~reposted from pebblewriter.com~

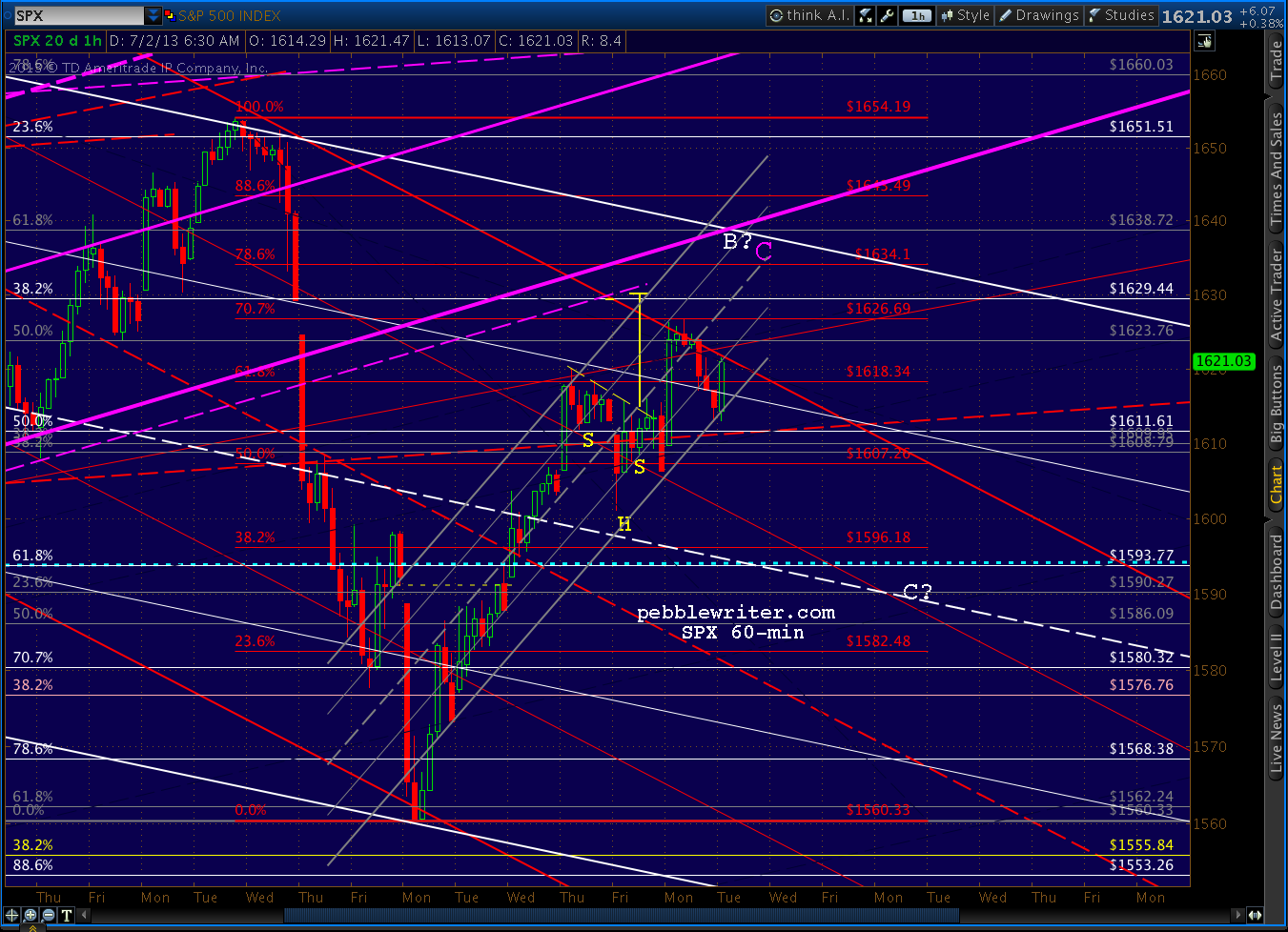

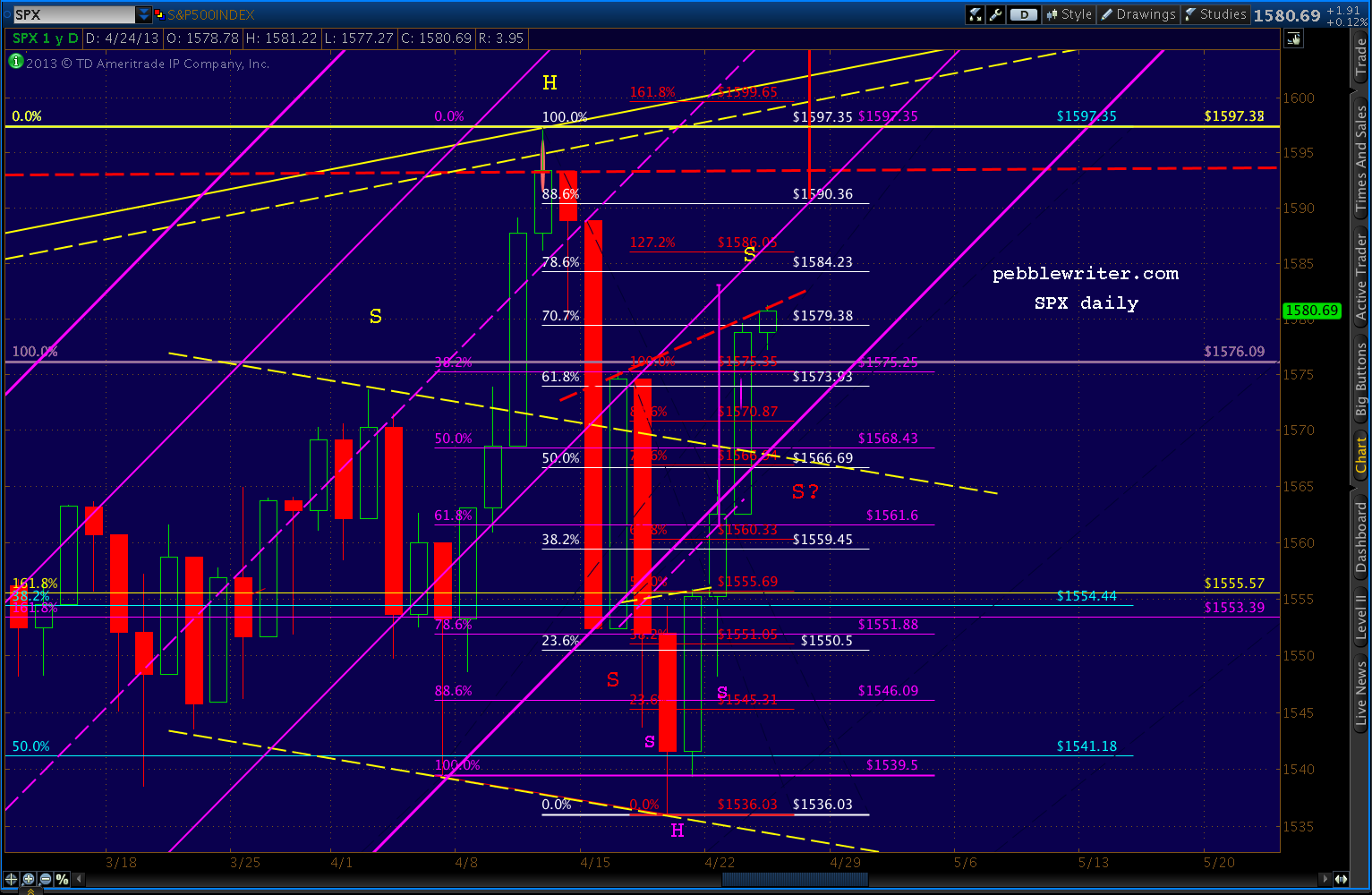

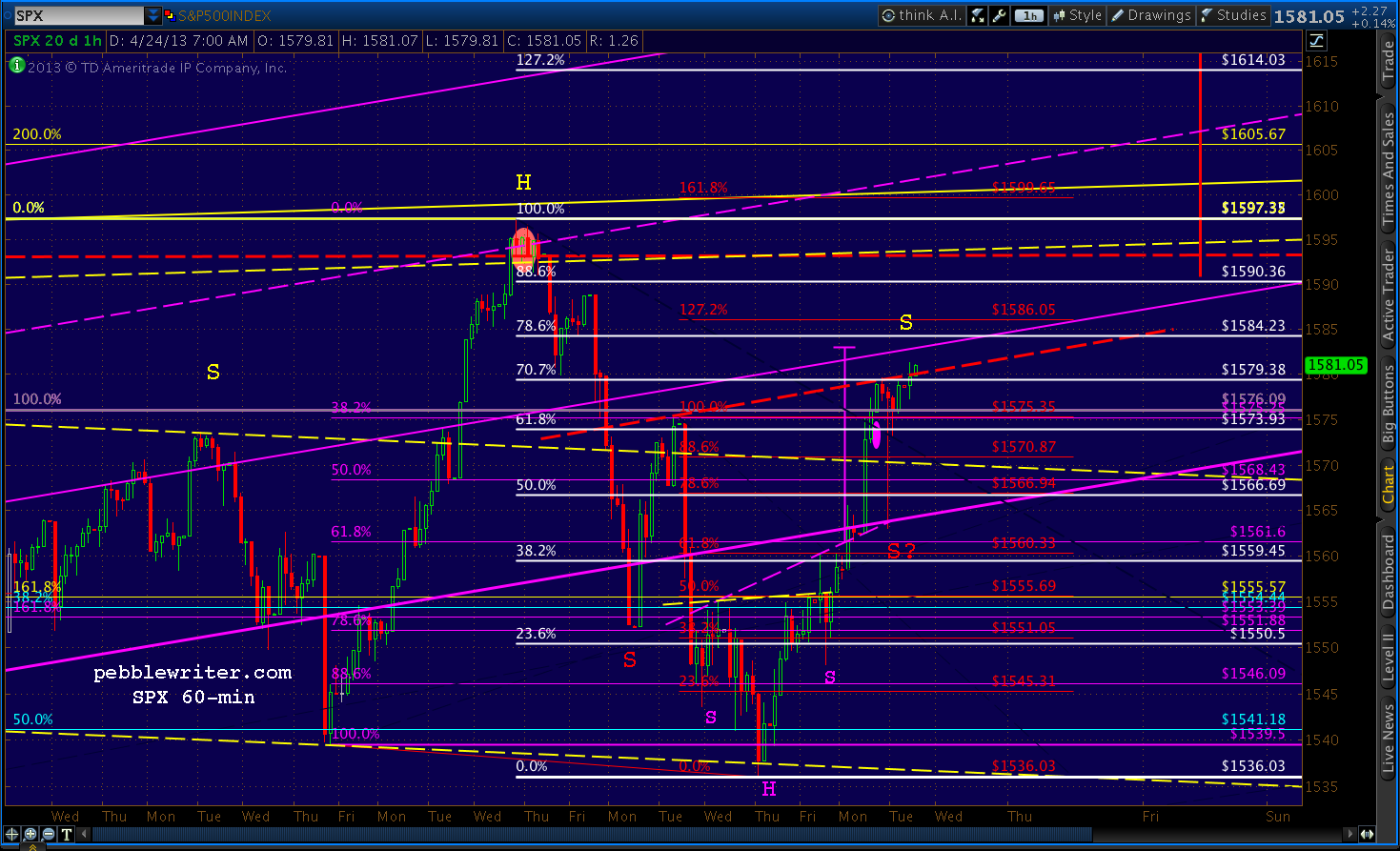

ES came within .09 of our interim target from Monday [see: CIW Oct 21] and is reversing nicely, though we're a day behind the schedule discussed on the 17th.

The implications are that this sell-off might be a little less deep than I originally thought. Still, as we discussed yesterday, it should be steep enough to flesh out the red channel within a few days.

