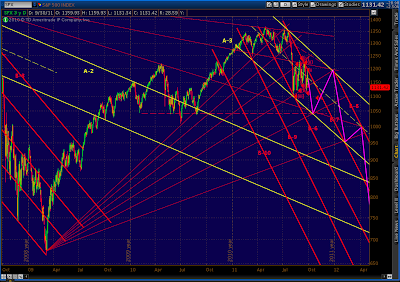

THE PATH TO 350 - DAY 3

So far, so good. Have a great weekend, everyone!

AND, THE REST...

Don't know for sure... but I'd bet dollars to donuts that we go through this point at 1117.50. Fan lines are your friend.

Will it wait till Monday, or is it ready to...

A look at SPXU harmonics, in no particular order. Lots of choices, here. The smallest crab starting 8/22 that points to 26 looks doable under wave 5 down, unless I'm way off on direction and timing.

The crab that started in Nov 10 points to 30, but that could take a little longer. Keep in mind, I'm speculating here. This is not investment advice.

NDX: continuation H&S pattern points to 1973, or you can look at it as a bear flag with potential to 1934. Either way, could get ugly in a hurry.

So far, so good. Have a great weekend, everyone!

AND, THE REST...

Don't know for sure... but I'd bet dollars to donuts that we go through this point at 1117.50. Fan lines are your friend.

Will it wait till Monday, or is it ready to...

A look at SPXU harmonics, in no particular order. Lots of choices, here. The smallest crab starting 8/22 that points to 26 looks doable under wave 5 down, unless I'm way off on direction and timing.

The crab that started in Nov 10 points to 30, but that could take a little longer. Keep in mind, I'm speculating here. This is not investment advice.

****************

|

| NDX: Rising Wedge, Gartley and H&S |

NDX: continuation H&S pattern points to 1973, or you can look at it as a bear flag with potential to 1934. Either way, could get ugly in a hurry.

Remember that at the 2011 top, NDX made one more higher high as SPX was making its first lower high, two weeks later the market cracked and we fell 250 points. Did the exact same thing in 2007/8.

| |

| TZA: Bull Flag, backtested, breaking out |

|

| TZA: IHS points to 64 |

| |

| SPX RSI TL -Moment of Truth |

Pebble,

ReplyDeleteCan you assist to analyze the instrument SPXU using the harmonic price pattern. I am seeing a bigger BAT pattern target of 34.18, and a smaller crab pattern of 28.47 or 35.28 ? Just wonder which is more likely to fit with the SPX decline scenario ?

wow, that's a good one. Take your pick! I'll throw up some different charts above, and discuss there.

ReplyDeleteYou could also try to figure out how much SPXU will move with an 8% decline in SPX (1130 to 1040) and use that as a short term target.

ReplyDelete