Oil is often viewed as a proxy for economic health. In a growing

economy, energy consumption increases. This increased demand generally

pressures prices higher. Likewise, a decline in oil prices often

accompanies declining demand.

That's

a greatly oversimplified view, of course. It ignores such important

issues such as Middle East tensions, weather and refinery anomalies,

etc.

But, the most important of these external factors is the US dollar -- the currency by which oil is traded globally (for now.)

A

weakening dollar is great for the many US companies that export

overseas. In general, it makes dollar denominated assets -- such as

stocks, real estate, etc -- more attractive to overseas investors which

helps the US attract and retain capital.

But, it makes

foreign-sourced oil much more expensive. This isn't an issue if you

travel everywhere via America's world-class public transportation

system. But, it really sucks for the guy with a 3-ton SUV -- or anyone

who consumes anything made overseas, for that matter. Imports are about

18% of GDP.

So, what's a central banker to do? Boost stocks and

investment in US assets, and there's a pretty good chance you blow the

budget of every American consumer. (Of course, it only

really affects those who eat and drive -- hey, buy a Chevy Volt already!)

Boost

the dollar to make gas and food more affordable for the 50 million

Americans living in poverty (1 in 5 children, 2 in 5 African American

children), and you risk a true disaster -- a stock market decline.

Never fear... Bernanke and his fellow Guardians of the American Dream know whose bread to butter.

The

chart below shows how crude light, the US dollar and the S&P 500

correlated over the past seven years. In 2006 and 2007, oil and the

stock market soared pretty much in sync while the dollar took it on the

chin. When SPX topped in late 2007, oil kept right on soaring --

because the dollar was still plunging. Nationwide, gas hit $4.12/gallon

in the summer of 2008.

We're

all conditioned to think of dollar strength as a function of risk off.

But, as the financial crisis worsened, the dollar couldn't catch a

bid. Money fled to the euro, the swiss franc, the sterling --

anywhere

but the dollar. There were several best-sellers on bookstore (remember

those? shelves that advised putting every last cent into the euro.

From

October 2007, when SPX peaked, until July 2008, stocks and the dollar

moved pretty much in tandem. But, as euro zone problems became more

apparent, the dollar finally bottomed. In August, as stocks began

sliding again, the dollar finally took off. Now deemed a safe haven, DX

soared 27% by March of 2009, while stocks shed another 54% in value

(58% in all.)

Of course, this did a number on oil -- already

reeling from declining global demand. CL plunged an astounding 78% in

only six months -- from 147 to 33. Fortunately for the stock market --

and especially the oil industry -- Ben Bernanke came to the rescue. The

first round of QE was a resounding success and both promptly reversed.

In

the first three months alone, CL more than doubled to 73. SPX added on

a respectable 44%. And the dollar took one for the team, shedding an

initial 13% on its way to an 18% loss.

So, why the history

lesson? By now most of you have noticed a slight discrepancy over the

past 3 1/2 years. Oil and the dollar have formed triangles. They've

had their ups and downs, but in general the highs have been getting

lower and the lows getting higher. I use the term "coiling" because

eventually prices won't be able to compress anymore.

This pent-up

energy will eventually be released in the form of sharply higher or

lower prices, though it won't necessarily happen tomorrow. Both have

drawn close to one side of the pattern, but there's still plenty of room

for a reversal.

Oil, if it doesn't suddenly shoot higher, will probably bounce back down. Likewise, the dollar is poised to bounce higher.

