reposted from pebblewriter.com ~

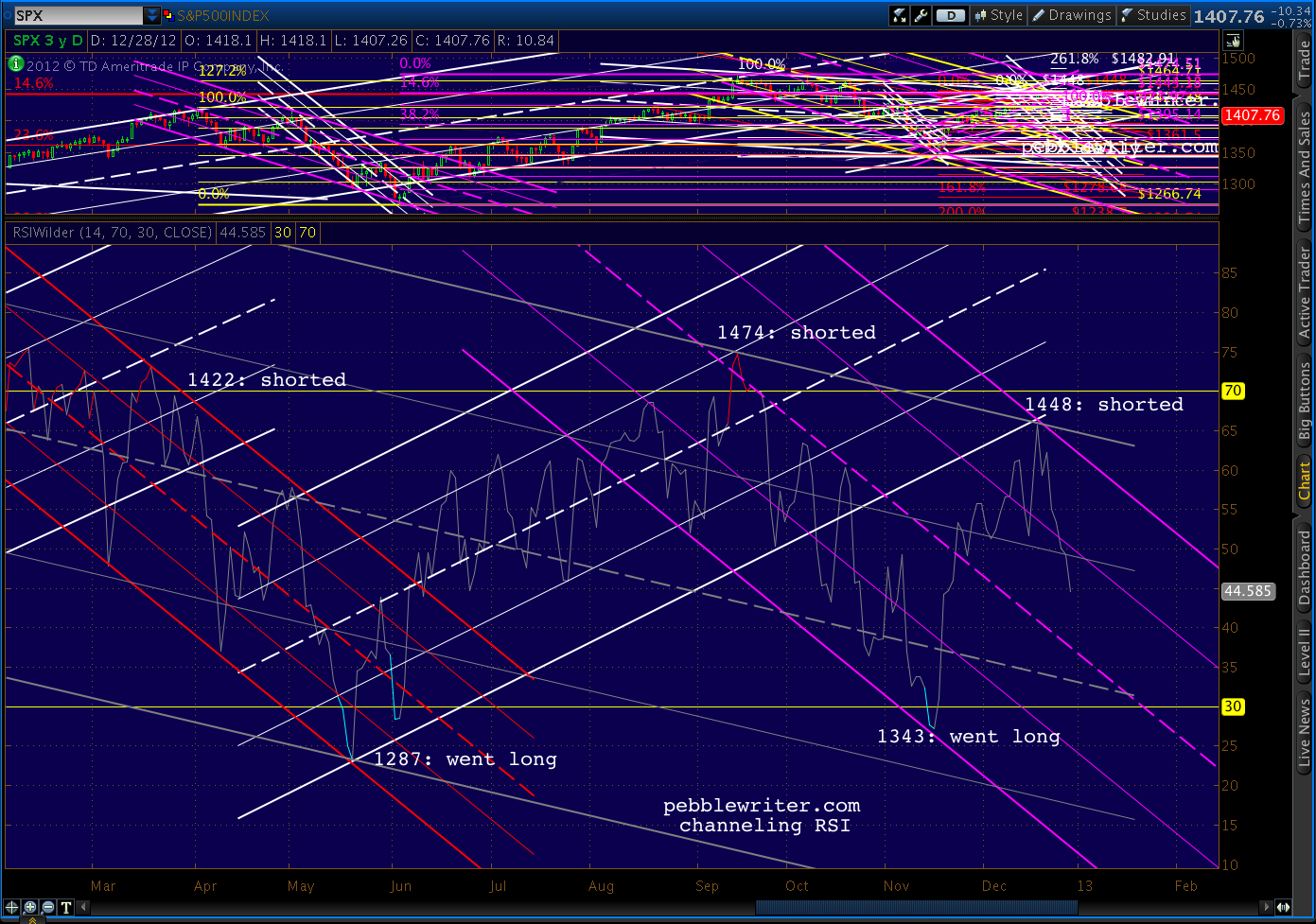

