~reposted from pebblewriter.com

I had dinner with one of our members the other day and got what I

think is some great advice: explain how one might best use

pebblewriter.com.

General Orientation

First,

I believe in market timing. While certainly not definitive proof, our

performance over the past three months makes a good argument. A

hypothetical, unleveraged portfolio that simply bought SPX when we

identified bottoms and sold short when we identified tops would be up

nearly 35% since the new site was launched on March 22 [see:

performance.]

So,

I focus on trying to determine where the markets might be headed over

the next few days or weeks. Active traders can take advantage of

anticipated swings, while buy and hold types can implement defensive

measures and/or tailor their asset mix accordingly.

I don't

suggest specific trades. Everyone has different investment objectives,

risk tolerance and cash flow needs. Some day traders, for instance, are

comfortable with futures or options and watch their investments like a

hawk. Others simply want to protect their trust fund or 401(k) from the

next crash. Most are somewhere in between.

My posts can be

somewhat dense. They often take an hour or more to write, and 10-20

minutes to read. And, they're additive -- meaning I don't re-explain

the big picture with every post. If you're new to PW or have been away

on vacation for a week or two, it helps to go back and catch up on the

past couple of weeks.

In general, I try to avoid posts like "the

monthly cycles guarantee the market's heading to 1390." The internet is

rife with these prognostications, and they're mostly worthless. If it

did go to 1390, how would we know whether it was a well thought-out

forecast or someone's lucky PO box number?

I try to explain the

reasoning behind my forecasts. This makes it easier for folks to

compare my forecast with others they might run across. You never know

when someone else has a better handle on things at the moment. And, I

guarantee you we won't earn 35% every quarter.

I also try to

convey the degree of my certainty. When I'm really torn between two

directions, or see the risk as being unusually high, I try to remember

to say so. This happens frequently, and often as not is the result of

market makers trying to wring the last cent out of bulls before a

downturn (and bears before an upturn.)

It will help to understand

some of the terminology I use -- especially the harmonic terms with

which many investors are unfamiliar. They are explained under the

"learn" tab. I'll post more chart patterns and definitions with

examples over time, but the markets have been so challenging lately I'm

working overtime just to keep up.

