reposted from pebblewriter.com:

The dollar and the euro each slightly overshot our short-term targets, but are resuming the path we mapped out for them last week.

The EURUSD came very close to a key .886 Fib level, prompting many to wonder "was that it?" I wasn't so sure, myself. The resultant sell-off was pretty convincing, taking out the previous low.

It has reversed as we expected it would overnight, and appears to be taking a run at 1.2588. If it can break that level, it should complete a measure move to the .886 at 1.2617.

The dollar, meanwhile, bounced hard off the channel midline as expected, and has resumed its decline to the 1.272/.5000 at 80.83 - 80.88.

Each of them is at a smaller degree Fib .786 or so, meaning they're due for a pause here. And, if they can't seal the deal with a higher high (euro) or lower low (DX), then the party's over sooner rather than later.

But, I'm still operating under the assumption that we'll get at least one last push in this corrective wave before things come undone at Jackson Hole. I have yet to see any serious trial balloons regarding an imminent QE announcement. While not necessary, I would expect the very political Fed to do so, especially given the diatribe coming out of Tampa this week.

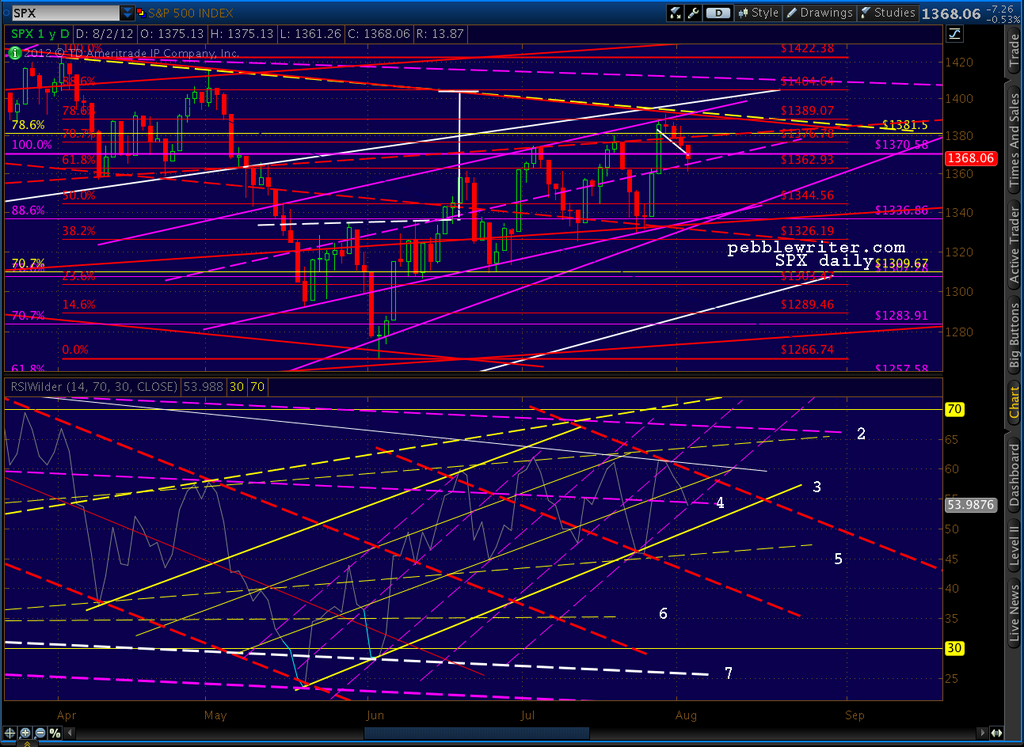

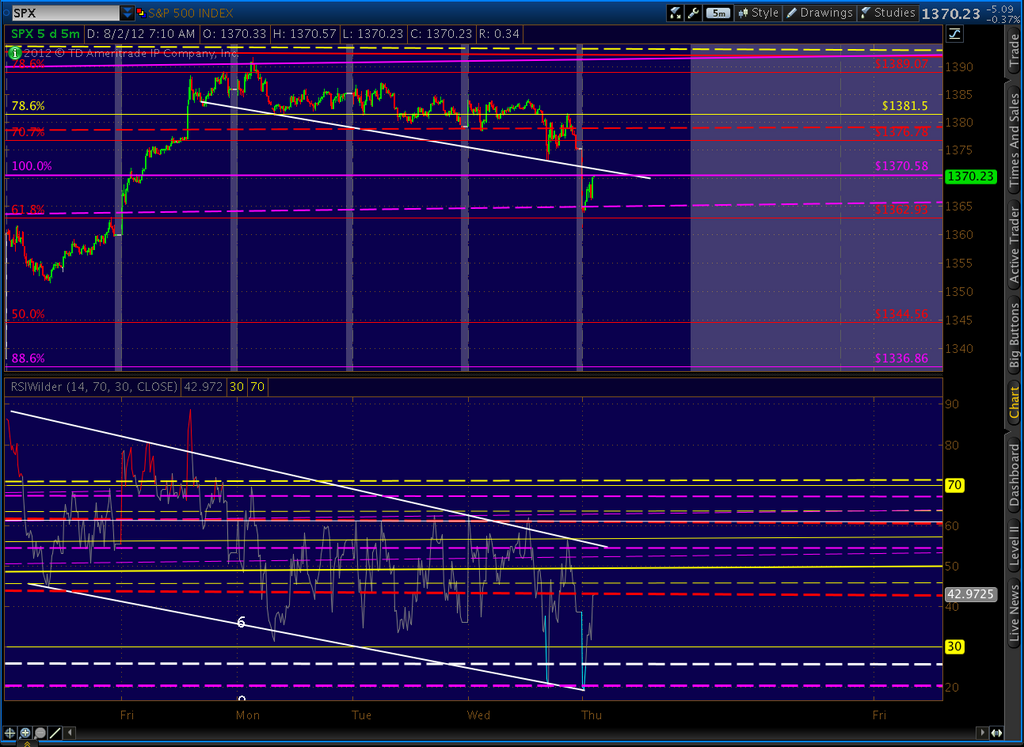

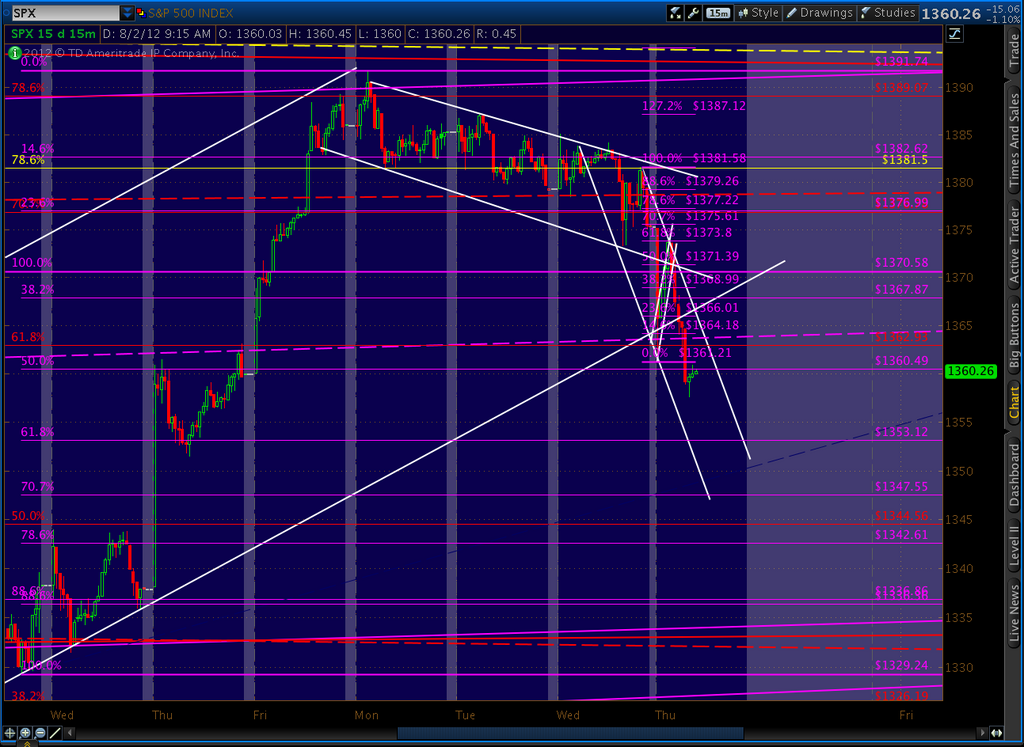

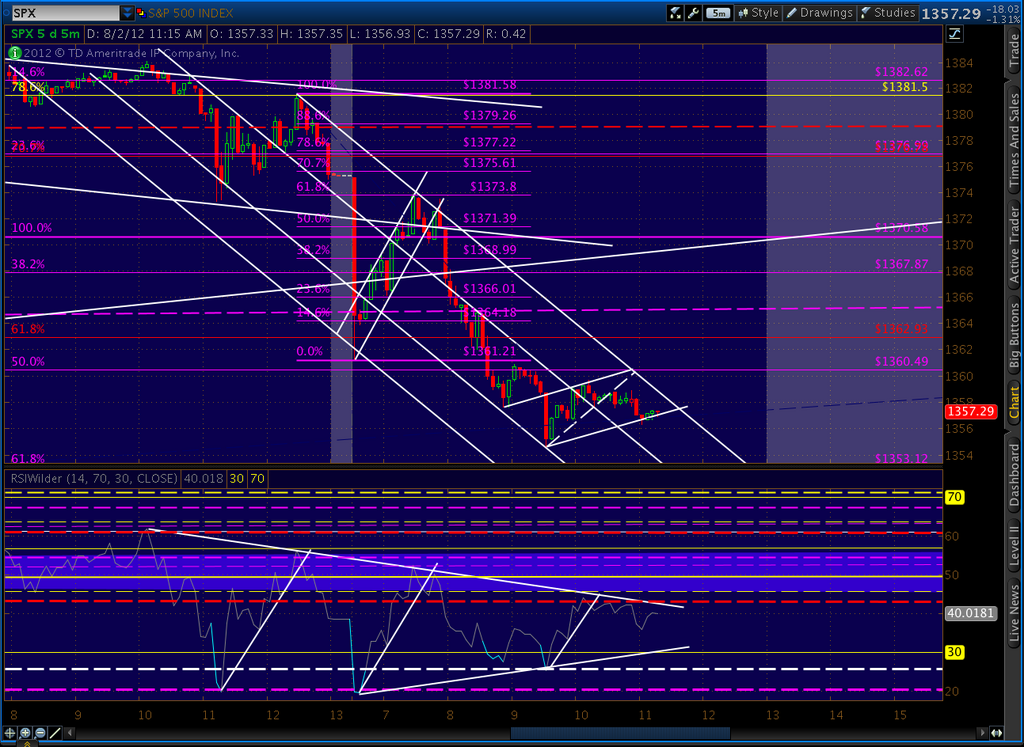

If DX and EURUSD are only in a corrective wave, can SPX break out to new highs as we wondered last week?

continued on pebblewriter.com ...

As we shuffle along towards Jackson Hole, I can't quite get lemmings out of my mind. Is that a field of clover we're rushing toward, or a cliff? QE3 is all anyone's talking about this week, but I still can't imagine the Fed playing this important card until it has no other choice.

From a technical standpoint, here are clear paths in either direction. If they announce QE3, or even hint strongly enough that it's coming, my initial targets are 1433 and 1451 (then 1464 and 1472.). If not, the market will tumble -- with targets starting at 1380 (then 1350 and 1300).

I focus on the "initial" targets, because much of what happens afterward is also subject to manipulation. If the news is "bad" and the market sells off, at some point BB will go on the air and explain he was just kidding. When he does this is anyone's guess, but I would imagine they'd want to keep the rising wedge intact.