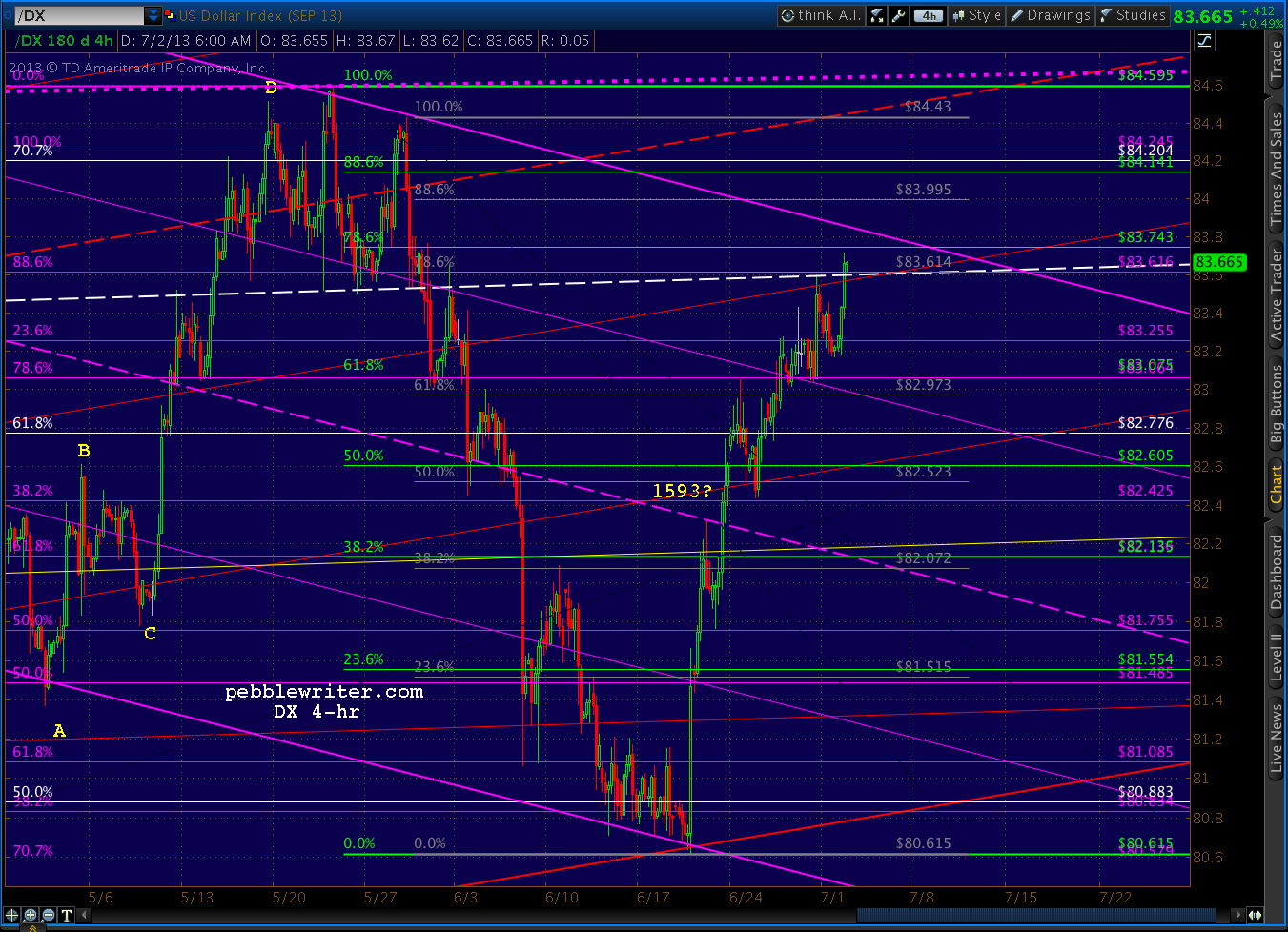

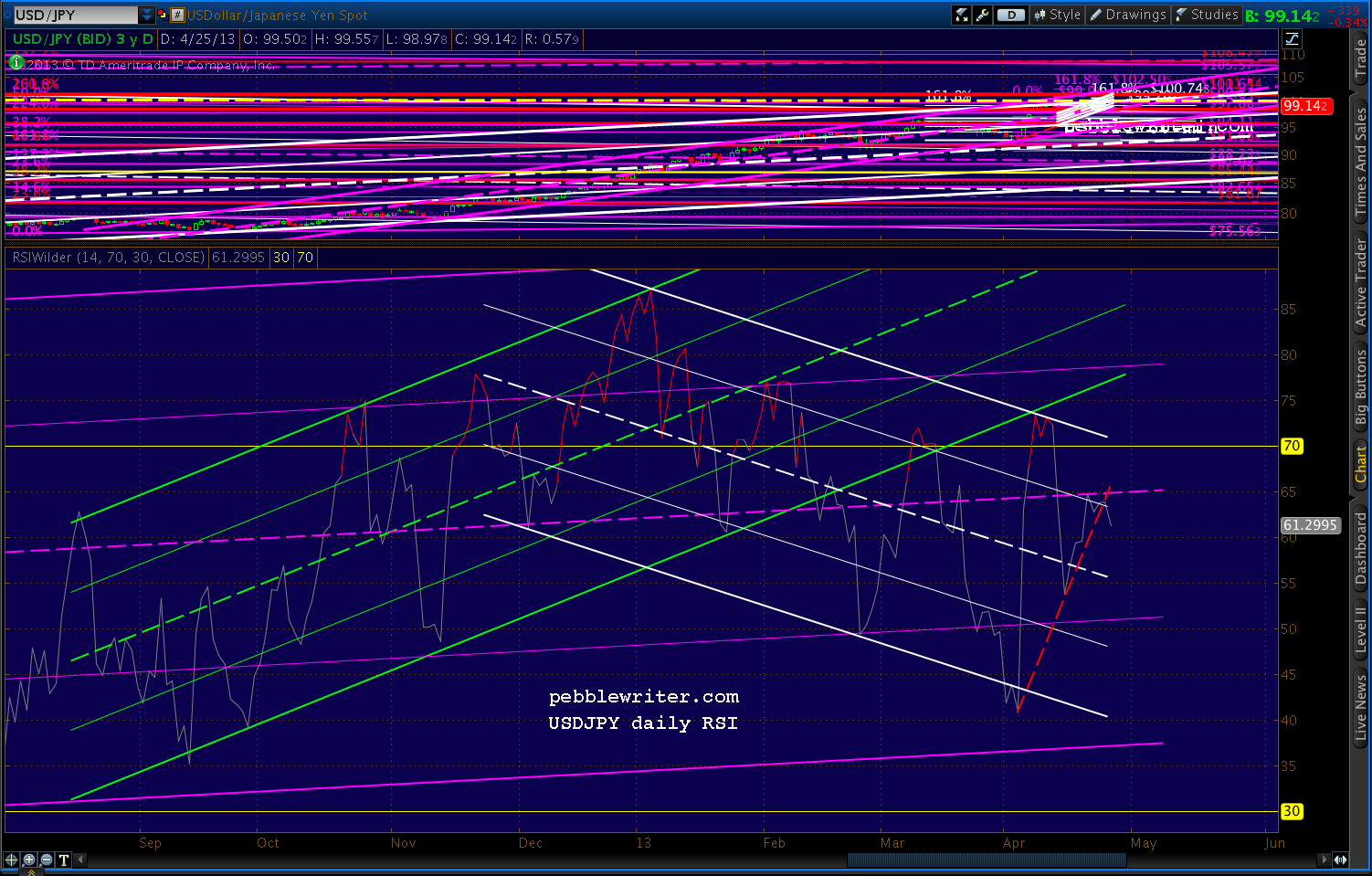

The dollar reverted to the pale blue .886 before falling back to a higher low, having been rebuffed by the falling wedge's lower bound. It'll be interesting to see whether the equity plunge is frightening enough to produce a real dollar rally -- or merely slow the bleeding.