Process

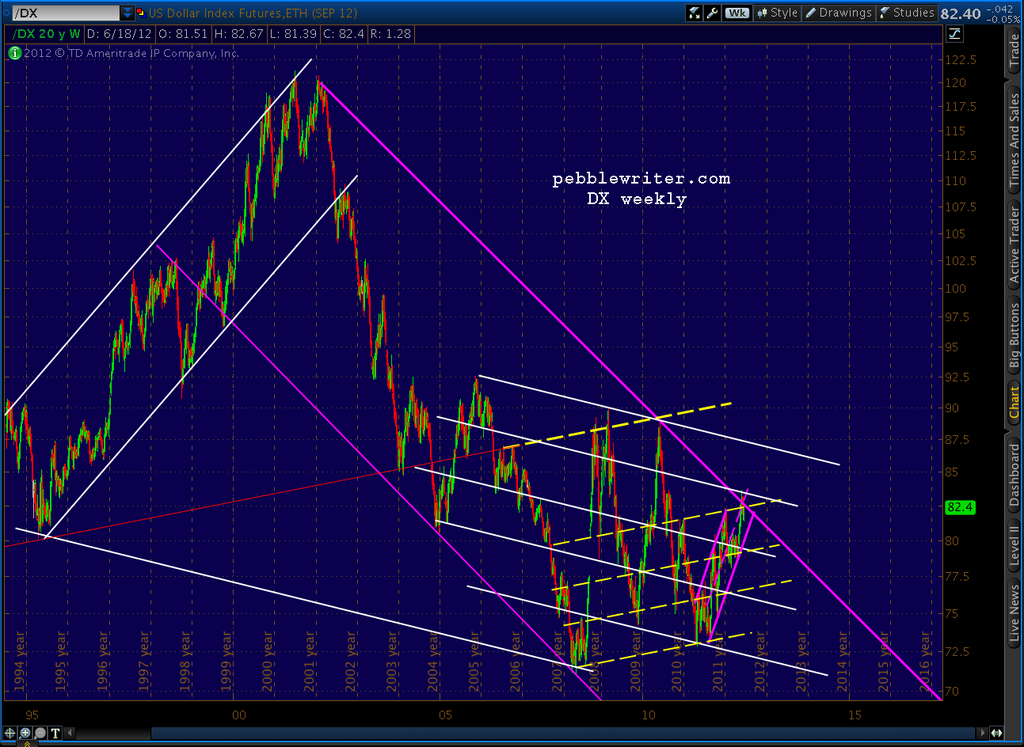

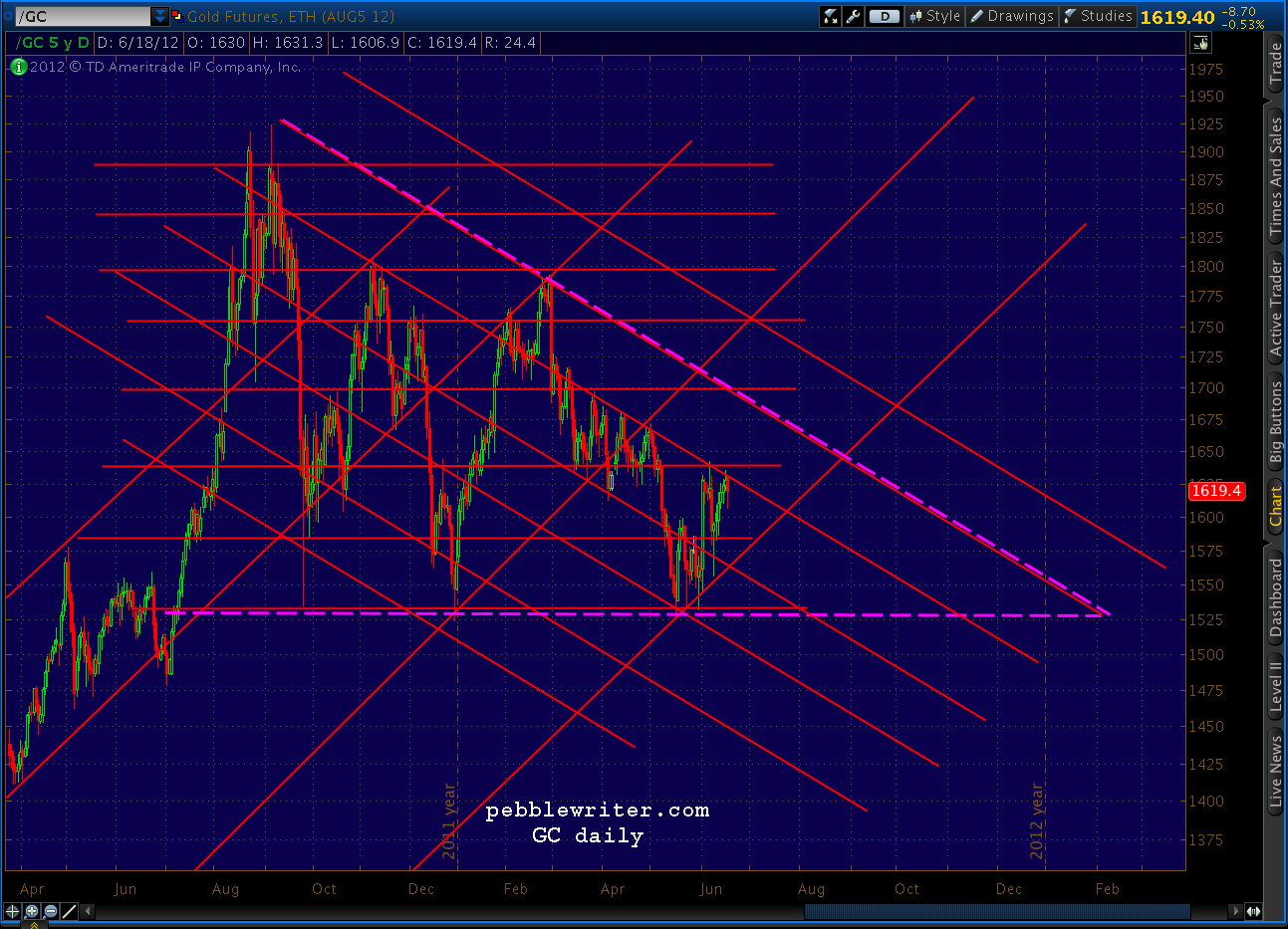

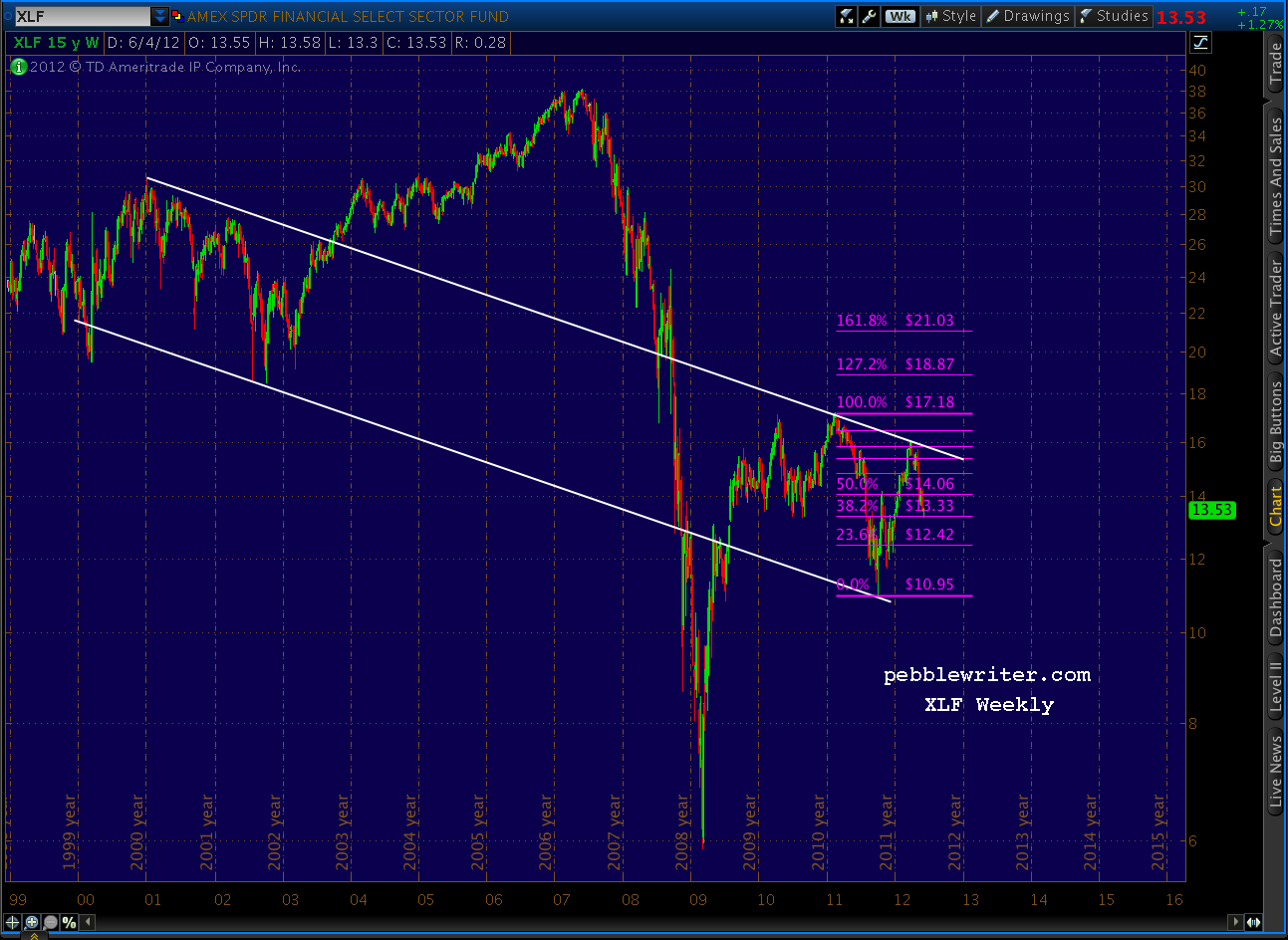

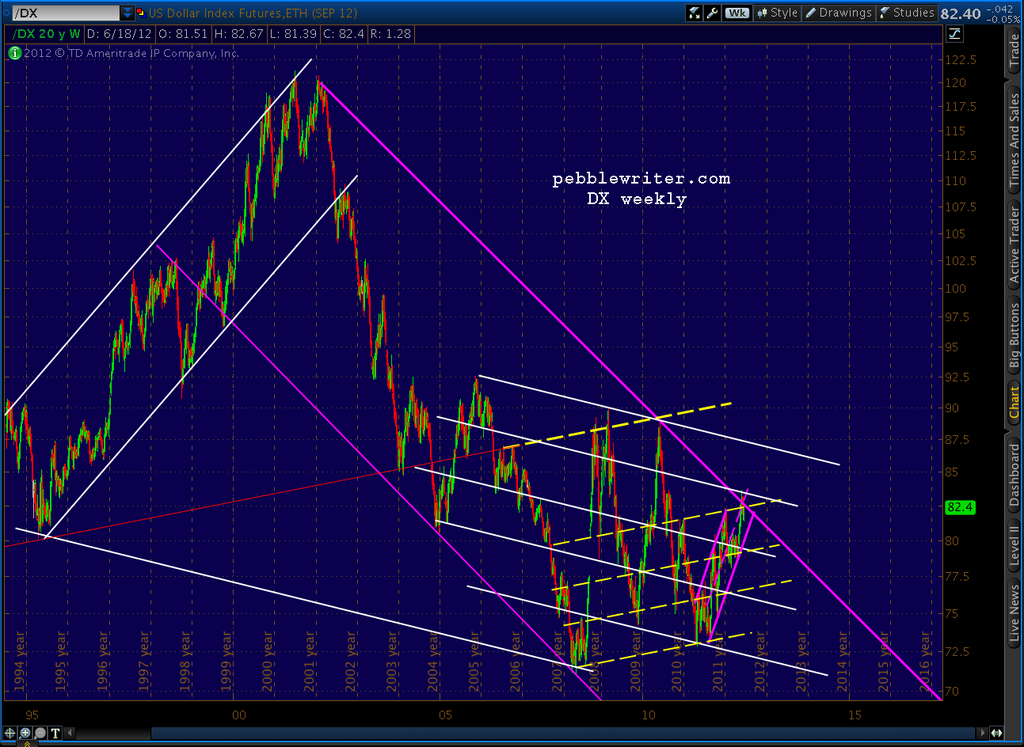

I

usually begin a forecast by observing major trend lines and channels

(parallel trend lines.) What do they say about the long-term trends?

There are often relevant channels that slope both up and down. Smaller

degree channels often run counter to the direction of larger degree

channels. And, it's not unusual to have channels within channels within

channels. The dollar is a great example.

In

general, prices moving in a channel tend to stay in that channel unless

acted upon by some other chart pattern or trend line. It's not hard to

see how the smaller channels conflict with the larger purple pattern.

Something's gotta give, and the consequences can spell danger or

opportunity depending on whether someone's properly positioned.

Larger/longer channels usually win, so a break from one is a big deal.