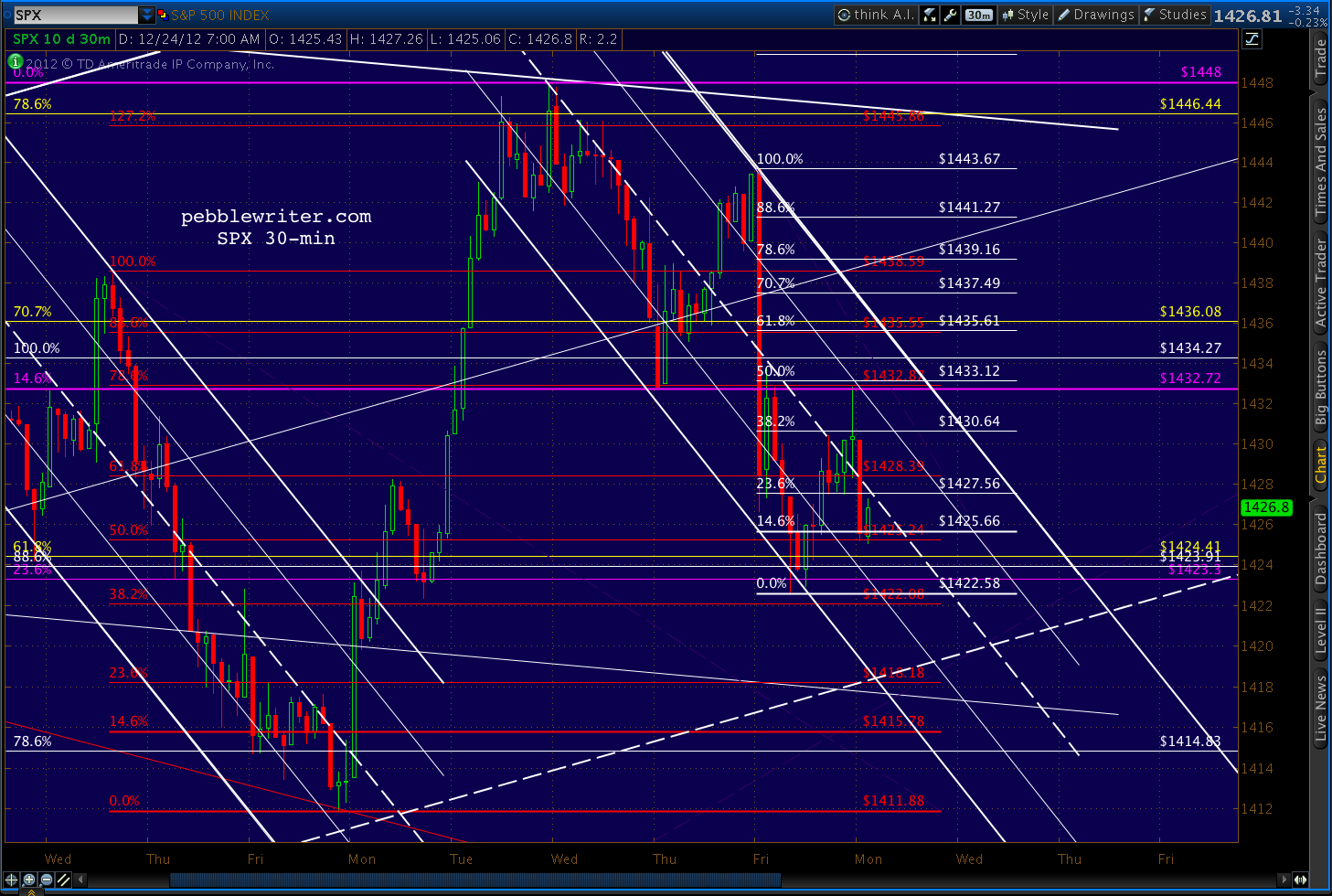

We remain short from SPX 1447 on Dec 18.