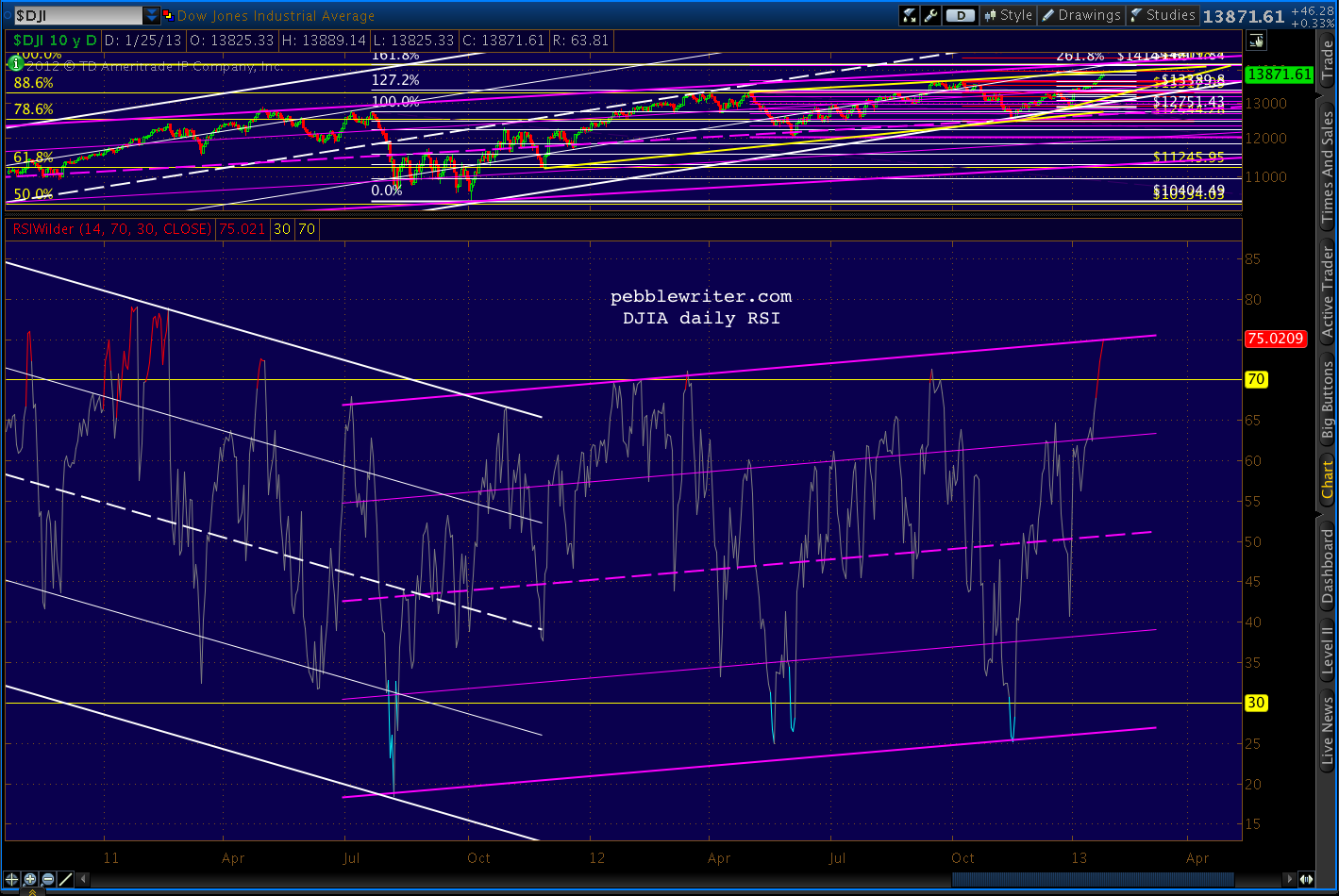

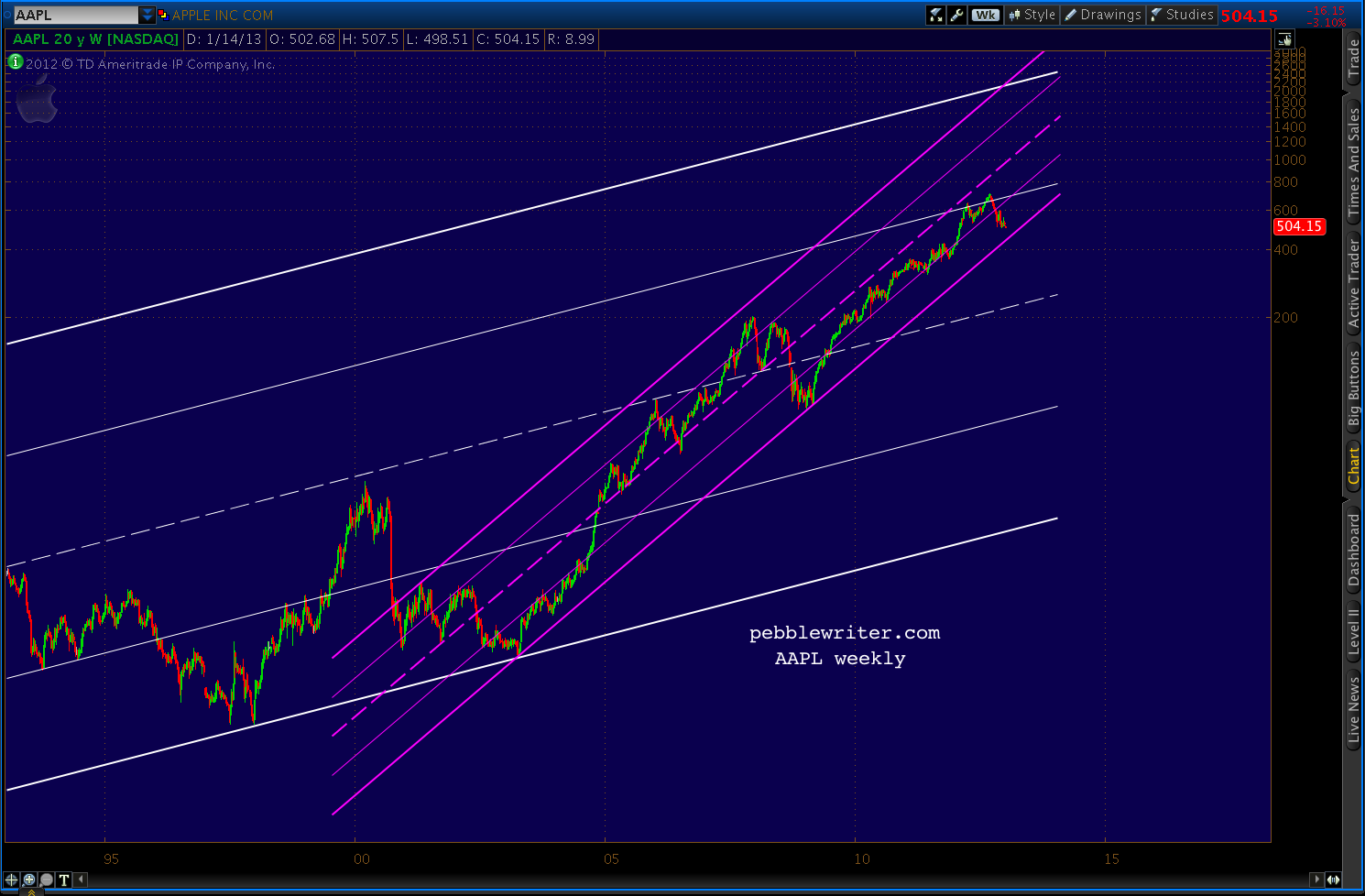

Stocks,

on the other hand, have made a series of higher highs and higher lows

in what's known as a rising wedge. These patterns also can't last

forever, and they almost always resolve to the downside.

Prices

are much closer to the upper bound than the lower, which also suggests

the next major move will be lower. In fact, when rising wedges break

down, they typically target their origin. Needless to say, a return to

2009 or even 2010 prices would be a huge blow to the rosy scenario TPTB

are crafting.