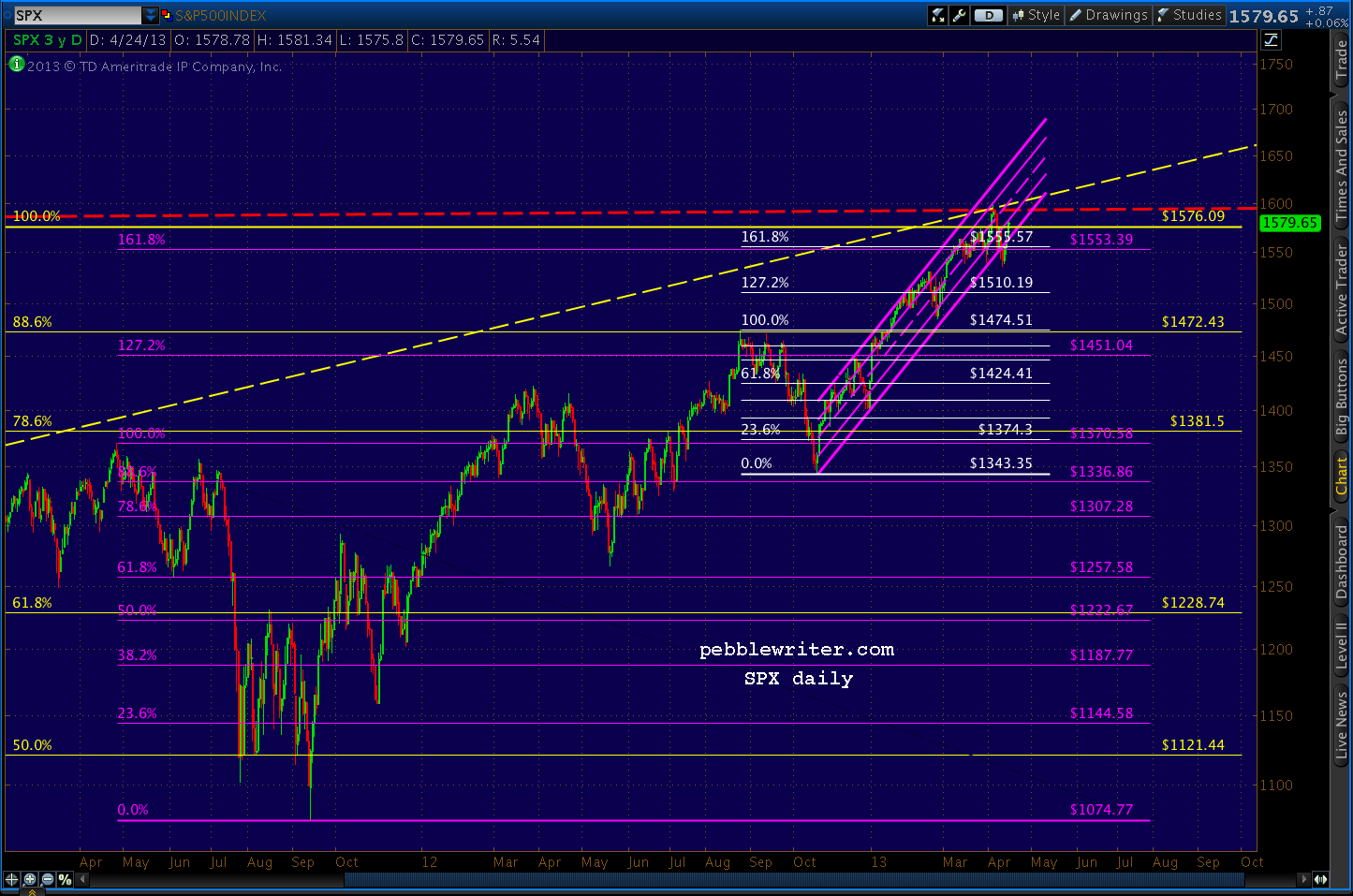

SPX's 90-pt plunge in late June (1654 to 1560, in yellow on the chart above) produced a dramatic spike in DX -- which then continued to rally with stocks until they had recovered their losses. For now, at least, the dip below the critical 78.725 has been averted.

I'm often asked why, if the larger harmonic patterns are so clear, one should muck about with the smaller patterns, channels, etc. The rally from 1640 to 1754 demonstrates the value quite well. The 110 points, alone, would have been a 6.7% return -- not shabby for a 12-session holding period.

Yet, as the chart below shows, there were several reversals that were fairly "by the numbers." The purple .786 (yellow .618) provided a 20-pt reversal, and the purple .886 another 11 points.

Adding in those extra 62 points alone (the reversals and their retracements) would have boosted the 6.7% return to about 10.5%. But, more importantly, the harmonics alone don't tell the whole story.

Consider our forecast from July 15, when SPX was about to register a new all-time high. Based on harmonics, I expected a reversal at 1712 (it came at 1709) and subsequent rally to 1765, followed by a 45-point retracement on the way to 1823 -- all by late August.

A buy-and-hold investor would have done reasonably well with that forecast. SPX came within 6 points of that 1765 target before reversing yesterday -- a modest 4.6% gain from 1682. There's nothing wrong with 4.6% for three months (about 18% annualized.)

