~

reprinted from pebblewriter.com

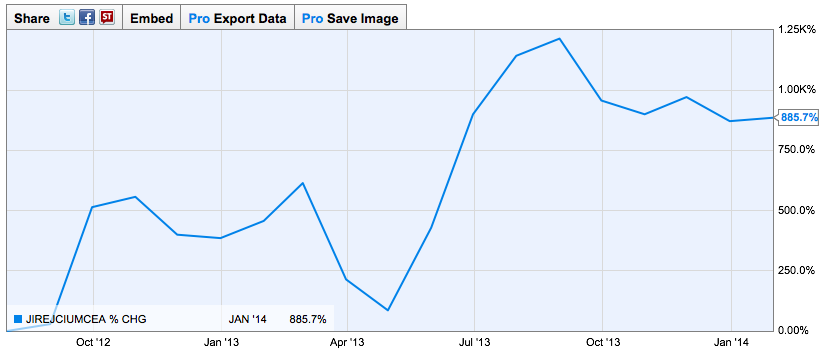

Those who have followed this blog for any length of time know about

our focus on the Japanese economy and the yen. I

presented this chart in December, which shows the impact on stocks of the last three USDJPY

reversals off a trend line (or top of a channel, depending on how

bearish you are) it recently tagged a 4th time.

The

latest out of Japan is the BOJ deciding to hold easing at current

levels (60-70 trillion yen or $590-690 billion.) This surprised many,

given that exports have fallen off a cliff on the eve of a 60%

consumption tax increase (from 5 to 8% on Apr 1.)

This article

from Reuters sums up very well the problem Japan faces: trashing the

yen can't undo the systemic economic imbalances of a stagnating economy

with way too much debt on its hands. Japan exports have leveled off,

producing

record trade deficits (in spite of a weaker yen), while the cost of imports continues to rise (thanks to the weaker yen.)

Japan's CPI conveniently leaves out

fresh

food, which has soared over 17% since the Nov 2012 assault on the yen

(Japan imports 40% of its food.) Is it any surprise that consumer

confidence is moving in the opposite direction?

And,

fuel prices have soared -- exacerbated by the continuing fallout (pun

very much intended) from Fukushima. The consumer, who also faces next

month's 60% tax hike mentioned above, is already getting crushed by QE.

So, why not scrap it?

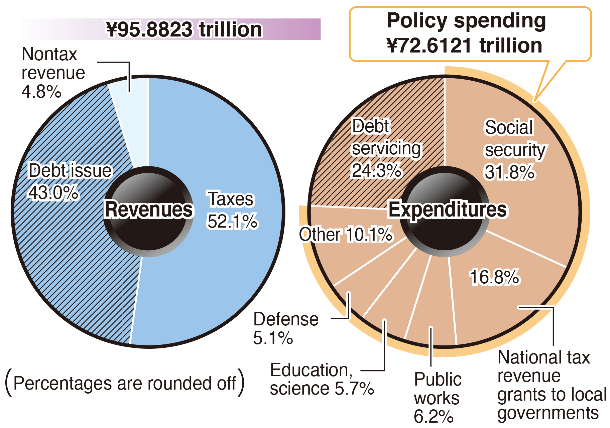

If they do, rates will skyrocket. Outstanding debt is 242% of GDP, and

annual debt service

(23 trillion yen) is already greater than 50% of tax receipts (43

trillion.) With QE of 60-70 trillion yen, the BOJ is essentially

monetizing all of Japan's debt directly or indirectly (issuance of 41

trillion yen is anticipated this year.) In short, QE is the only thing

keeping rates "manageable."

In

sum, the BOJ is in a box from which there is increasingly no escape.

They can make ends meet by issuing much more debt to fund the 43% of

expenditures not covered by tax revenues. Issuing that debt keeps rates

low enough to be able to pay the interest. But, a rock bottom yen

bites the consumer in the ass and, in the end, means tax revenues go

sayonara, increasing the need for more debt... Wash, rinse, repeat.

As BOJ's Kuroda put it in his latest "let's play make-believe" press conference:

When

the sales tax hike was raised to 5 percent from 3 percent in April

1997, Japan's economic growth turned negative in April-June but

rebounded in July-September. But, the Asian currency crisis erupted in

the summer that year and Japan fell into a recession as it faced its domestic banking crisis in the autumn.

He

assures us that this time will be different, but I think it's wishful

thinking. I think Japan is very much on the path to default or

depression, and there's no amount of debt issuance that can alter that

outcome. When the money spigot turns off, the primary beneficiaries of

Japan's QE hot money (Thailand, Singapore, Philippines, Malaysia,

Korea... not to mention China, Japan's biggest trading partner) will go

tapioca. The Asian currency crisis will come roaring back in a big way.