Does

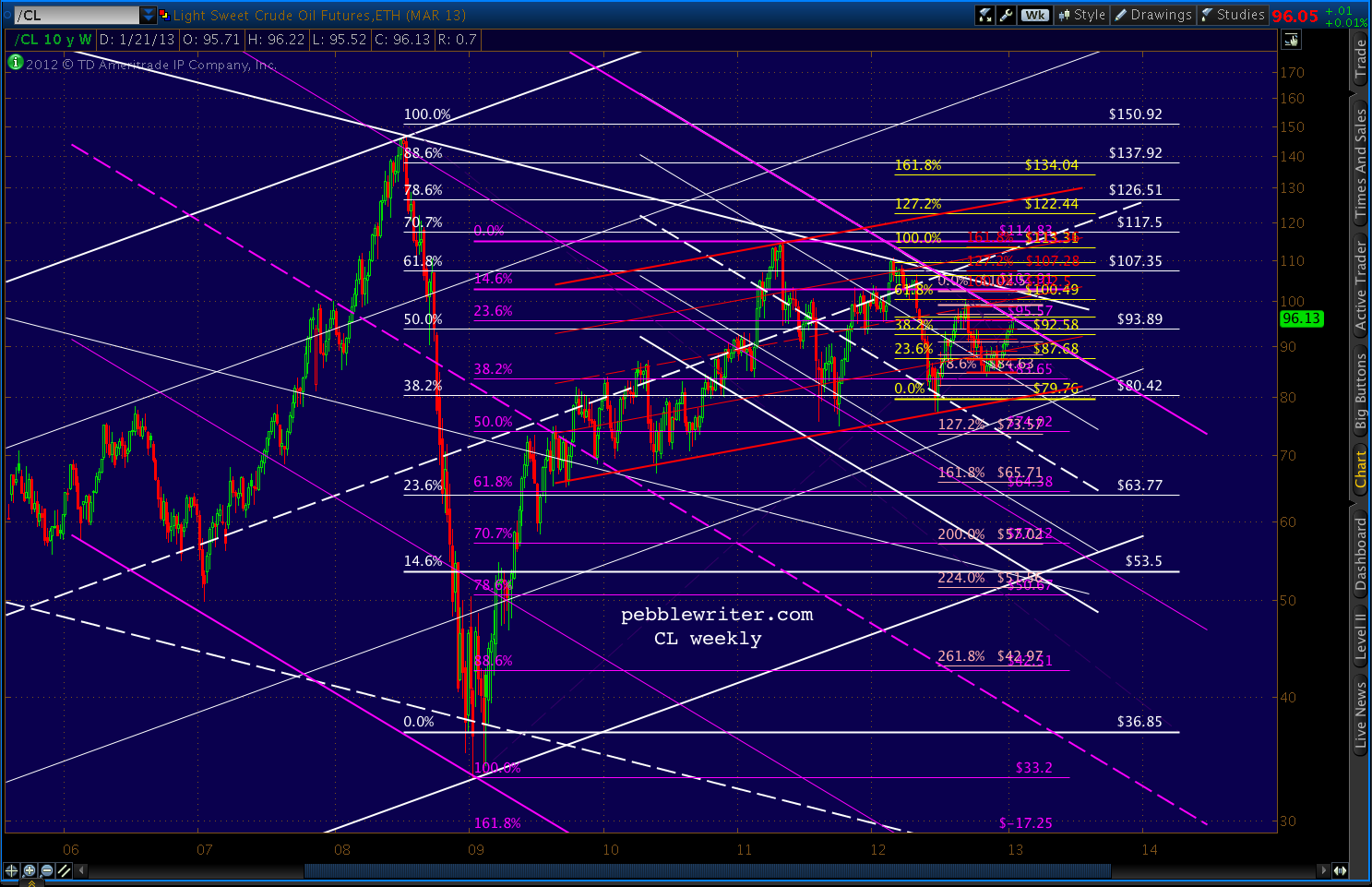

oil offer any hints as to which way prices are likely to go? I'm

drawn to a few periods in particular. From June 2009 to May 2010, oil

gained 19% compared to SPX's 27%. Yet, they both shed roughly 20% in

the May - June 2010 correction.

We had another round of QE, which

collapsed the dollar and sent stocks up 36% and oil up 70% through May

2011. This time, SPX corrected 22% and oil 35% (through Oct 2011.)

At

that point, CL sold off strongly -- dropping 23% through the end of

June. SPX, however, lagged. It lost 8%, then promptly regained 90% of

it in the next three weeks (compared to CL's 40% retracement.) When the

slide continued, however, SPX caught up -- in spades.

It lost 80%

of its gains from June 2010, while CL only lost about half that. SPX

then went on to make three new highs in a row, adding 38% through

today's close.

CL managed an 88% retracement of its May-October

losses for a 47% gain through Feb 2012, and has made two lower highs

(each a 61.8% retracement of the previous high) since then. Total gain

from Oct 2011: 27%. And, it's been a fairly neutral currency market.