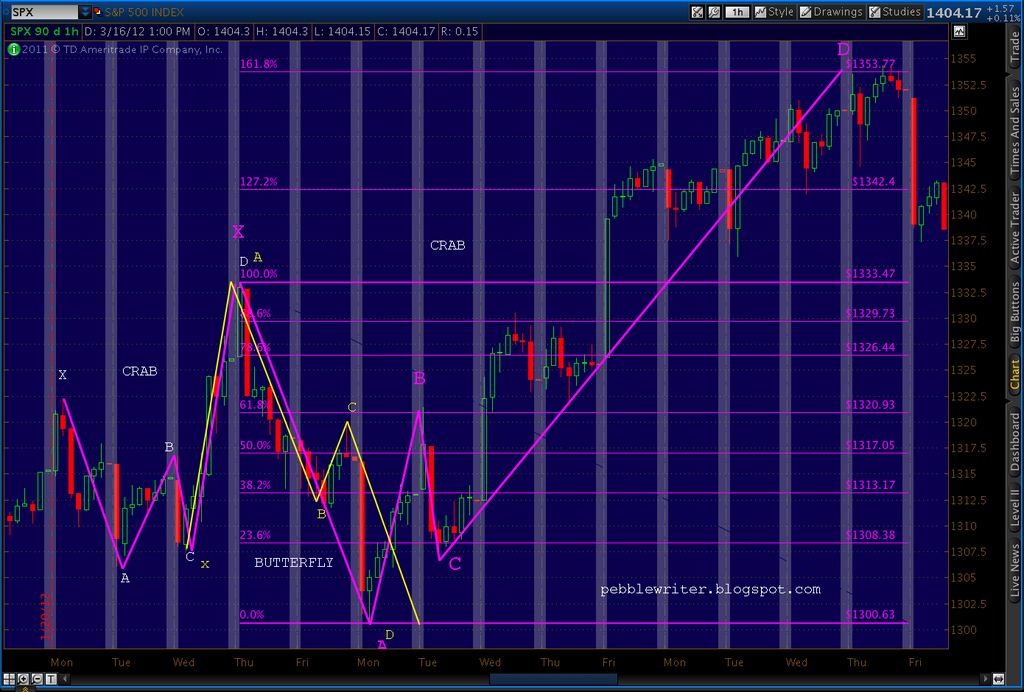

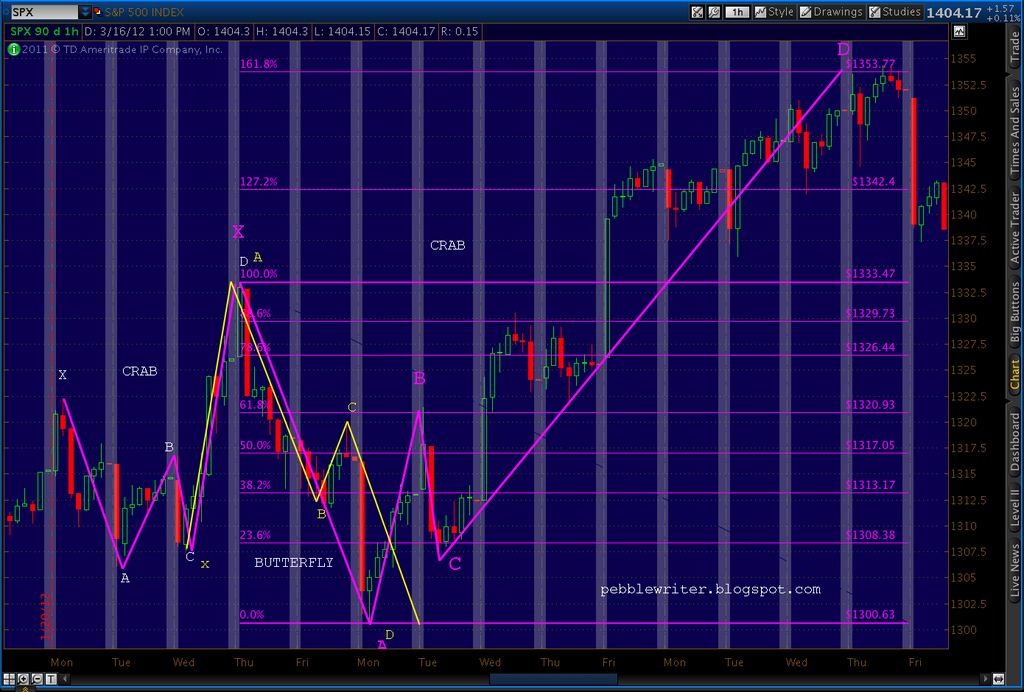

Once

I have a sense of what the channels indicate, I look at the harmonic

and other chart patterns. Like channels, harmonic patterns can be

nested inside one another and often conflict. They can also evolve,

such as when a Gartley completes at the .786 Fib level, but goes on to

form a larger Butterfly pattern, or a Butterfly completes within the XA

leg of a larger Crab pattern. Here's a great example from the

Butterfly pattern page.

It's

hard to keep track of all the various patterns. But, I've found it

extremely important to watch for both the patterns that track your

expectations and those that conflict. If nothing else, it helps to know

when the upside/downside case is helped or hurt by that day's price

action.

