I hope everyone had a lovely Christmas. Intra-day posts will be open to the public this week, my little gift to those considering a pebblewriter membership. Sorry, but our forecast will still be available to members only.

As announced on Monday, subscription prices will increase on January 1. In keeping with our practice of paying for performance, the annual rate will be about $10 for each percentage point of return since the new site's inception on Mar 22, 2012.

We're up about 95% over those first nine months [SEE DETAILS HERE] so the new rates will be as follows:

If we are fortunate enough to continue averaging a little over 10% per month, annual memberships would be $1,200+ in March. So, locking in current prices is a no-brainer.

Sign up HERE.

We remain short from 1447 on Dec 18. Per the 1:10 post in the members section:

Keep an eye on the dollar index and the little H&S patterns on SPX this morning. Some strength is to be expected early in the session, but there is the risk of a small breakout.

As announced on Monday, subscription prices will increase on January 1. In keeping with our practice of paying for performance, the annual rate will be about $10 for each percentage point of return since the new site's inception on Mar 22, 2012.

We're up about 95% over those first nine months [SEE DETAILS HERE] so the new rates will be as follows:

If we are fortunate enough to continue averaging a little over 10% per month, annual memberships would be $1,200+ in March. So, locking in current prices is a no-brainer.

Sign up HERE.

* * * * * * * *

We remain short from 1447 on Dec 18. Per the 1:10 post in the members section:

SPX just tagged the .786 mentioned above, pushing just beyond 1446.44. I’m closing my intra-day longs (again) here at 1447 and will see what kind of reaction we get here. Charts in a few.But, I'll repeat my warning from Monday: bulls will be looking for opportunities to shift momentum, and it could be especially easy with low volume and the inattention that comes with a holiday week like this.

Keep an eye on the dollar index and the little H&S patterns on SPX this morning. Some strength is to be expected early in the session, but there is the risk of a small breakout.

