reposted from pebblewriter.com

**************************************************************************

Maybe it should read "be put away in May?"

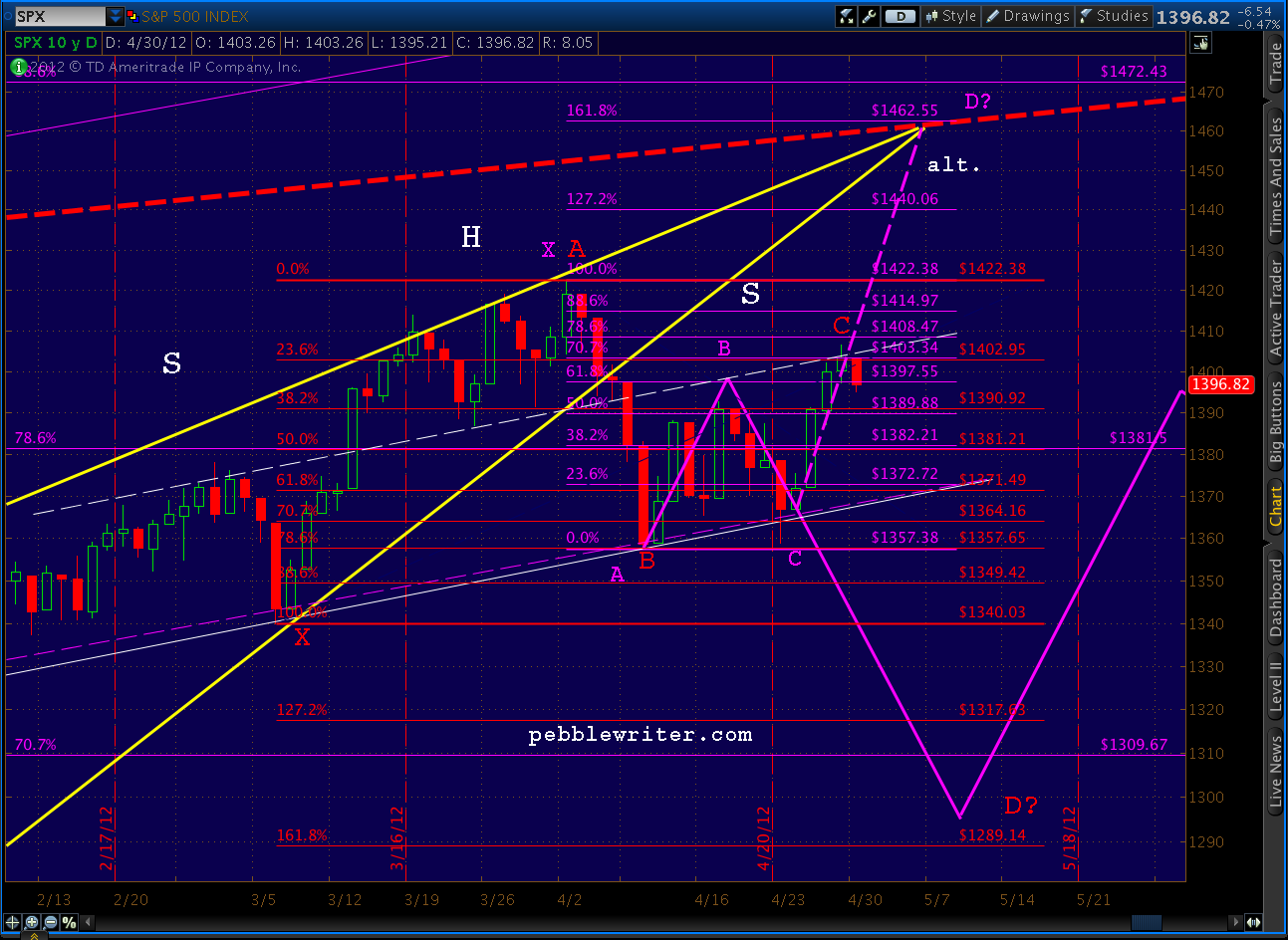

It occurred to me over the weekend that Friday's posts probably sounded a little schizophrenic. "Next Stop 1462?" does seem somewhat out of step with "VIX Ready to Rumble." Is it me, or is it the market that's schizophrenic?