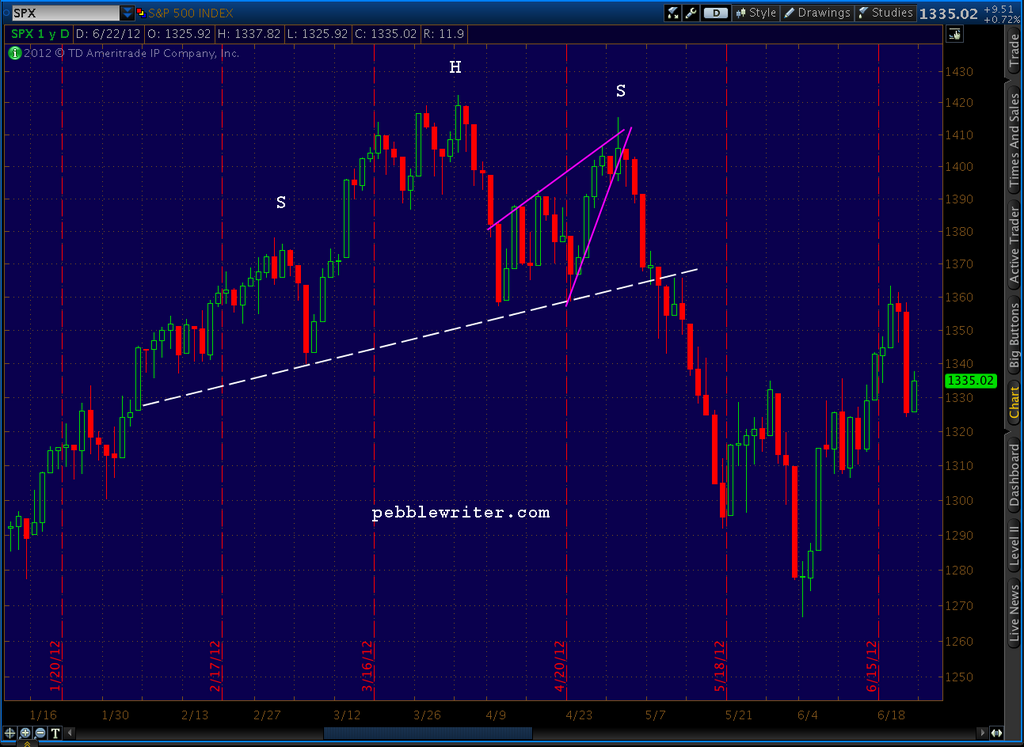

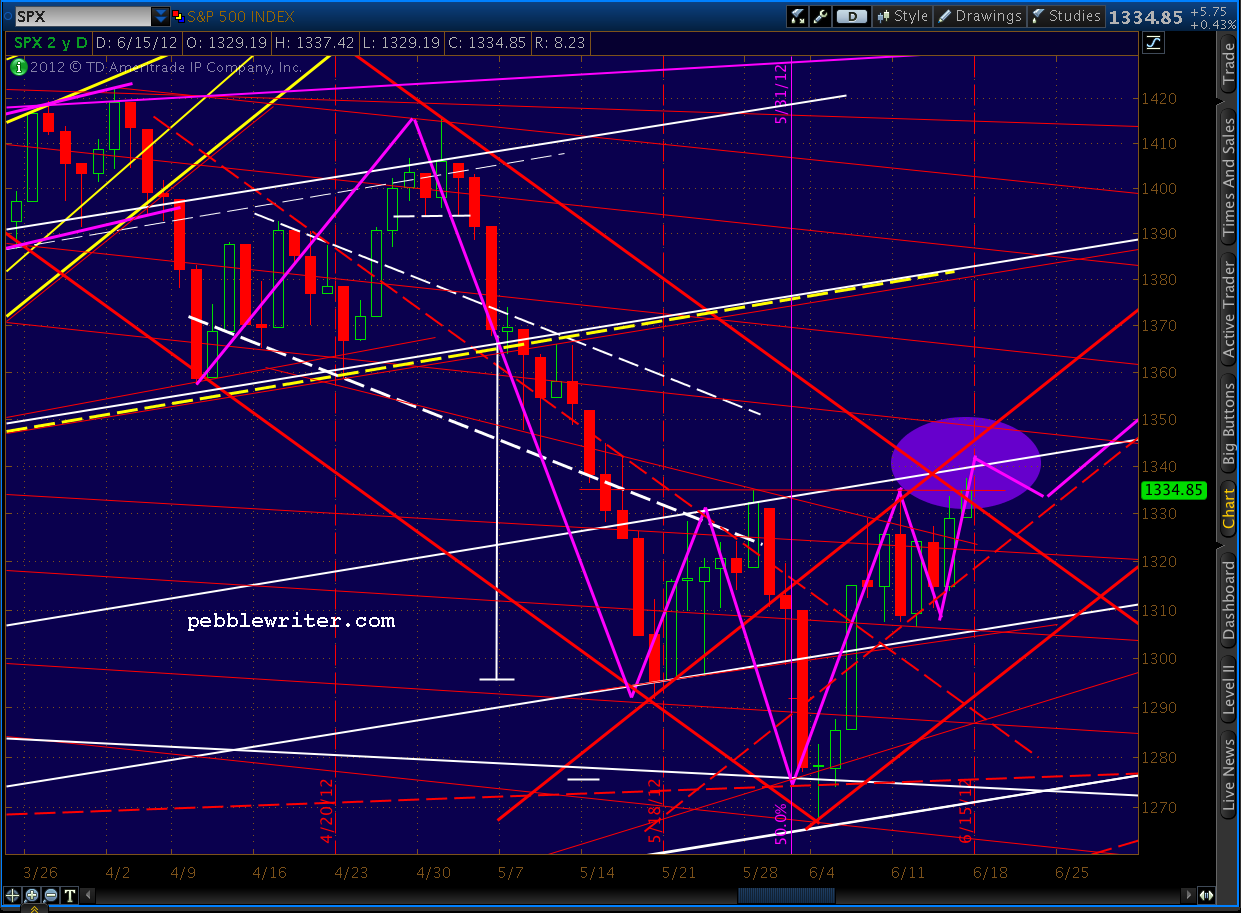

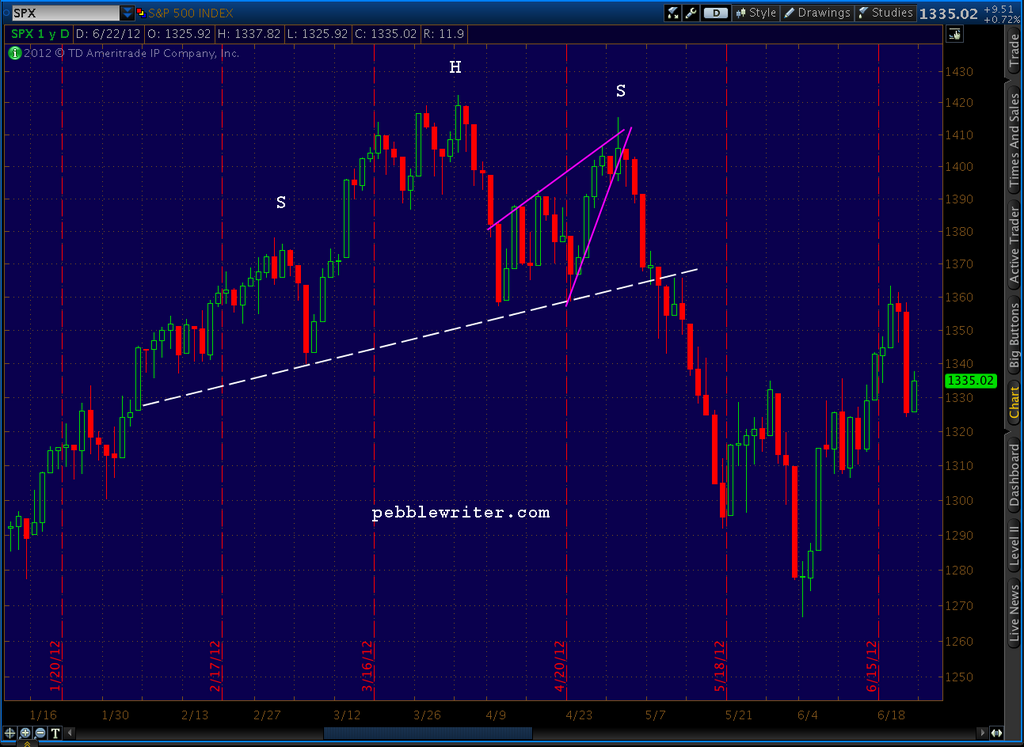

The same can be said for chart patterns such as Head &

Shoulder patterns or Wedges. It's not unusual, for instance, for a

Rising Wedge to set up in the right shoulder of a H&S pattern such

as recently happened in the S&P 500.

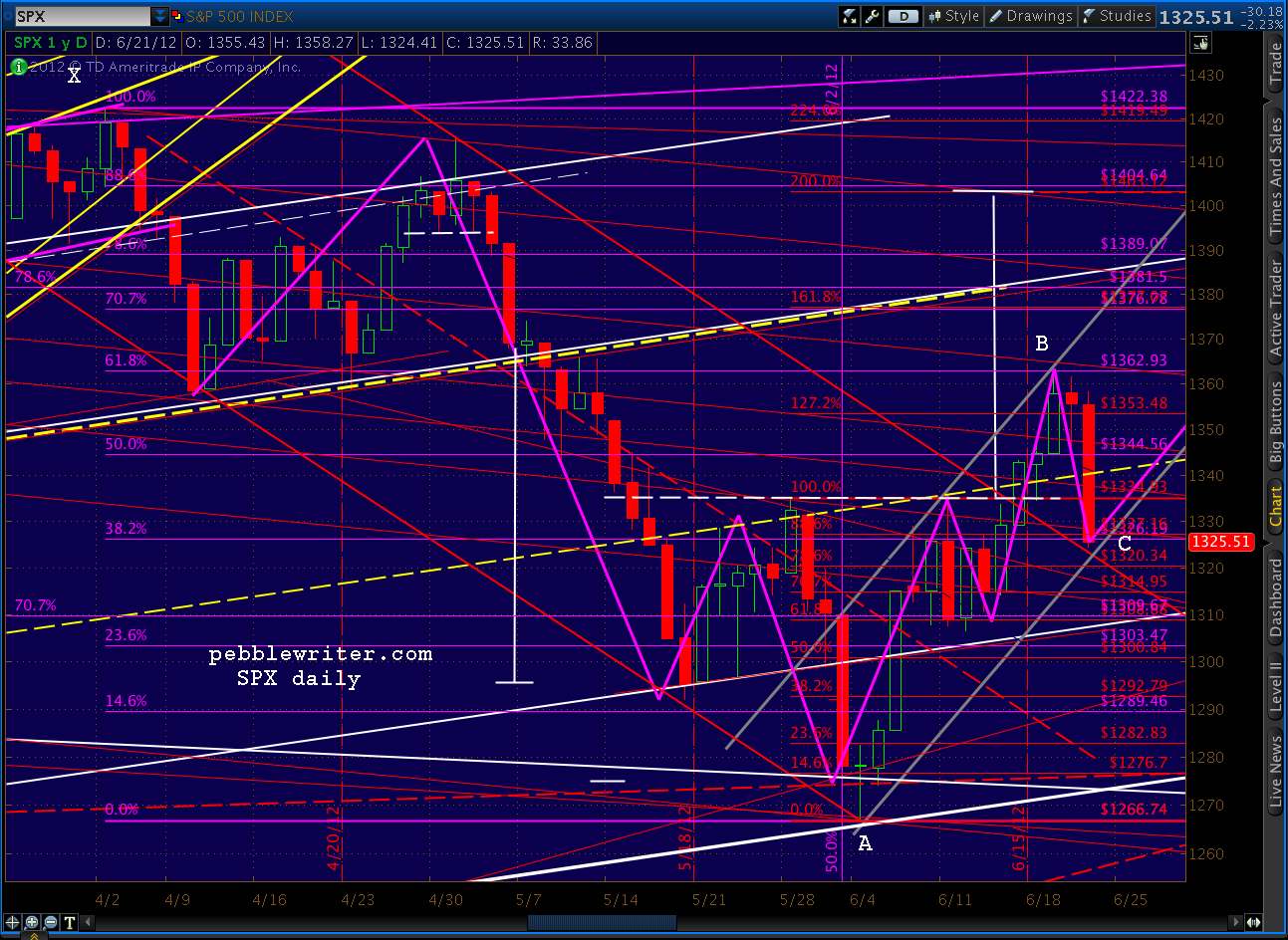

I

also like to look for correlations between patterns in different

assets. If I see a huge run-up coming in equities and the US dollar at

the same time, something's probably wrong with one or the other

forecast. The less certain I am about a particular chart, the more I'll

look elsewhere for confirmation. Other indices such as COMP, RUT, NYA

and e-minis have often provided hints when SPX was tough to figure.

