Many are watching the Dow Transports' recent all-time highs, wondering if Dow Theory suggests new highs for the DJIA as well.

Without wading into the debate over which interpretation of the theory holds water and which are all wet, I think it's important to recognize that the DJIA is one of those indices not making new all-time highs lately.

Should the Industrials not break above 14,198.10, this would be considered a Dow Theory non-confirmation, at least on a larger scale. The last time this happened was in July of 2011, when the Transports made a new high of 5627.85 and the DJIA failed to best its May 2 12,876 high.

We can argue about cause and effect, but there's no argument about what happened next.

Eighteen months later, the DJT has again broken out to new all-time highs. DJIA has not. Here's the current visual, which shows the current degree of divergence is much larger than back then.

The Industrials, in fact, are a great candidate for a double-top.

Drilling down, we can see DJIA has nearly completed a Crab Pattern at the Fibonacci 161.8% extension (14,201.84) of the July-October 2011 crash (the white pattern.)

It intersects nearly perfectly with the previous 2007 high of 14,198.10 at the very point where the purple channel top and white 25% channel line also intersect. But, it need not even reach that level to be considered a double top (within 1%.)

And, only a few points away we find a Butterfly Pattern target (small red pattern) at 13,985.65 and a Crab Pattern target (in white) of 13,963.50.

The last leg up in the move since October 2011 has been 1424 points -- roughly 87% of the leg 3 rally between June and September of 2012. A Fibonacci 88.6% of the leg 3 rally would register at 13,912 -- well within the margin of error for any of the harmonic patterns mentioned above, and only 16 points above today's high.