This morning's drop does little to clarify things. Again, we reversed right at the H&S pattern shoulder line -- dropping as low as 1395 on the Chicago PMI survey (off 6 points to 56.2 for the third monthly drop in a row -- see details below.)

Furthermore, the RSI TL we were watching so closely last week appears to be holding. It broke on Friday, but has snapped back to the point where we can probably ignore Friday's action.

As anticipated, VIX did do a little rumbling this morning, up almost 7% to 17.41, currently loitering at 17.30. These RSI channels have done an amazing job at forecasting VIX over the past couple of months.

Unfortunately, we're no closer to resolution of last week's "analog vs alternative" quandary. For a long, tedious discussion please re-read the past few posts from last week. The cliff notes version is: "50:50." That is, both options are on the table, and will be until we see some sort of break out. I'm keeping my powder mostly dry until the path forward is more clear.

I'll continue to watch the red-dashed RSI TL on SPX above. I'm also watching the McClellan Oscillator, which is often a good indicator. Like many other indicators, it's on the verge of a breakout or breakdown. Now, if we can only figure out which one...

The economic data continues to forecast slowing. But, at what point will the market care? As we've discussed many times -- good news is good, and bad news is good (if it stimulates another round of QE.) It seems the only thing that might quash the QE hopes is an announcement from the Fed that it's off the table (don't hold your breath.)

Stay tuned.

**************************************************************************

Maybe it should read "be put away in May?"