However, by simply paying attention to the channels, we were able to spot the trend shift in early August that signaled a deeper dip than originally anticipated. That deviation provided an additional opportunity of 54 points (27 X 2.) The September dip from 1729 to 1646 provided another 166 points of potential return.

Suddenly, a 77-pt or 4.6% potential return becomes a 297-pt or 17.7% return (about 70% annualized) -- from simply tossing channel analysis into the equation. By considering many other chart patterns, coincident developments in other securities and currencies, analogs, RSI channels and other, more traditional technical analysis, we've been able to do even better.

Let's be clear on one thing: it is highly unusual for anyone to catch the absolute top and bottom of every major move. We've done better than most, but I still miss a lot more than I care to admit. But, that's not important...because, it's not our goal.

Our goal is simply to catch "most of the moves most of the time." This means developing the very best forecast we can and following it until it stops working. Sometimes, it works for days or even weeks. And, sometimes it works for all of five minutes.

The key is acknowledging when it's not working -- which means (1) having a discrete price level or chart pattern that provides a clear signal, and (2) setting aside one's ego and admitting that the forecast was hogwash in the first place (by far the harder of the two!)

ES came within .09 of our interim target from Monday [see: CIW Oct 21] and is reversing nicely, though we're a day behind the schedule discussed on the 17th.

The implications are that this sell-off might be a little less deep than I originally thought. Still, as we discussed yesterday, it should be steep enough to flesh out the red channel within a few days.

The dollar reverted to the pale blue .886 before falling back to a higher low, having been rebuffed by the falling wedge's lower bound. It'll be interesting to see whether the equity plunge is frightening enough to produce a real dollar rally -- or merely slow the bleeding.

SPX's 90-pt plunge in late June (1654 to 1560, in yellow on the chart above) produced a dramatic spike in DX -- which then continued to rally with stocks until they had recovered their losses. For now, at least, the dip below the critical 78.725 has been averted.

I'm often asked why, if the larger harmonic patterns are so clear, one should muck about with the smaller patterns, channels, etc. The rally from 1640 to 1754 demonstrates the value quite well. The 110 points, alone, would have been a 6.7% return -- not shabby for a 12-session holding period.

Yet, as the chart below shows, there were several reversals that were fairly "by the numbers." The purple .786 (yellow .618) provided a 20-pt reversal, and the purple .886 another 11 points.

Adding in those extra 62 points alone (the reversals and their retracements) would have boosted the 6.7% return to about 10.5%. But, more importantly, the harmonics alone don't tell the whole story.

Consider our forecast from July 15, when SPX was about to register a new all-time high. Based on harmonics, I expected a reversal at 1712 (it came at 1709) and subsequent rally to 1765, followed by a 45-point retracement on the way to 1823 -- all by late August.

A buy-and-hold investor would have done reasonably well with that forecast. SPX came within 6 points of that 1765 target before reversing yesterday -- a modest 4.6% gain from 1682. There's nothing wrong with 4.6% for three months (about 18% annualized.)

However, by simply paying attention to the channels, we were able to spot the trend shift in early August that signaled a deeper dip than originally anticipated. That deviation provided an additional opportunity of 54 points (27 X 2.) The September dip from 1729 to 1646 provided another 166 points of potential return.

Suddenly, a 77-pt or 4.6% potential return becomes a 297-pt or 17.7% return (about 70% annualized) -- from simply tossing channel analysis into the equation. By considering many other chart patterns, coincident developments in other securities and currencies, analogs, RSI channels and other, more traditional technical analysis, we've been able to do even better.

Let's be clear on one thing: it is highly unusual for anyone to catch the absolute top and bottom of every major move. We've done better than most, but I still miss a lot more than I care to admit. But, that's not important...because, it's not our goal.

Our goal is simply to catch "most of the moves most of the time." This means developing the very best forecast we can and following it until it stops working. Sometimes, it works for days or even weeks. And, sometimes it works for all of five minutes.

The key is acknowledging when it's not working -- which means (1) having a discrete price level or chart pattern that provides a clear signal, and (2) setting aside one's ego and admitting that the forecast was hogwash in the first place (by far the harder of the two!)

continued on pebblewriter.com