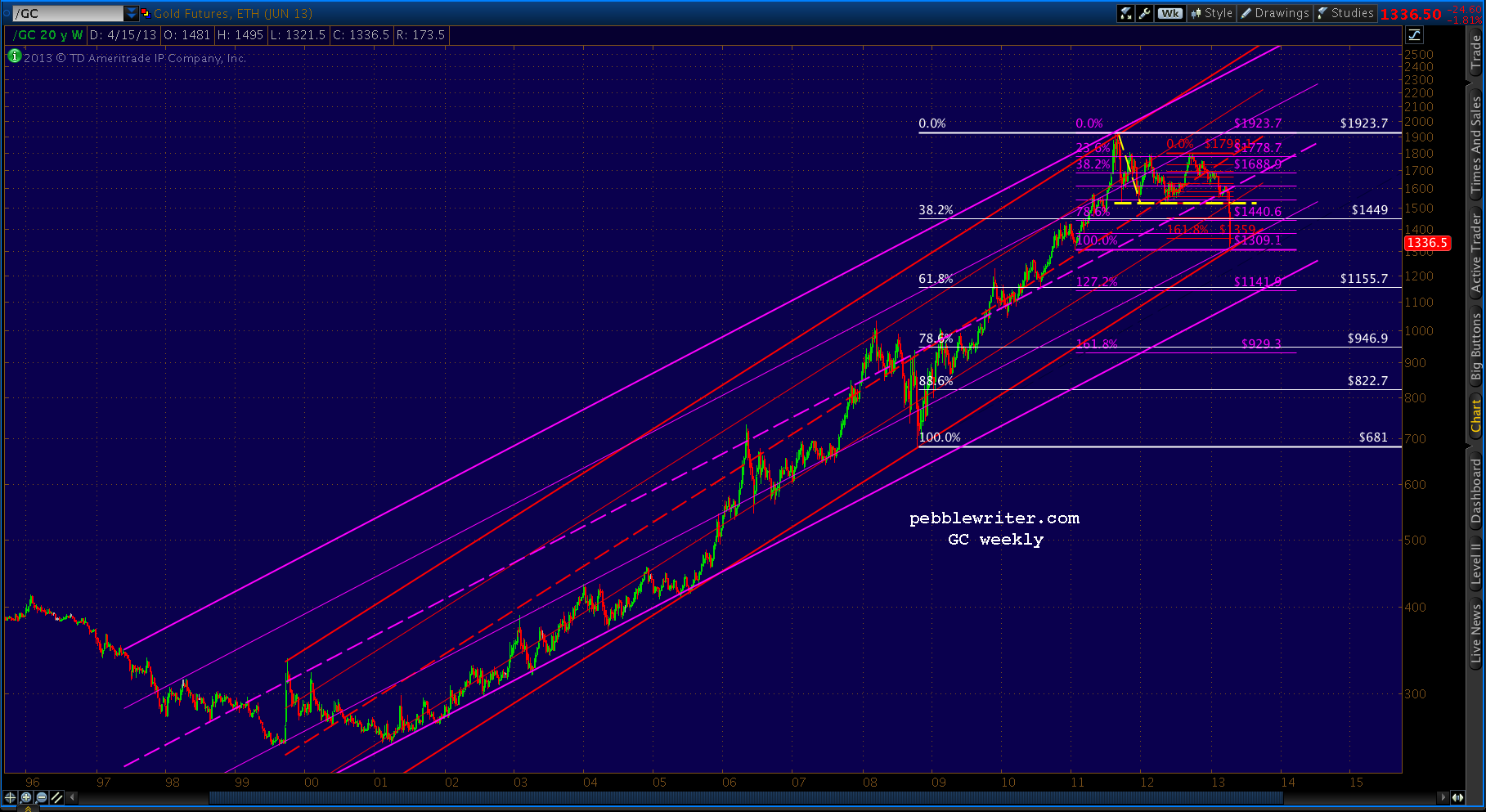

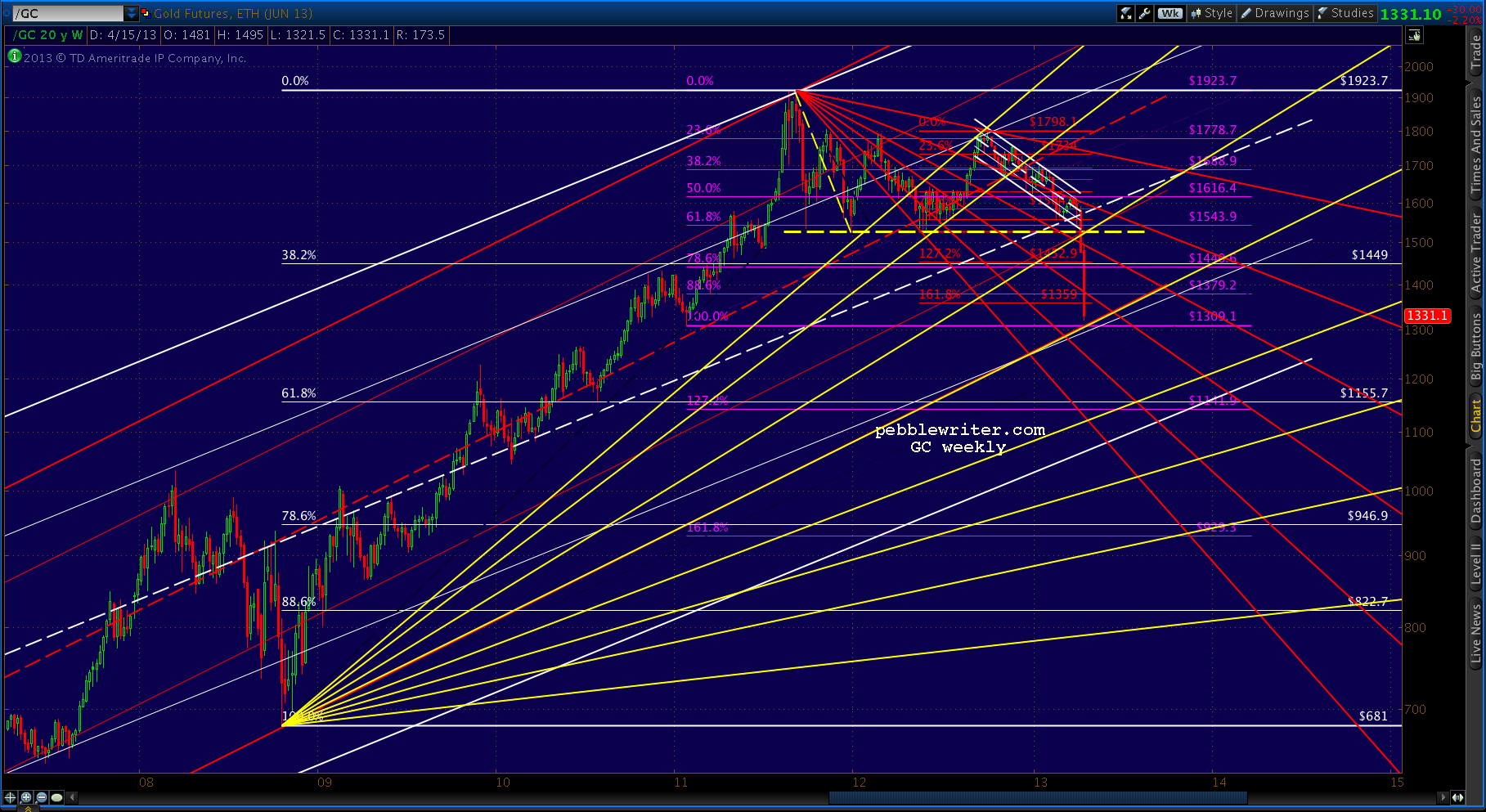

Everyone's talking about whether the S&P

500 will make a new all-time high, topping 2007's 1576.09. But, after

inflation, it's still down about 25% from its 2000 peak. The real

Nasdaq is down over 50%. For someone planning to retire,

that's risk.

One

final thought...the beauty of our strategy is it provides concrete

decision points. If you buy AAPL at 500 based on the hype around the

new iWatch and the stock falls the following day to 490, should you

hold? What if it falls to 460?

What if the iWatch is released and

the stock only recovers to 485? Do you sell? Double down? Wait for

the sales numbers? Wait for the next quarterly report? At what point do

you pull the plug?

Between Harmonics and chart patterns, we're

rarely left without a sense of whether our investment thesis is correct

or not. Even a simple channel will usually tell you if you're on the

right track.

In early December 2012, we had been following an

analog that had earned us over 10% per month -- forecasting all the

major moves since the previous March. The analog called for a reversal

and move lower from either at 1424 or 1446.

I tried shorting both

times, giving up a few points before it became apparent the market

wasn't going to tumble. The same thing happened a few weeks later, when

the Fiscal Cliff "solution" sent the market gapping higher after New

Years Day.

There were multiple potential targets to the upside, so

I have tested the short waters many times on the way up from 1474 to

1573. It's always fun (and more profitable) to be right for a big

score, but by managing my exposure and paying attention to the trends,

I've still pulled in decent returns without taking undue risks (March

update coming this afternoon.)

I will continue refining the

strategy and trading techniques in anticipation of our new fund that I

anticipate coming out next month. I have developed a distribution list

for those who have expressed interest in getting more info. If you'd like to be on it but

haven't yet contacted me, please

CLICK HERE.