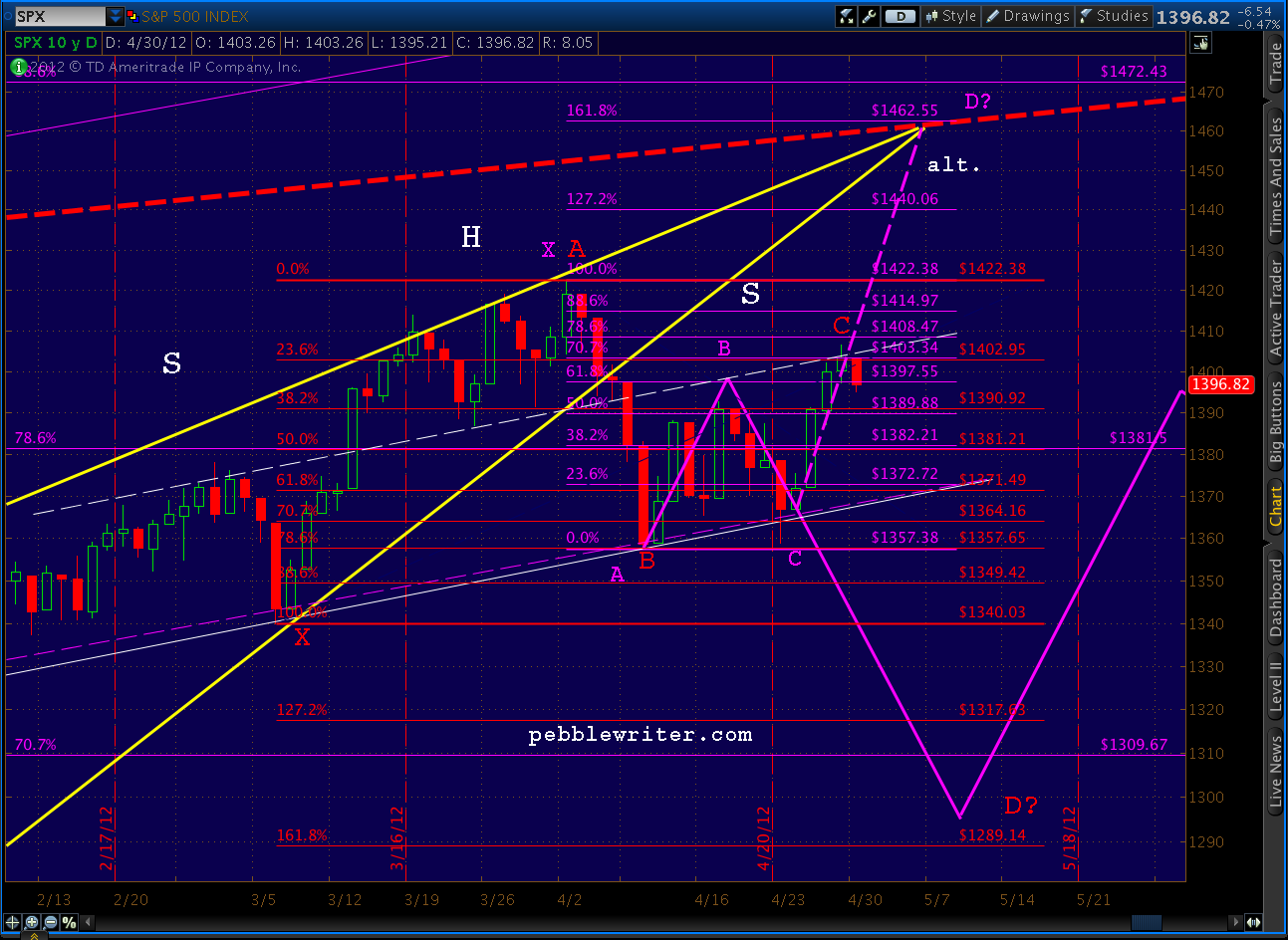

It occurred to me over the weekend that Friday's posts probably sounded a little schizophrenic. "Next Stop 1462?" does seem somewhat out of step with "VIX Ready to Rumble." Is it me, or is it the market that's schizophrenic?

This morning's drop does little to clarify things. Again, we reversed right at the H&S pattern shoulder line -- dropping as low as 1395 on the Chicago PMI survey (off 6 points to 56.2 for the third monthly drop in a row -- see details below.)

Furthermore, the RSI TL we were watching so closely last week appears to be holding. It broke on Friday, but has snapped back to the point where we can probably ignore Friday's action.

As anticipated, VIX did do a little rumbling this morning, up almost 7% to 17.41, currently loitering at 17.30. These RSI channels have done an amazing job at forecasting VIX over the past couple of months.

Unfortunately, we're no closer to resolution of last week's "analog vs alternative" quandary. For a long, tedious discussion please re-read the past few posts from last week. The cliff notes version is: "50:50." That is, both options are on the table, and will be until we see some sort of break out. I'm keeping my powder mostly dry until the path forward is more clear.

I'll continue to watch the red-dashed RSI TL on SPX above. I'm also watching the McClellan Oscillator, which is often a good indicator. Like many other indicators, it's on the verge of a breakout or breakdown. Now, if we can only figure out which one...

The economic data continues to forecast slowing. But, at what point will the market care? As we've discussed many times -- good news is good, and bad news is good (if it stimulates another round of QE.) It seems the only thing that might quash the QE hopes is an announcement from the Fed that it's off the table (don't hold your breath.)

Stay tuned.

*******************

The April PMI survey isn't pretty. The production component dropped a huge 11 points -- the largest drop in 11 months. But, the Buying Policy component is particularly telling. It asks respondents to report how far in advance they must order what they need for their businesses. It's a good handle on the tightness in the supply chain. This month, it fell dramatically -- from 45 to 28. In other words, there's plenty of capacity -- not a good sign for those expecting the economy to heat up.

I only just noticed today the new site url...good wishes with that.

ReplyDelete---

As for the schizo' market...I'd say this of the US market

'Largely deluded, occasional..brief..and seemingly uncorrelated moments of lucidity. Suffers also from serious mania, interspersed with spells of paranoia and brief terror. Has 'attachment issues' to a creature called the Bernanke, who appears to be providing periodic drugs to mediate severe emotional trauma during those brief moments of lucidity. Outlook is poor, long term recovery seems highly improbable. However, further evaluation might yet help further treatment.

yours

Dr. Doomster.