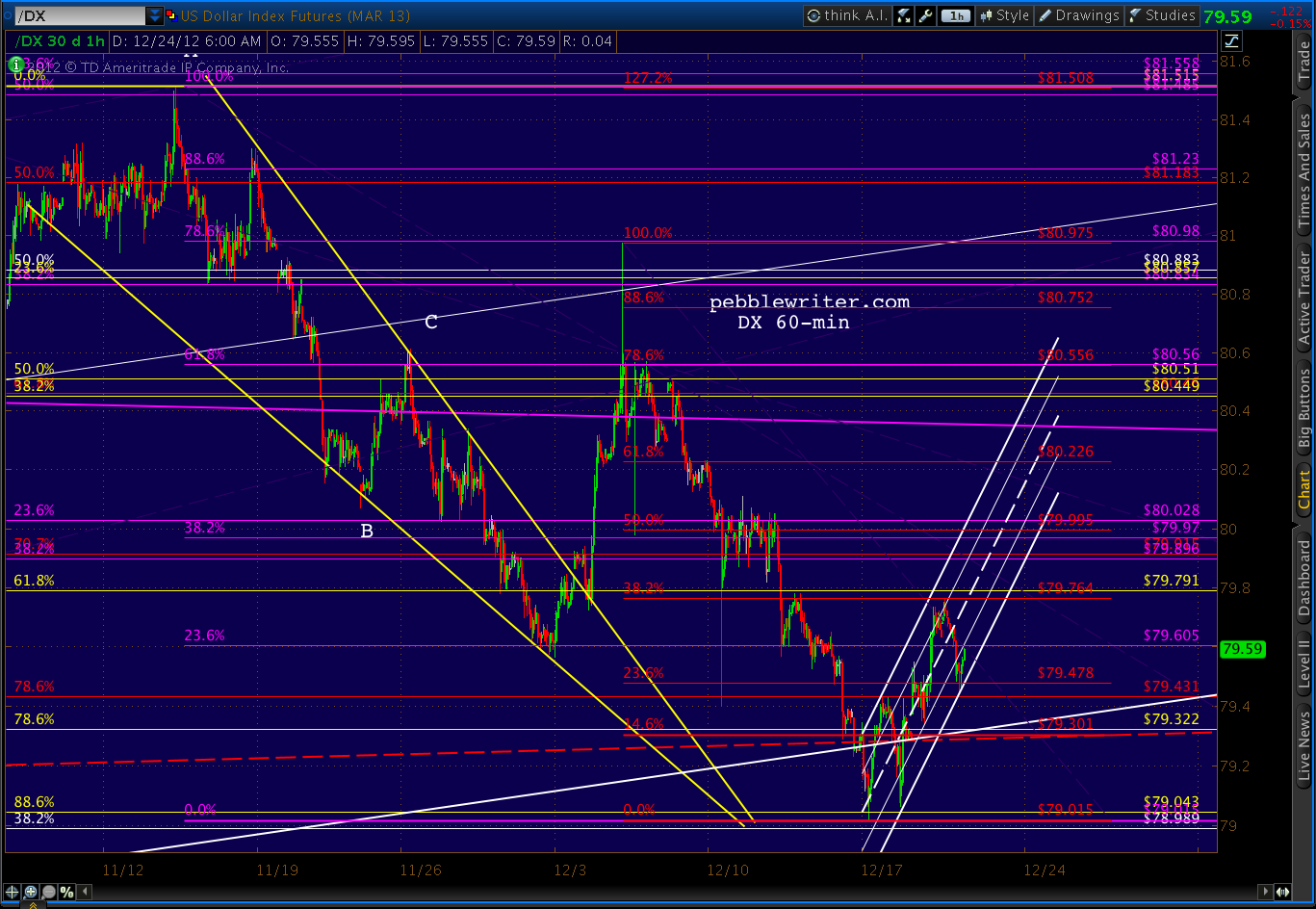

Keep an eye on the dollar's proposed channel for any signs of weakness…

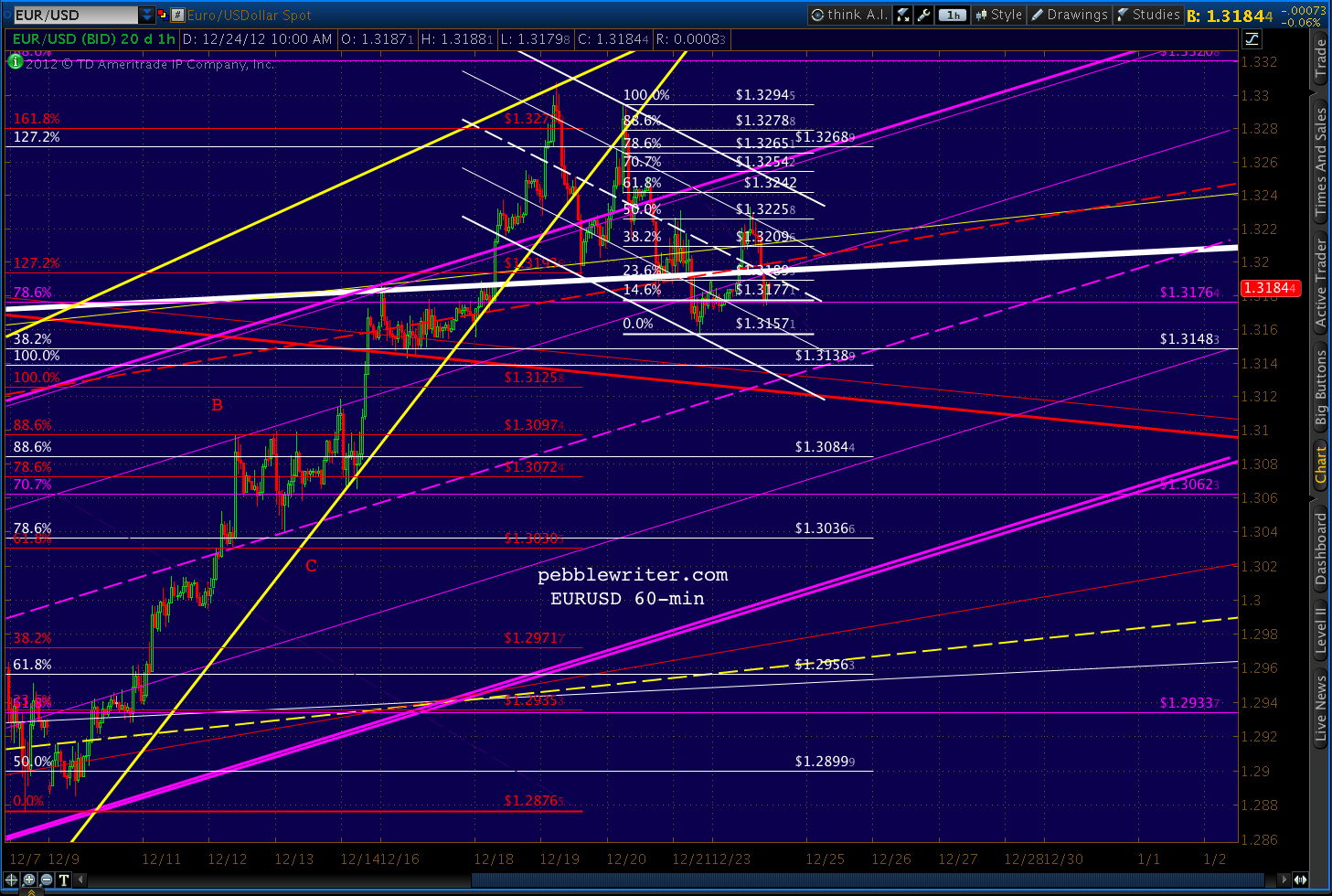

…as well as the EURUSD, which is trying to stage a comeback. A move through 1.3232 would signal 1.3265 — 1.3238.