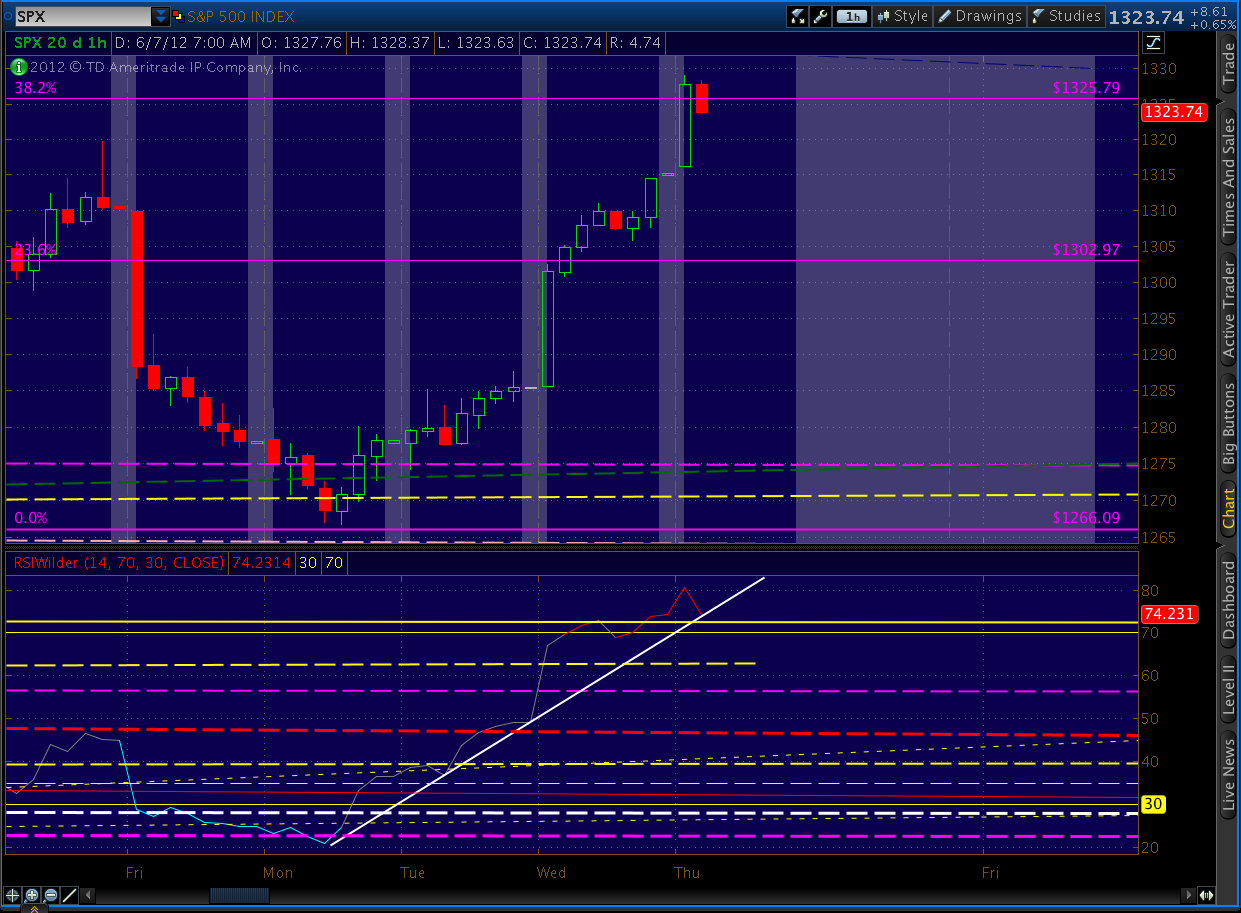

Once

I have a price target in mind, I try to work out the timing. Factors

such as Fibonacci time ratios, options expiration, Fed meetings and

elections often play a role in the timing of price movements. Contrary

to what I was taught in business school, the markets rarely follow a

"random walk."

Once I have a set of forecasts that agree with one

another, I'll ask myself whether they make sense given what's going on

in the world (financial and otherwise.) What's the financial press

saying (hint: usually wrong)? Are there potential downgradings in the

works? What about seasonal or cyclical factors?

I rarely look at other analysts' opinions. But, when I do, it is

always

after determining my own forecast. I'm loath to develop a bias based

on a theory I don't understand that well. After a spectacular first

eight months last year, I gave way too much back over the next six

months when I bought into the prevailing Elliott Wave P-2 script.

I'm

often told that my style resembles that of one analyst or another.

And, I'm frequently asked whether I agree with a particular person.

It's not that I'm smarter than anyone else, but I really try to avoid

such questions. They require a level of familiarity with someone else's

technique that I might not have. And, they can be a real distraction.

Having

said that, if a member comes across a really compelling conflicting

forecast, I'm certainly happy to entertain it. Just make sure the

question includes an explanation of the other guys' reasoning. I just

don't have time to become an expert on the effects of solar flares and

rising hemlines.