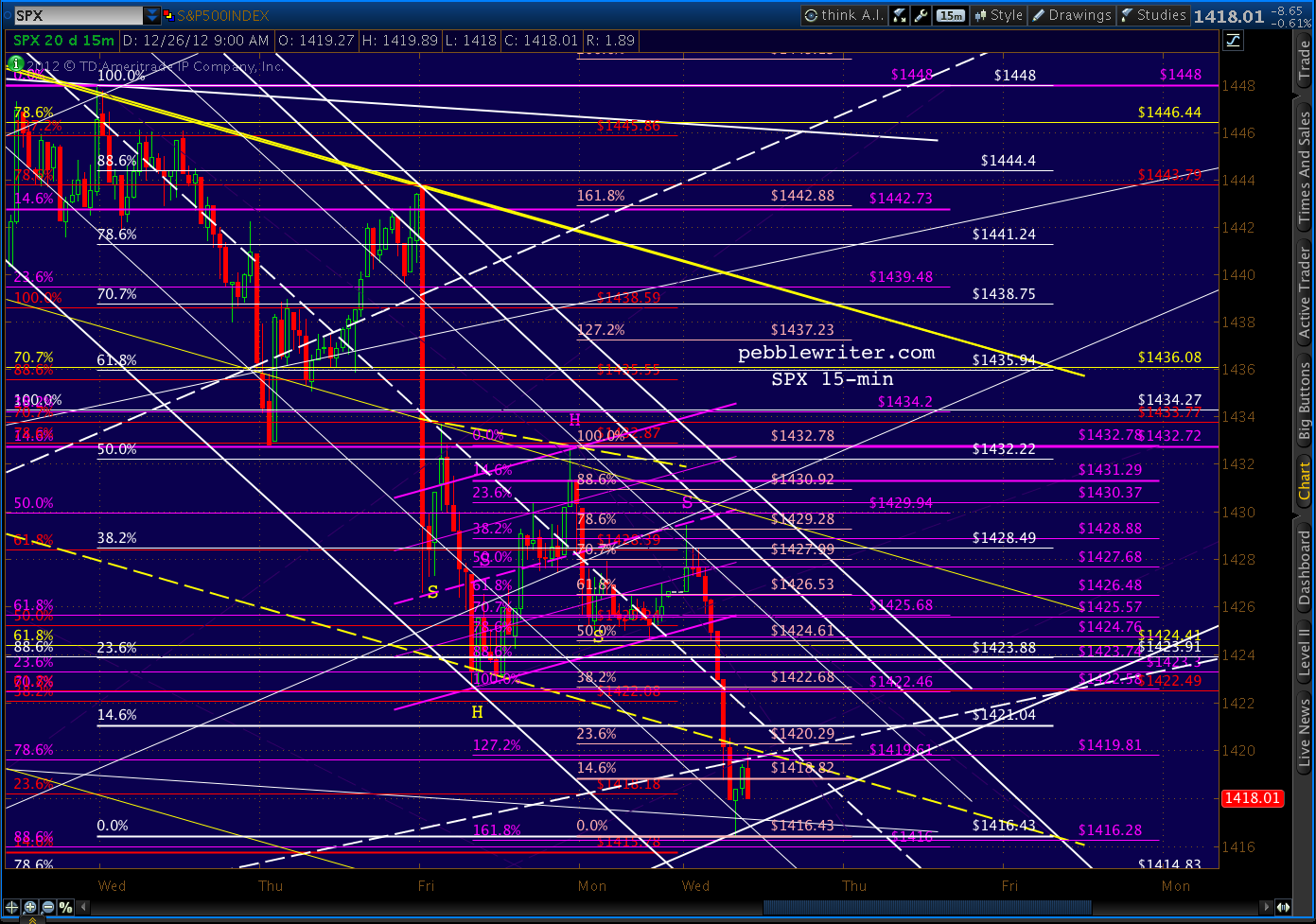

As we discussed Monday, the key SPX level to watch is 1432, which would take prices out of the proposed falling channel as well as complete the lopsided little IH&S that targets a Bat Pattern completion at 1441. I'd put the odds at 50:50.

SPX's bearish H&S pattern has picked up a new neckiline -- the bottom of the purple channel above. The neckline is rising, but it currently completes around 1425.

The EURUSD is coming up on its .618 at 1.3250 -- also the top of a well-formed channel. The rally should fail at that point, with the key level to watch afterwards being the recent bottom at 1.3157. Charts later.

UPDATE: 10:50 AM

SPX just broke below the neckline of the bearish H&S pattern (in purple below.) If the pattern plays out, it targets about 1416 -- which intersects with a little Crab Pattern at the purple 1.618 at 1416.28. The key level for bulls to hold is 1422.58.

A drop to 1416 would very likely see a decent bounce, as it also represents a Bat Pattern completion at the Fib .886 of the 1411 - 1448 rally between Dec 14 and Dec 18.

The slightly less likely target is the 1.272/.786 intersection at 1419.61-1419.81. Either level marks an important channel midline, which -- combined with the harmonic pattern completions -- could elicit a strong bounce.

A drop through 1411 means much more immediate downside.

UPDATE: 12:00 PM

We reached our primary target, reversing at 1416.43. If SPX can break back through the white channel midline at around 1422, the top case is a bounce to the .618 just formed at 1426.53 (also a white channel line) or the .786 at 1429.28 (the top of the white channel.)

This is a short-term trade only, and is likely to complete by Friday. As always, stops are strongly recommended -- so, 1415ish should do the trick.

Any breakout from the channel has upside potential to 1436.

UPDATE: 12:30 PM

DX tested the bottom of the little white channel I posted earlier, then zipped right back to its midline with the equities sell-off to 1416.43.

It has now tested the upper bound of the yellow channel twice in the past two sessions, and must either commit to the rapidly rising white channel -- breaking out of the yellow -- or consolidating further.

A break out of the SPX white channel would likely equate to a breakdown of DX's white channel. If stocks get a rebound to 1436 as discussed above, look for the dollar to flesh out the proposed purple channel to around the .618 at 79.319.