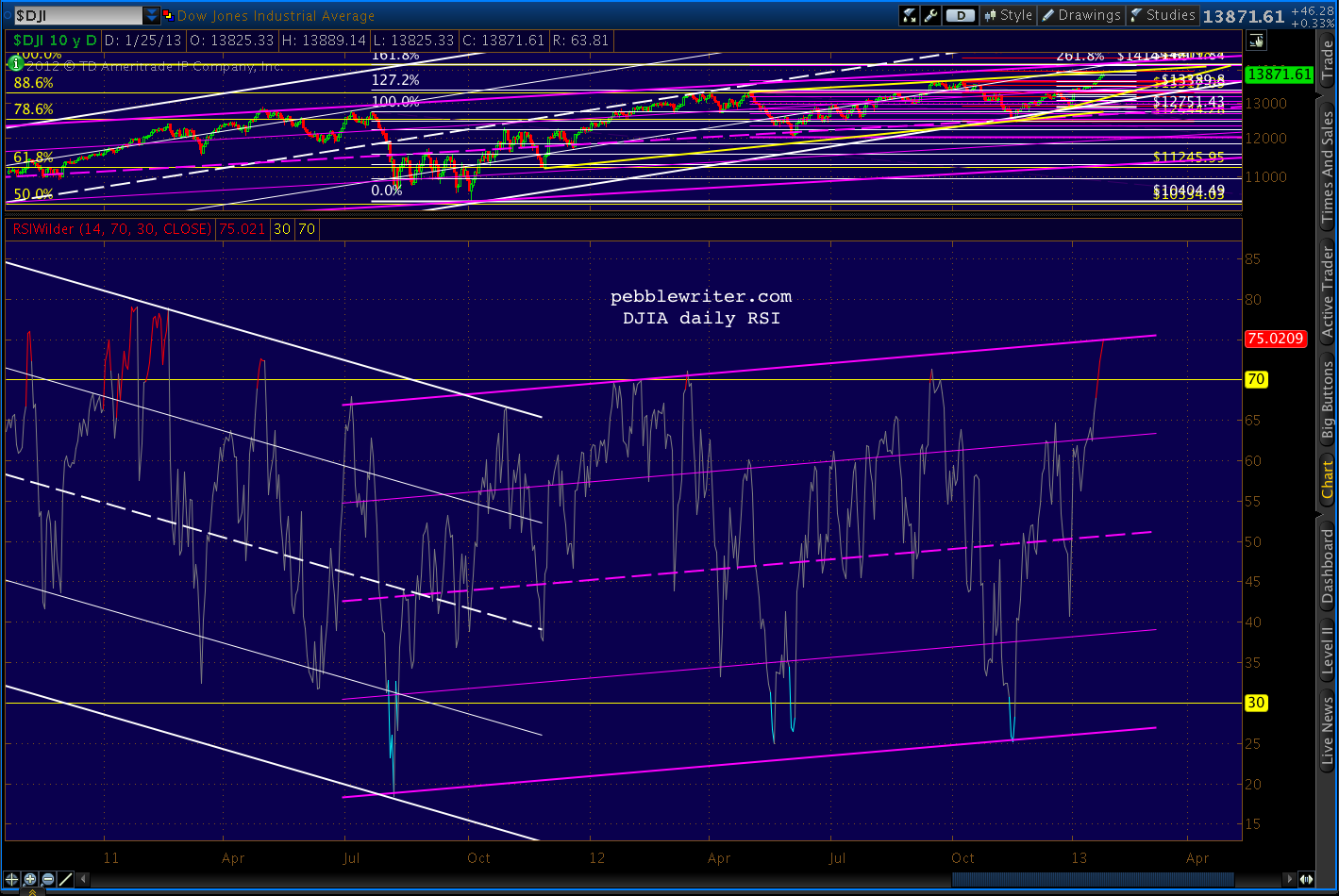

And, for those who, like me, love to channel stuff, the DJIA's daily RSI has its own bearish tale to tell.

Could DJIA blow through 14,200 confirm the Transports' all-time high and spoil the bears' party? Of course. There are still plenty of earnings reports to sift through, including AMZN, CAT, FB, YHOO, IP, PFE and F in the next few days. We could get great Durable Goods numbers Monday, Case-Shiller Home Price Index on Tuesday, or a bullish FOMC outcome on Wednesday.

But, anyone counting on new all-time highs should remember July 2011 and consider protecting their downside.

Without wading into the debate over which interpretation of the theory holds water and which are all wet, I think it's important to recognize that the DJIA is one of those indices not making new all-time highs lately.

Should the Industrials not break above 14,198.10, this would be considered a Dow Theory non-confirmation, at least on a larger scale. The last time this happened was in July of 2011, when the Transports made a new high of 5627.85 and the DJIA failed to best its May 2 12,876 high.

We can argue about cause and effect, but there's no argument about what happened next.

Eighteen months later, the DJT has again broken out to new all-time highs. DJIA has not. Here's the current visual, which shows the current degree of divergence is much larger than back then.

The Industrials, in fact, are a great candidate for a double-top.

Drilling down, we can see DJIA has nearly completed a Crab Pattern at the Fibonacci 161.8% extension (14,201.84) of the July-October 2011 crash (the white pattern.)

It intersects nearly perfectly with the previous 2007 high of 14,198.10 at the very point where the purple channel top and white 25% channel line also intersect. But, it need not even reach that level to be considered a double top (within 1%.)

And, only a few points away we find a Butterfly Pattern target (small red pattern) at 13,985.65 and a Crab Pattern target (in white) of 13,963.50.

The last leg up in the move since October 2011 has been 1424 points -- roughly 87% of the leg 3 rally between June and September of 2012. A Fibonacci 88.6% of the leg 3 rally would register at 13,912 -- well within the margin of error for any of the harmonic patterns mentioned above, and only 16 points above today's high.

And, for those who, like me, love to channel stuff, the DJIA's daily RSI has its own bearish tale to tell.

Could DJIA blow through 14,200 confirm the Transports' all-time high and spoil the bears' party? Of course. There are still plenty of earnings reports to sift through, including AMZN, CAT, FB, YHOO, IP, PFE and F in the next few days. We could get great Durable Goods numbers Monday, Case-Shiller Home Price Index on Tuesday, or a bullish FOMC outcome on Wednesday.

But, anyone counting on new all-time highs should remember July 2011 and consider protecting their downside.