Implementation

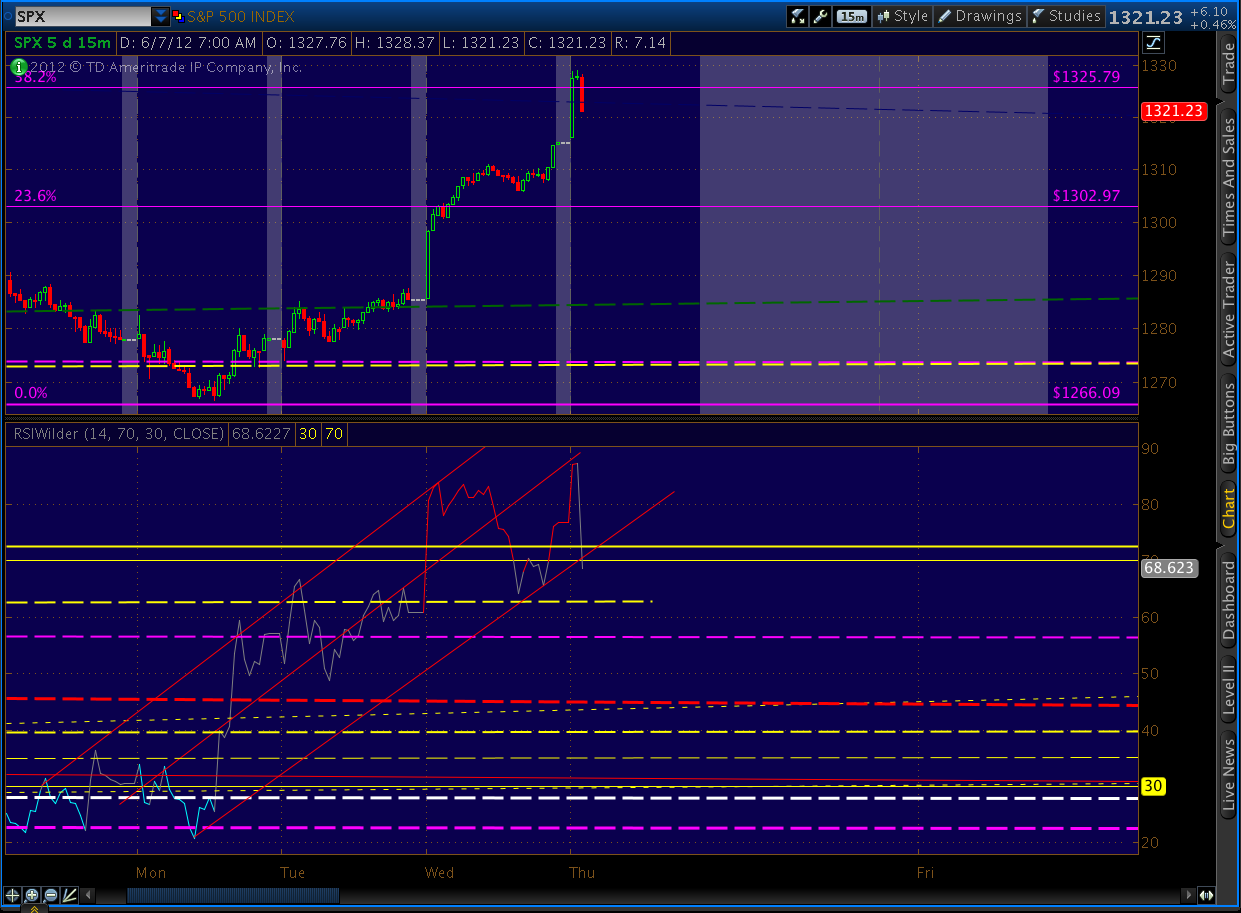

Markets

generally move in concert (or opposite one another.) So, when the

S&P 500 crashes, you can usually expect to see the NYA tag along.

For this reason, almost all of my daily posting is done around the SPX.

So, members have to do a little extrapolation if they own something

slightly different. Otherwise, I try to stay current on the US

dollar (DX), the euro (EURUSD) and VIX. In my opinion, the three of

them can explain what's going on at least 90% of the time.

If one

wanted to track along with what I'm thinking, it would be a pretty

simple matter to buy an ETF such as SPY at the bottoms and sell it short

at the tops. The only caveat would be to closely monitor the site,

because I sometimes opine on short-term swings that can really add up. Members are notified of new posts by email and updates within posts by text (if you sign up for it.)

I don't always post when things are right on track. For instance, if

my top scenario is that the market will turn at 1326, don't expect a

new

post announcing that we've hit 1326 and the market should now start

going up as I said two days ago. I might post if I have something new

to add, but more than likely I'm busy putting in trades like everyone else.

Likewise, if you find yourself wondering why I

haven't yet posted when one of my forecasts starts stinking up the joint,

odds are I'm studying it intently and/or preparing a new post. I can't

watch every market every moment of every day, and I'll occasionally miss

some stuff while shuttling a daughter to school or basketball game.

But, I do my best to stay connected and will let folks know if I'm going

to be out of pocket for very long.

Even really clever forecasts can be

rendered useless by unanticipated events or my sheer stupidity, so I'm a

big believer in always using stops. Sometimes, I remember to mention

them, but the lack of a mention doesn't mean they're not warranted. My recommendation -- always use them.

I

hope to start charting more non-US markets and currency pairs soon.

And, I'm often a little behind on indices like NDX, RUT and

COMP and currencies like the AUDUSD and JPYUSD. Hopefully this will

improve as the dust settles a bit more.

Summary

I'll

update this piece periodically as time permits. Please pass along any

suggestions. I read everything that comes my way, even if I don't have

time to respond right away. And, as always, thanks for being a member of pebblewriter. I'll continue to do my best to be worthy of that honor.

~pebblewriter

*******