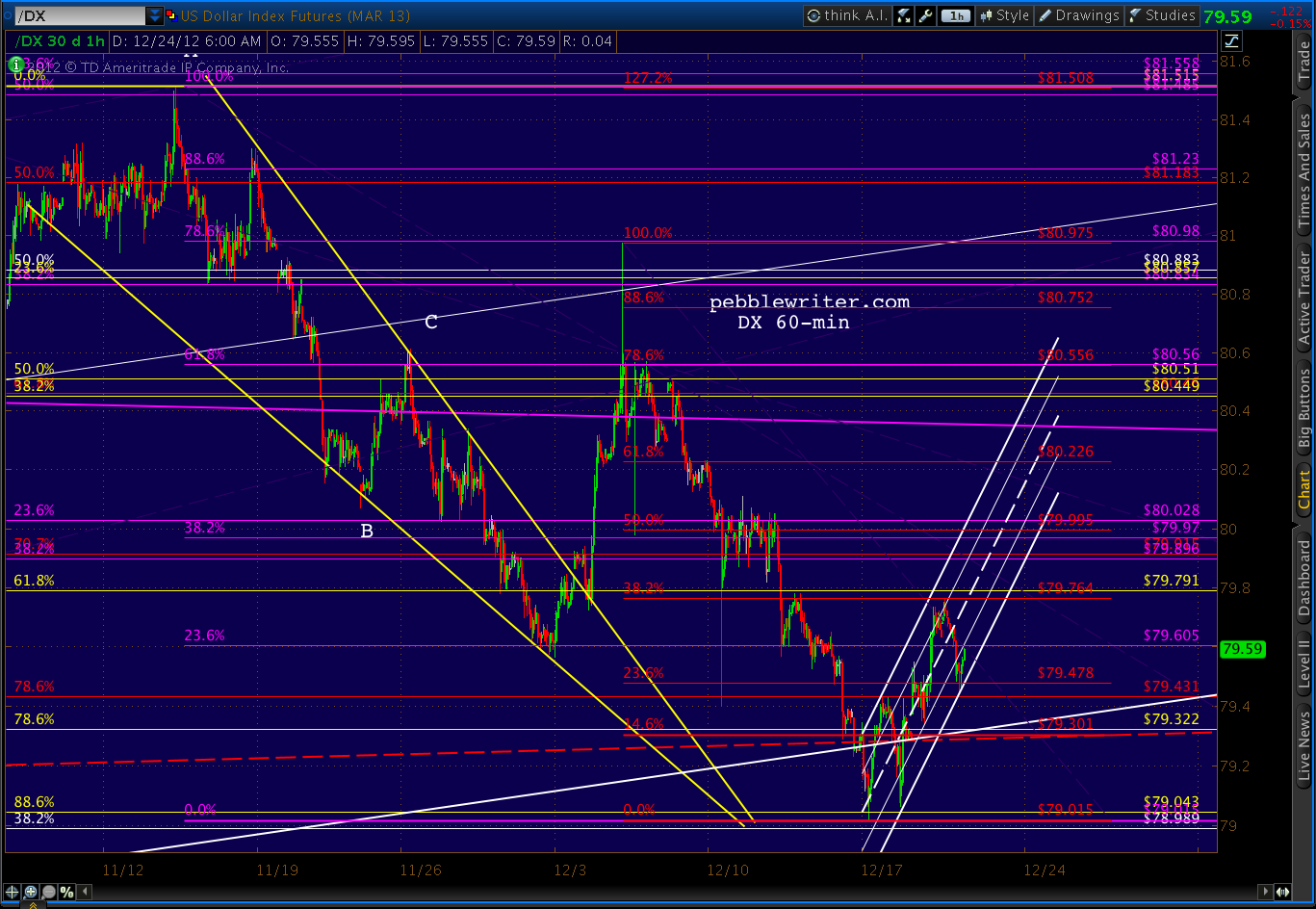

The dollar is either finding support at a channel midline (purple) or about to find it at the bottom of a channel (white), depending on which channel ultimately holds.

DX RSI shows great channel support either way.