UPDATE: 10:15 AM

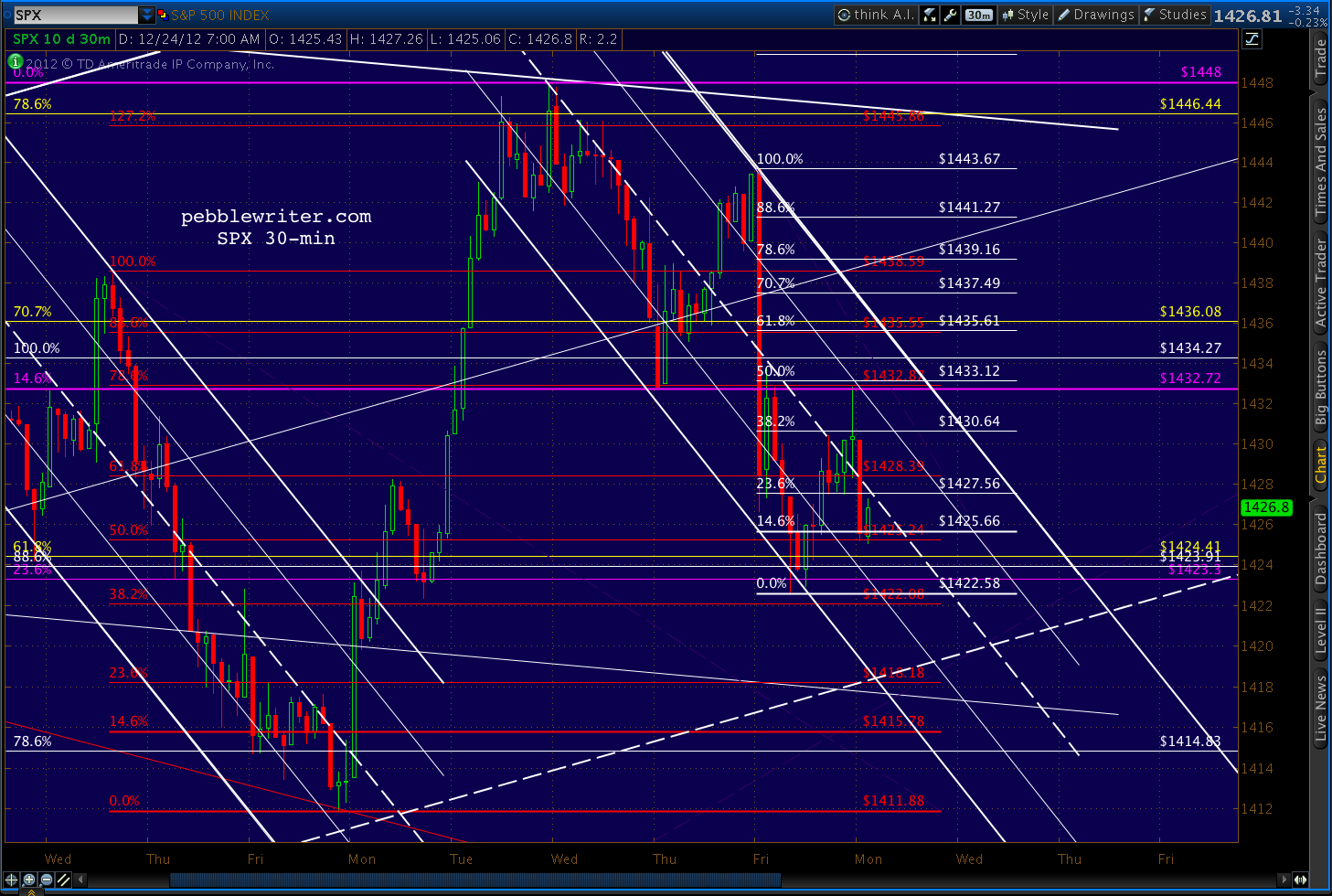

As to SPX, any push beyond 1432.78 carries the risk of a Bat completion up at 1441.27. Though, there would no doubt be a reaction at the .618 of 1435 first.