* * *

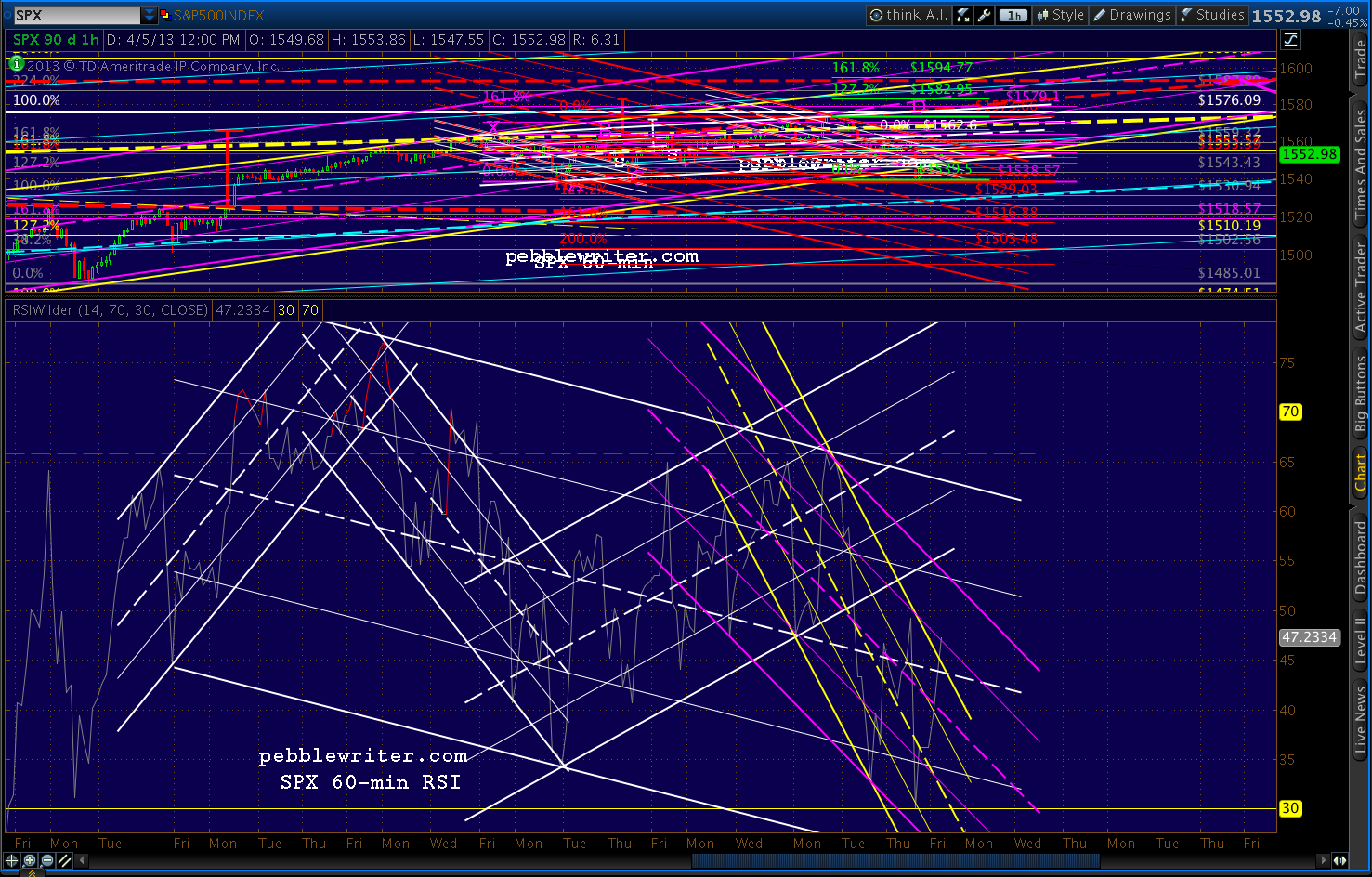

UPDATE: 3:50 PM

The

market has rebounded nicely since this morning's 1539.50 low. Anyone

too wigged out about Cyprus, the NFP number, Korea, etc. should take the

money and run. Forget about the market and enjoy your weekend.

But,

60-min RSI just broke out of the most severe of the bearish channels

and SPX should have no trouble reaching 1560 either today or Monday.

What it does

then matters a lot, but I suspect our forecast is still intact.

I'll hold long unless we reach 1560 today, at which point I'd probably go to cash. Stay tuned.

UPDATE: 4:05 PM

Nice

safe close, back in the loving arms of both the purple channel and the

white channel. I'll update the forecast later this afternoon, but I

believe we're in good shape re the forecast.

Oh... and

congratulations to anyone who bought SPY 155 calls at 12 cents earlier

(they traded up to .38 shortly before the close.) Take the money and do

something nice for somebody deserving. Karma and all that...

More later.