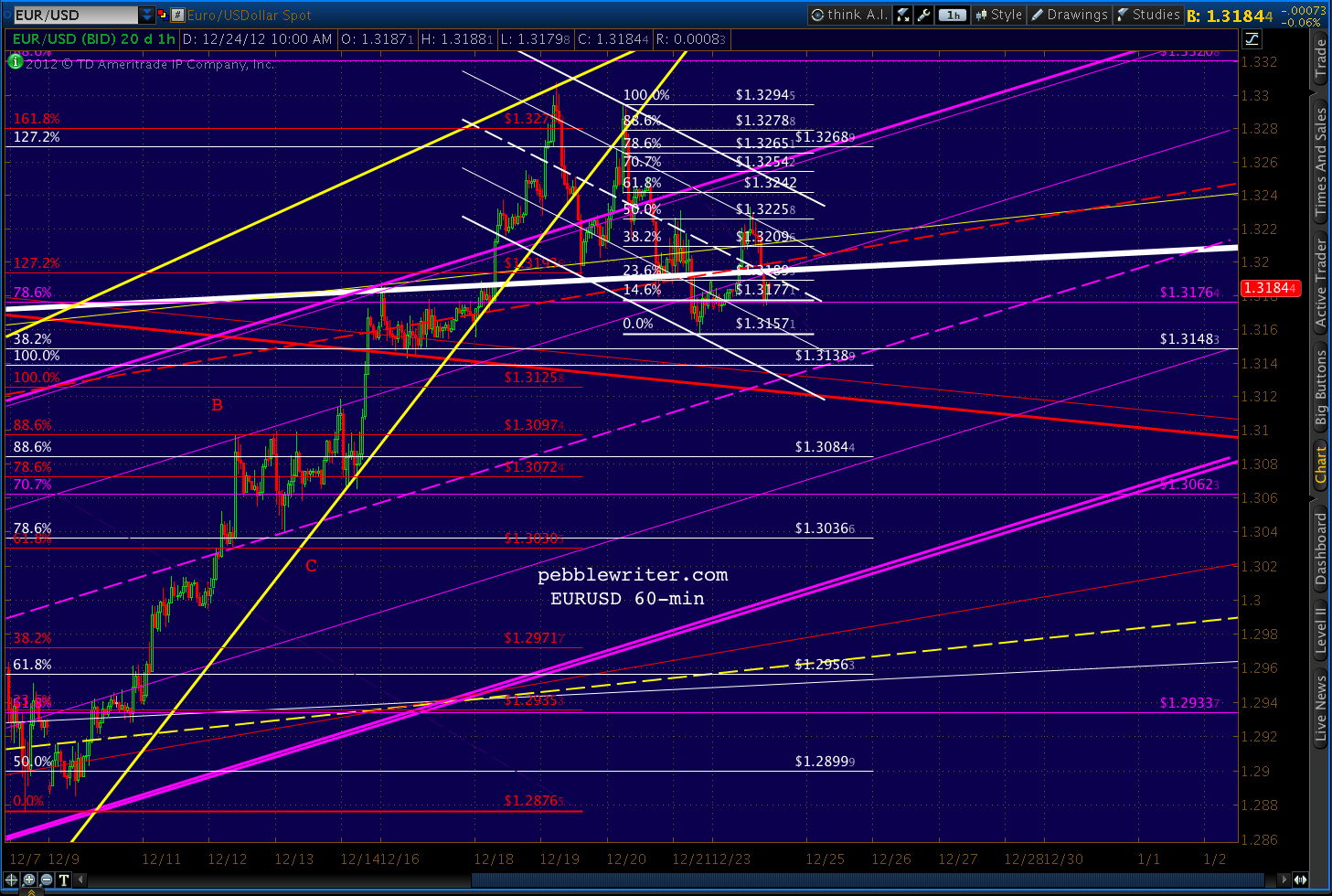

The EURUSD is still hanging in there, backtesting the red channel midline again in the midst of the major white channel back test that's been going on since Dec 18, and post the rising wedge break of Dec 19.