Since the 1432.78 high on Dec 21 stopped just shy of the 1432.82 low the day before, it might mark the completion of a Wave 4 in the first subwave of whatever degree wave down we’re currently in. Thus, the bulls might attempt to throw this most obvious bearish wave count into disarray by overlapping 1432.82.

It would then be easier to characterize the 1448-1422 slide as a normal A-B-C corrective wave rather than a bearish impulsive wave. Regular readers know that I don’t use Elliott Wave for predictive purposes, but it’s good to be aware of what Wavers might be thinking — since breaking through key EW levels will likely get them moving one direction or the other.

Our bearish case would benefit most by a reversal right here at the midline of the proposed white channel.

More later.

UPDATE: 11:45 AM

SPX just completed a small H&S pattern (below, in purple.) If it plays out, it will negate a potential IH&S pattern (in yellow). If the purple pattern plays out, it targets 1417 or so, which is around the bottom of the little white channel that’s tracking pretty well so far.

If the yellow pattern completes with a return to the dashed yellow line at Friday’s 1432 high, it would target somewhere in the vicinity of the .886 retracement of the 1443-1422 drop at 1441.

A low-volume, holiday-shortened feel-good day like today would be the perfect time to execute a ramp job. As discussed above, keep your guard up.

UPDATE: 1:00 PM

Things remain on track here at the end of the holiday-shortened equity trading day. Any fireworks will have to wait until Wednesday.

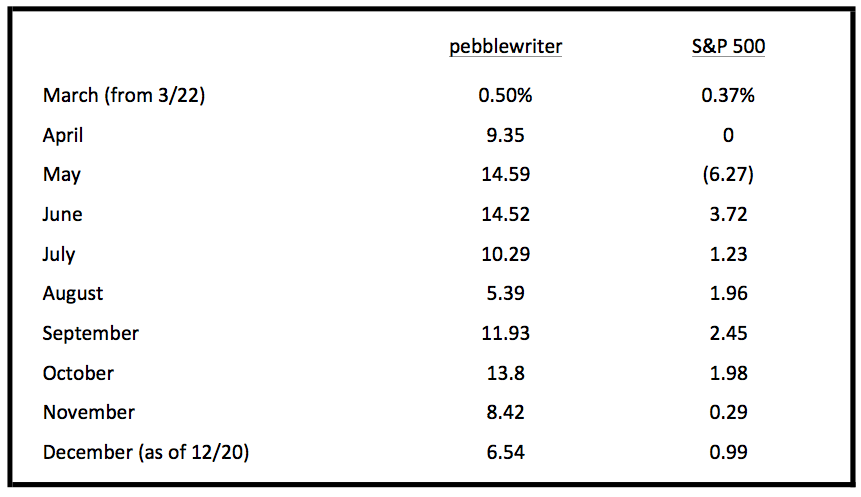

BTW, I updated the RESULTS PAGE this weekend for those who follow such things. Friday marked the end of the third quarter since the new site went live on Mar 22. After Dec 31, reports will be based upon calendar quarters.

Since inception last March, we’re up about 95% as compared to 3.7% for SPX (without dividends.) I don’t have figures for the same time period for hedge funds, but according to HSBC’s Dec 13 Hedge Fund Weekly [available on Zerohedge.com] the average ytd performance for all equity hedge funds was 5.15%. The top-performing fund (BTG Pactual’s Distressed Mortgage Fund) returned 39.91%.

For more, click HERE.