reprinted from pebblewriter.com...

The Bat Pattern that completed on Sep 14 [see: The World According to Ben] has played out nicely so far. Remember, Bat Patterns provide early warning of a reversal at a Fibonacci 88.6% of a previous significant move. In this case, it was 88.6% of the 2007 -- 2009 crash from 1576 to 666.

Note: In reality, the pattern paid off twice. Since SPX reversed at the 61.8% Fib in 2010, it first signaled a Gartley Pattern. These complete at the 78.6% Fib -- 1381.50 in this case. SPX came within 11 points of this target in May 2011, providing an excellent opportunity for making money on the ensuing downturn.

Since reversing at 1474, SPX shed 44 points to 1430, then retraced 88.6% of that decline to complete a much smaller Bat Pattern at 1470 on October 5 (charted below in purple.) Although 44 points is nothing to sneeze at, it doesn't measure up to the 98 points lost the last time a Bat Pattern of this magnitude completed in Feb 2007.

Harmonic patterns frequently nest inside and morph into one another. An astute trader can either profit from the turns or, at the very least, protect a buy-and-hold portfolio from otherwise unforeseeable market plunges.

There are many ways to utilize Harmonic patterns. I use them in combination with other chart patterns and technical analysis to enhance the accuracy of forecasts. A stripped-down version of my current short-term chart shows the role that harmonics, channels and a large rising wedge have played over the past month or so.

The descending red channel did a fabulous job of guiding the downside from Sep 14 to Oct 3. When it was broken on the 4th, a new channel was established (in white.) This nearly horizontal channel proved its worth earlier today, signaling us to take profits on a short position established a few days ago at 1455.