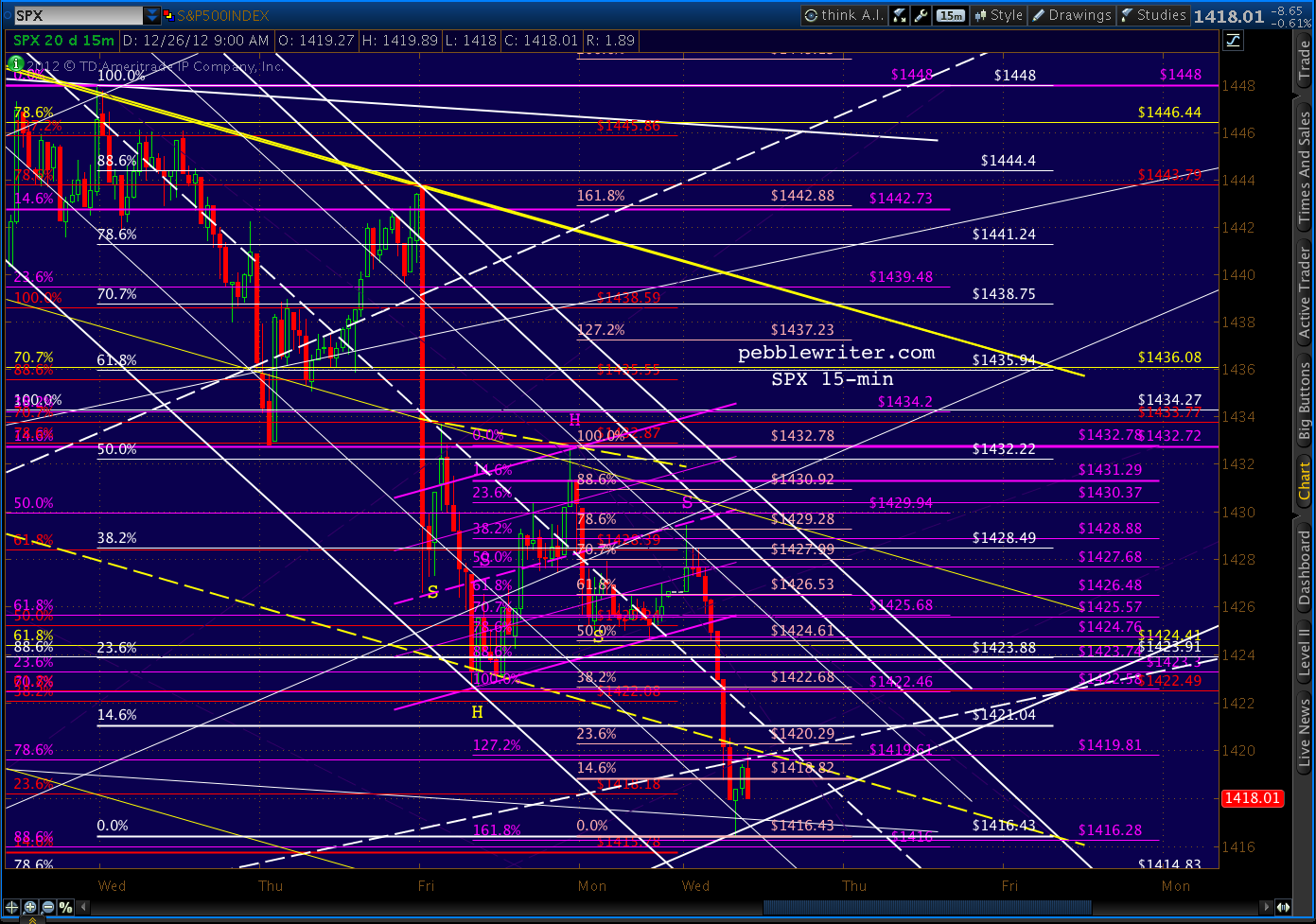

As Reeodd mentioned on Disqus Friday, the H&S pattern that completed (see the 2:50 entry) would look better formed if the right shoulder were a little higher. This is definitely true, though the past six months has seen many very lopsided H&S patterns play out perfectly.

Bottom line, the pattern completed -- but it didn't close beneath the neckline. We saw a bounce right at the close that allowed it to remain just above.

I don't usually count these patterns as "in play" until a close below the neckline. But, in this case, I think that rule is mostly academic.

The reality is that the market will move today in accordance with the news out of Capitol Hill, which might be in keeping with normally reliable chart patterns -- or not.

I have no inside knowledge of the goings on in Washington. But my view has always been that Congress, while recognizing the need for Fiscal Cliff-type changes, cannot ever be expected to commit political suicide by actually voting for them.

Old guys in strongly partisan districts might be the exception, and we're seeing olive branches extended (even aisle-crossing) by some. But, young turks whose anti-establishment vitriol got them elected are unlikely to fall in line -- as happened with Plan B last week.

And, if that sounds like I'm hedging my bets, it should (metaphorically, anyway.) Betting on the outcome of the political process is a crap shoot, pure and simple. I express an opinion because that's what members expect. It should, in no way, be considered as fact until after midnight tonight.