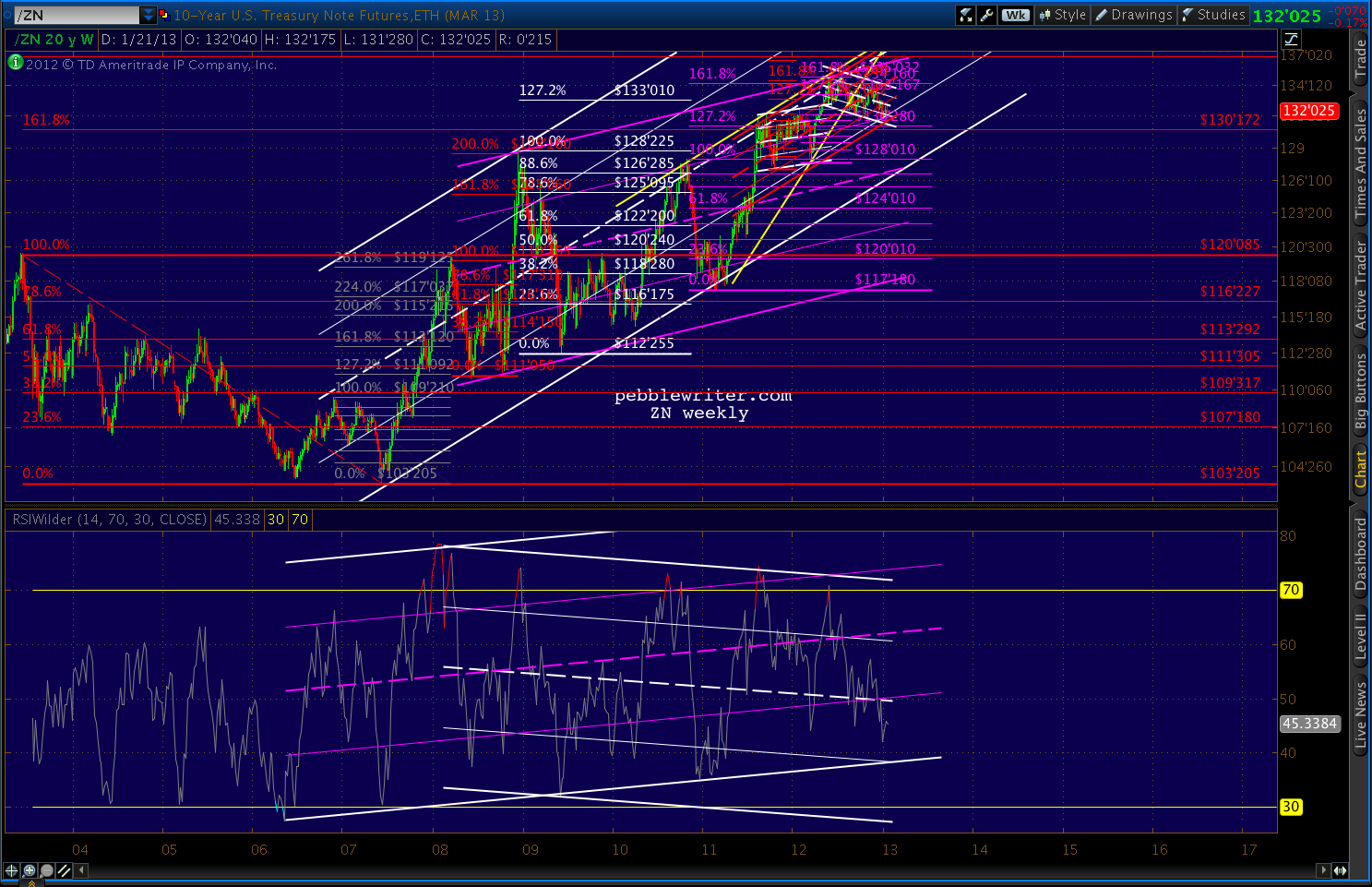

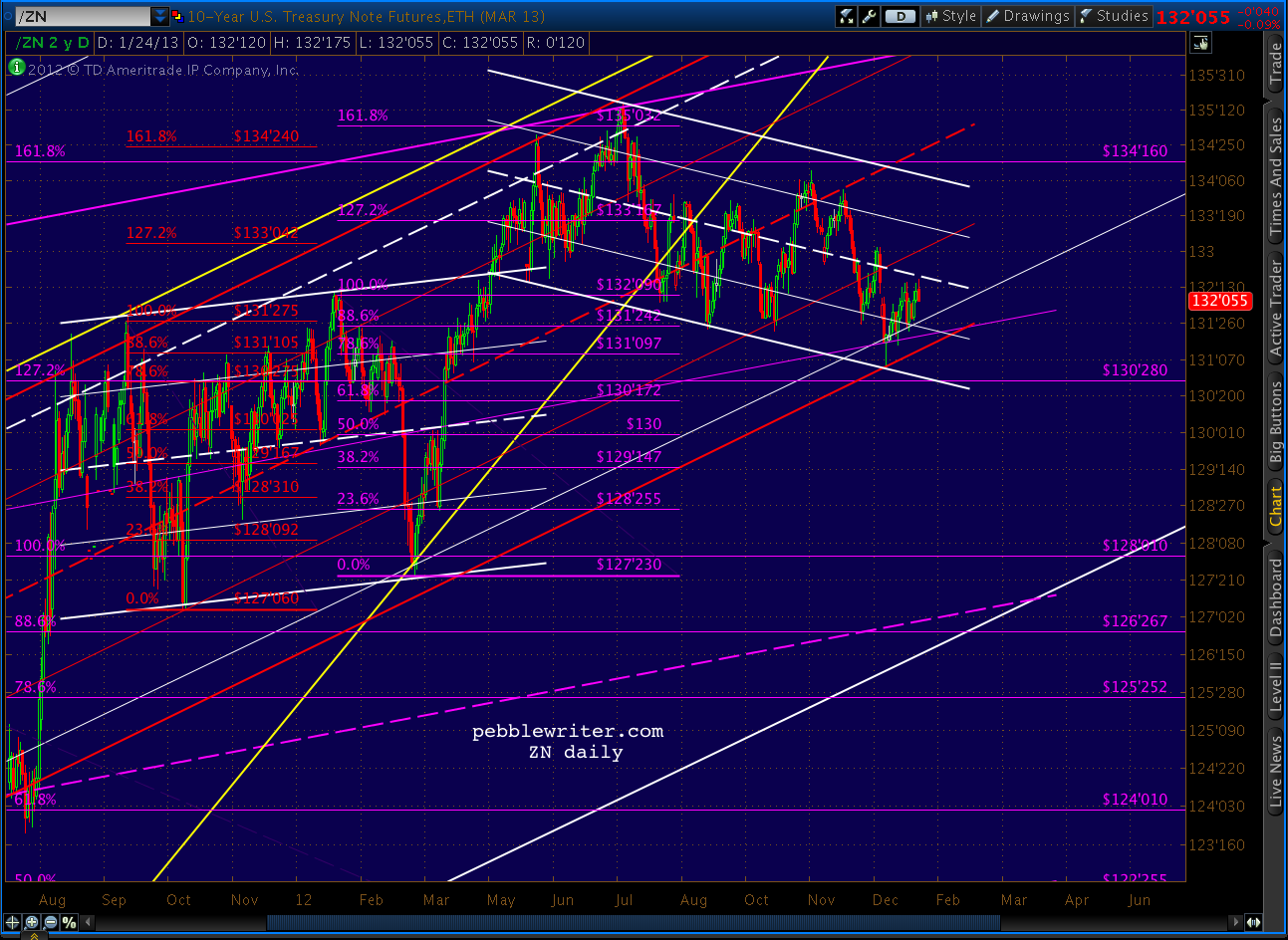

I

can't help wondering what the oil and currency markets know that the

stock market doesn't. A look at the CL charts indicates more downside.

Will SPX again play catch-up?

Even ignoring what I suspect about the dollar and equity markets, CL presents a bearish picture.

Whether it breaks down or out, CL is obviously at a turning point. We'll keep an eye on it...