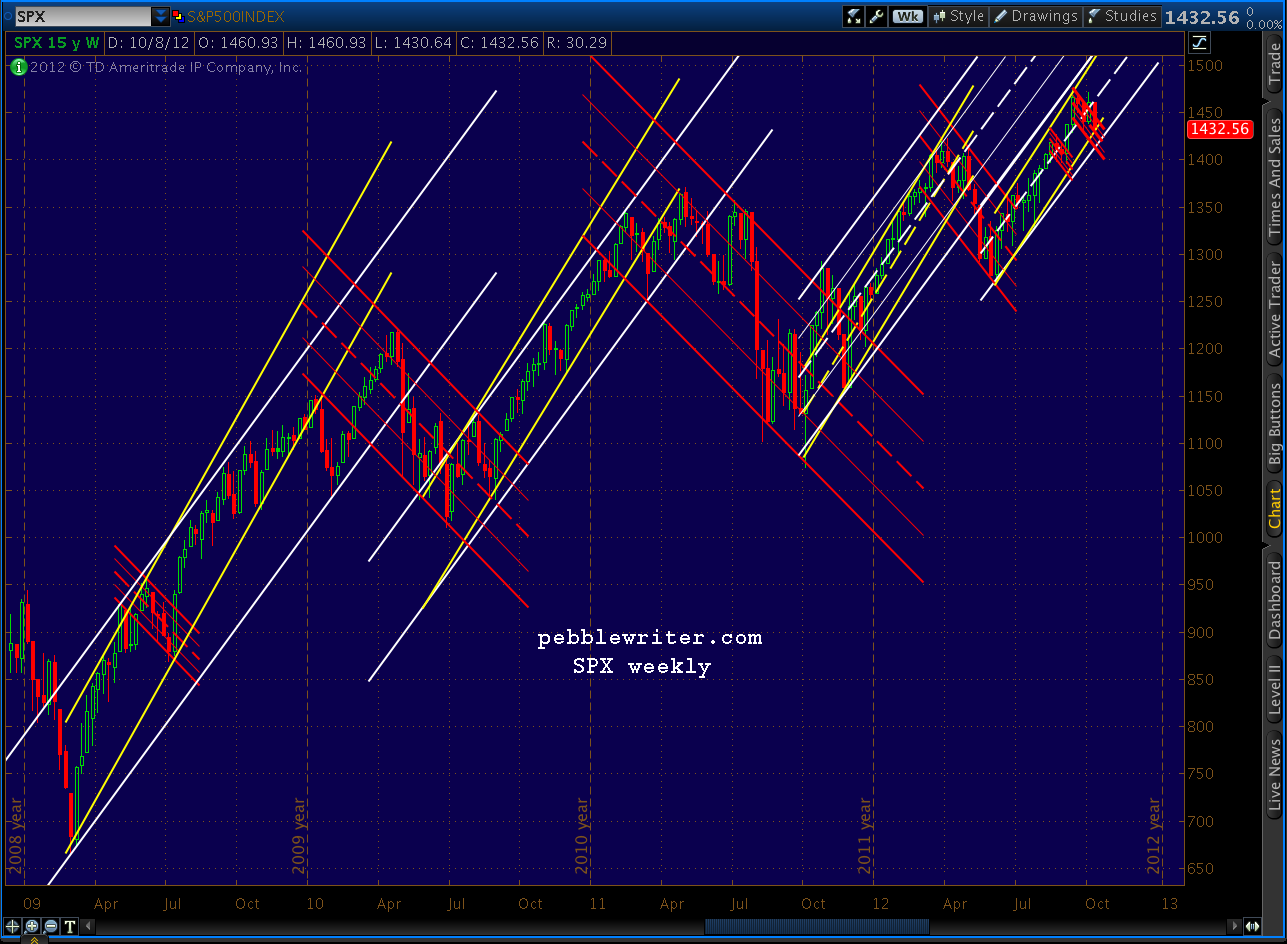

All of this action has taken place within the confines of a large rising channel (in yellow above) that's guided prices since the 1266 low on June 4. This yellow channel, in turn, is contained in a larger white channel. Together, they're playing out a familiar refrain.

As the market rises, it usually accelerates in a series of channels featuring continually steepening slopes (there are several others in addition to the white and yellow.) When the market tops out, it decelerates, breaking these channels one at a time until ready to begin the process anew.

Declines are typically contained in similarly-sloped falling channels -- seen above in red. The falling red channel in the short-term chart above is barely visible in the upper, right corner of this chart -- providing context for the Bat Pattern reversal from 1474 thus far.

What does it all mean for the future? The major indicators discussed above (harmonics, chart patterns, etc.) all point to the same conclusion -- a market running out of steam. In fact, it appears to be in for a nasty downturn in the not too distant future.

Analogs, sometimes called fractals, are simply repeats of past price movements. The 2011-as-2007 analog provided an opportunity to short the July 2011 crash in advance, accurately predicting the very day the downturn would begin [see: Why Analogs Work.] Another analog posted this past March [see: Analog Details] accurately predicted the downturn from 1422 and subsequent return to 1474.

Tuesday, I posted a new and promising analog [see: Analog Alert] that shows the top is either already in or will be soon -- perhaps just after the election. Check daily updates on pebblewriter.com for additional information.

GLTA.

The Bat Pattern that completed on Sep 14 [see: The World According to Ben] has played out nicely so far. Remember, Bat Patterns provide early warning of a reversal at a Fibonacci 88.6% of a previous significant move. In this case, it was 88.6% of the 2007 -- 2009 crash from 1576 to 666.

Note: In reality, the pattern paid off twice. Since SPX reversed at the 61.8% Fib in 2010, it first signaled a Gartley Pattern. These complete at the 78.6% Fib -- 1381.50 in this case. SPX came within 11 points of this target in May 2011, providing an excellent opportunity for making money on the ensuing downturn.

Since reversing at 1474, SPX shed 44 points to 1430, then retraced 88.6% of that decline to complete a much smaller Bat Pattern at 1470 on October 5 (charted below in purple.) Although 44 points is nothing to sneeze at, it doesn't measure up to the 98 points lost the last time a Bat Pattern of this magnitude completed in Feb 2007.

Harmonic patterns frequently nest inside and morph into one another. An astute trader can either profit from the turns or, at the very least, protect a buy-and-hold portfolio from otherwise unforeseeable market plunges.

There are many ways to utilize Harmonic patterns. I use them in combination with other chart patterns and technical analysis to enhance the accuracy of forecasts. A stripped-down version of my current short-term chart shows the role that harmonics, channels and a large rising wedge have played over the past month or so.

The descending red channel did a fabulous job of guiding the downside from Sep 14 to Oct 3. When it was broken on the 4th, a new channel was established (in white.) This nearly horizontal channel proved its worth earlier today, signaling us to take profits on a short position established a few days ago at 1455.

All of this action has taken place within the confines of a large rising channel (in yellow above) that's guided prices since the 1266 low on June 4. This yellow channel, in turn, is contained in a larger white channel. Together, they're playing out a familiar refrain.

As the market rises, it usually accelerates in a series of channels featuring continually steepening slopes (there are several others in addition to the white and yellow.) When the market tops out, it decelerates, breaking these channels one at a time until ready to begin the process anew.

Declines are typically contained in similarly-sloped falling channels -- seen above in red. The falling red channel in the short-term chart above is barely visible in the upper, right corner of this chart -- providing context for the Bat Pattern reversal from 1474 thus far.

What does it all mean for the future? The major indicators discussed above (harmonics, chart patterns, etc.) all point to the same conclusion -- a market running out of steam. In fact, it appears to be in for a nasty downturn in the not too distant future.

Analogs, sometimes called fractals, are simply repeats of past price movements. The 2011-as-2007 analog provided an opportunity to short the July 2011 crash in advance, accurately predicting the very day the downturn would begin [see: Why Analogs Work.] Another analog posted this past March [see: Analog Details] accurately predicted the downturn from 1422 and subsequent return to 1474.

Tuesday, I posted a new and promising analog [see: Analog Alert] that shows the top is either already in or will be soon -- perhaps just after the election. Check daily updates on pebblewriter.com for additional information.

GLTA.