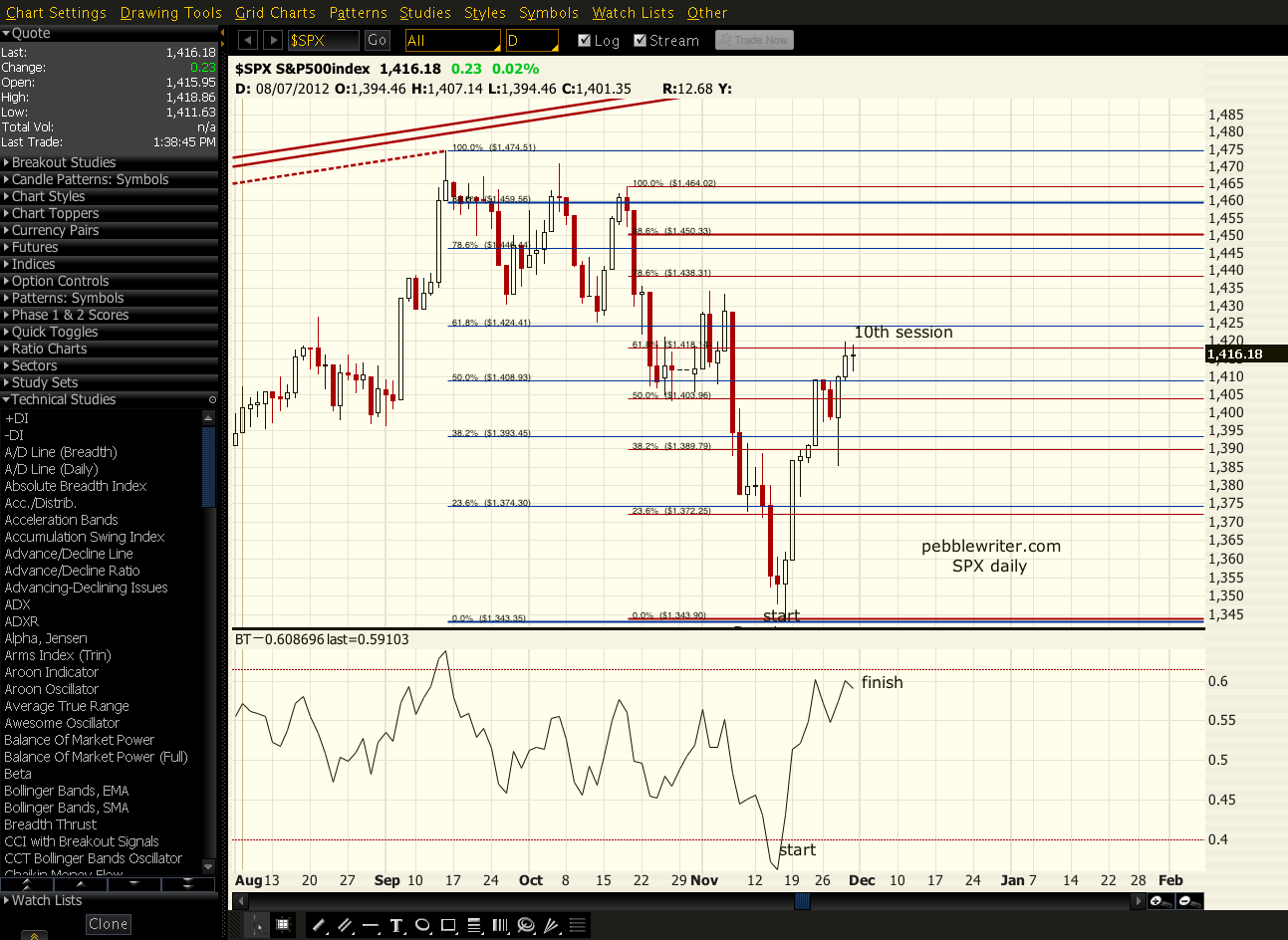

Our forecast still calls for much lower prices in the next 9 sessions. Thus, I remain short. But, anyone uncomfortable with the very real risk of a short position imploding as the result of a last minute political stick-save should really be on the sidelines until all the dust settles.