If the news is "good", how long will it take for the markets to run out of steam? There are numerous harmonic targets that we've identified before [link here.] And, how long until prices at the pump and the grocery store -- already sky high due to the drought and Middle East tensions among other reasons -- begin to alarm consumers?

This morning's consumer confidence report already shows a drop from 65.4 to 50 (versus expectations of 66.) I guess higher prices is one way to increase spending -- albeit with a rather nasty boomerang effect. And, if inflation should become apparent, how long until higher interest rates -- the kiss of death to the $16 trillion crap game?

It's perhaps appropriate that the iconic scene of lemmings throwing themselves off a cliff in a suicidal version of follow-the-leader was also manipulated. The makers of the 1958 Disney documentary White Wilderness reportedly flew thousands of lemmings from Hudson Bay to Calgary where they were thrown over the cliff for dramatic effect.

If central bankers do "save" the global economy in the coming weeks by enacting QE3, it will no doubt be heralded by the media as a brave and noble deed. For anyone with any foresight, however, it's obvious this is just one step closer to the cliff.

Get the rest of the article as well as live intra-day market commentary at pebblewriter.com...

The dollar and the euro each slightly overshot our short-term targets, but are resuming the path we mapped out for them last week.

The EURUSD came very close to a key .886 Fib level, prompting many to wonder "was that it?" I wasn't so sure, myself. The resultant sell-off was pretty convincing, taking out the previous low.

It has reversed as we expected it would overnight, and appears to be taking a run at 1.2588. If it can break that level, it should complete a measure move to the .886 at 1.2617.

The dollar, meanwhile, bounced hard off the channel midline as expected, and has resumed its decline to the 1.272/.5000 at 80.83 - 80.88.

Each of them is at a smaller degree Fib .786 or so, meaning they're due for a pause here. And, if they can't seal the deal with a higher high (euro) or lower low (DX), then the party's over sooner rather than later.

But, I'm still operating under the assumption that we'll get at least one last push in this corrective wave before things come undone at Jackson Hole. I have yet to see any serious trial balloons regarding an imminent QE announcement. While not necessary, I would expect the very political Fed to do so, especially given the diatribe coming out of Tampa this week.

If DX and EURUSD are only in a corrective wave, can SPX break out to new highs as we wondered last week?

continued on pebblewriter.com ...

* * * * * * * *

As we shuffle along towards Jackson Hole, I can't quite get lemmings out of my mind. Is that a field of clover we're rushing toward, or a cliff? QE3 is all anyone's talking about this week, but I still can't imagine the Fed playing this important card until it has no other choice.

From a technical standpoint, here are clear paths in either direction. If they announce QE3, or even hint strongly enough that it's coming, my initial targets are 1433 and 1451 (then 1464 and 1472.). If not, the market will tumble -- with targets starting at 1380 (then 1350 and 1300).

I focus on the "initial" targets, because much of what happens afterward is also subject to manipulation. If the news is "bad" and the market sells off, at some point BB will go on the air and explain he was just kidding. When he does this is anyone's guess, but I would imagine they'd want to keep the rising wedge intact.

If the news is "good", how long will it take for the markets to run out of steam? There are numerous harmonic targets that we've identified before [link here.] And, how long until prices at the pump and the grocery store -- already sky high due to the drought and Middle East tensions among other reasons -- begin to alarm consumers?

This morning's consumer confidence report already shows a drop from 65.4 to 50 (versus expectations of 66.) I guess higher prices is one way to increase spending -- albeit with a rather nasty boomerang effect. And, if inflation should become apparent, how long until higher interest rates -- the kiss of death to the $16 trillion crap game?

It's perhaps appropriate that the iconic scene of lemmings throwing themselves off a cliff in a suicidal version of follow-the-leader was also manipulated. The makers of the 1958 Disney documentary White Wilderness reportedly flew thousands of lemmings from Hudson Bay to Calgary where they were thrown over the cliff for dramatic effect.

If central bankers do "save" the global economy in the coming weeks by enacting QE3, it will no doubt be heralded by the media as a brave and noble deed. For anyone with any foresight, however, it's obvious this is just one step closer to the cliff.

* * * * * * * *