Attention

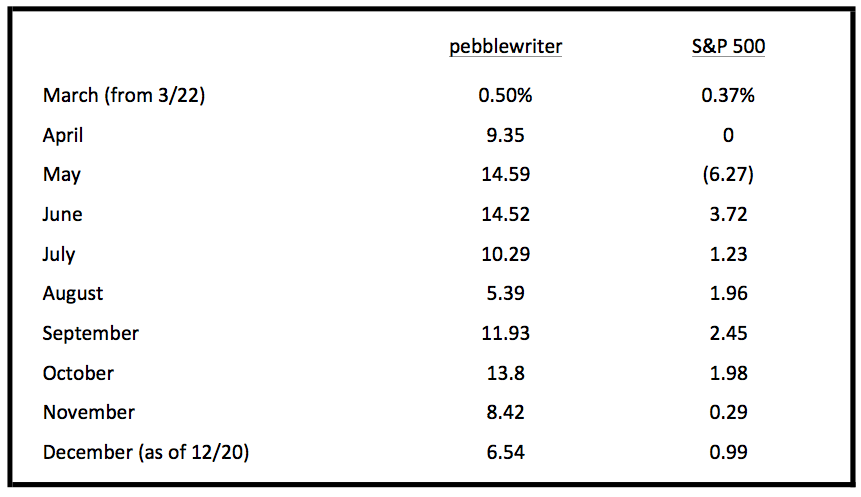

Prospective Members: Membership rates are slated to increase on

January 1, 2013. I have been following a practice of charging about $10

for every percentage point of return. Our results for the first nine

months of the new site (since inception March 22) total a little over

95% [DETAILS HERE], so the new rates will be:

I announced a few days ago that the first fifteen to sign up for an annual membership at the current rate of $800 would be granted Charter Member status.

Charter Member rates are locked in for the life of the site, so you'll never pay more -- no matter where annual rates end up. And, Charter Members will also be eligible for discounts on other services currently in the works.

The response has been pretty strong; and, I'd hate to exclude anyone stuck on a plane or a ski slope. Okay... it might also have something to do with a busy weekend with the family (yesterday was my 17th wedding anniversary) and the fact that I haven't had time to put together a new Sign-Up page.

Regardless, consider the offer extended just a little longer (but, don't push your luck!)

We remain short from SPX 1447 on Dec 18.

The dollar is either finding support at a channel midline (purple) or about to find it at the bottom of a channel (white), depending on which channel ultimately holds.

DX RSI shows great channel support either way.

The EURUSD is still hanging in there, backtesting the red channel midline again in the midst of the major white channel back test that's been going on since Dec 18, and post the rising wedge break of Dec 19.

As Reeodd mentioned on Disqus Friday, the H&S pattern that completed (see the 2:50 entry) would look better formed if the right shoulder were a little higher. This is definitely true, though the past six months has seen many very lopsided H&S patterns play out perfectly.

Bottom line, the pattern completed -- but it didn't close beneath the neckline. We saw a bounce right at the close that allowed it to remain just above.

I don't usually count these patterns as "in play" until a close below the neckline. But, in this case, I think that rule is mostly academic.

The reality is that the market will move today in accordance with the news out of Capitol Hill, which might be in keeping with normally reliable chart patterns -- or not.

I have no inside knowledge of the goings on in Washington. But my view has always been that Congress, while recognizing the need for Fiscal Cliff-type changes, cannot ever be expected to commit political suicide by actually voting for them.

Old guys in strongly partisan districts might be the exception, and we're seeing olive branches extended (even aisle-crossing) by some. But, young turks whose anti-establishment vitriol got them elected are unlikely to fall in line -- as happened with Plan B last week.

And, if that sounds like I'm hedging my bets, it should (metaphorically, anyway.) Betting on the outcome of the political process is a crap shoot, pure and simple. I express an opinion because that's what members expect. It should, in no way, be considered as fact until after midnight tonight.

Our forecast still calls for much lower prices in the next 9 sessions. Thus, I remain short. But, anyone uncomfortable with the very real risk of a short position imploding as the result of a last minute political stick-save should really be on the sidelines until all the dust settles.

continued on pebblewriter.com...

If we're fortunate enough to continue averaging a little over 10% per month, annual memberships would be $1,200+ in March. Wouldn't it be great if you could lock in your rate now? You're in luck!

- Quarterly: $375

- Semi-Annual: $550

- Annual: $950

I announced a few days ago that the first fifteen to sign up for an annual membership at the current rate of $800 would be granted Charter Member status.

Charter Member rates are locked in for the life of the site, so you'll never pay more -- no matter where annual rates end up. And, Charter Members will also be eligible for discounts on other services currently in the works.

The response has been pretty strong; and, I'd hate to exclude anyone stuck on a plane or a ski slope. Okay... it might also have something to do with a busy weekend with the family (yesterday was my 17th wedding anniversary) and the fact that I haven't had time to put together a new Sign-Up page.

Regardless, consider the offer extended just a little longer (but, don't push your luck!)