First, I should make clear that I think the euro zone is toast. The only thing holding it together right now is Germany’s indecision as to whether it’ll save money in the long run by going its own way.

But, one of these days, investors will turn their attention back to the US dollar. When that happens, there’s a fair chance that the American problems will be judged to be every bit as serious as the EZ’s. In the end, it’s a dirty shirt contest and either currency could take first prize — especially if everything starts melting down — stocks, bonds, metals alike.

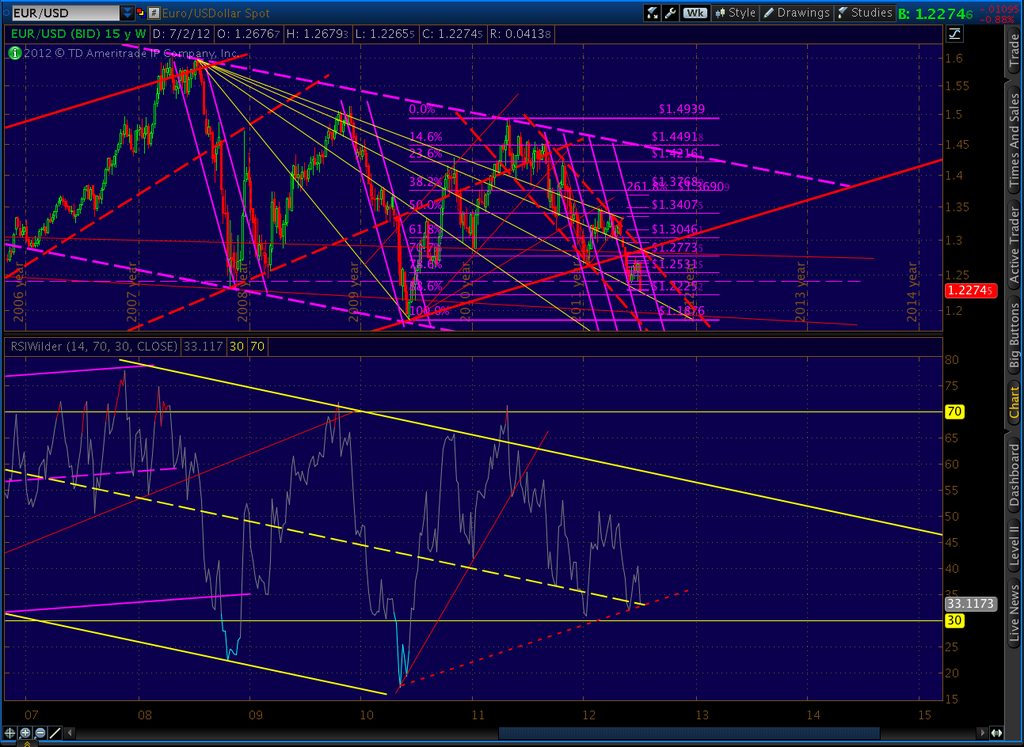

With that said, let’s look at the charts. A close-up of the weekly chart shows the potential lifeline offered by the RSI channel. We’re clinging to the mid line and a TL off the recent RSI lows.

Prices for the pair are clinging to a fan line off the 2008 highs – seen below as a solid yellow line. This line passes through the .886 Fib line sometime in the next two weeks. It’s hard to chart precisely, but today’s low of 1.2259 is only a bit higher than the .886 of 1.2225. There should be a significant reaction at that point.

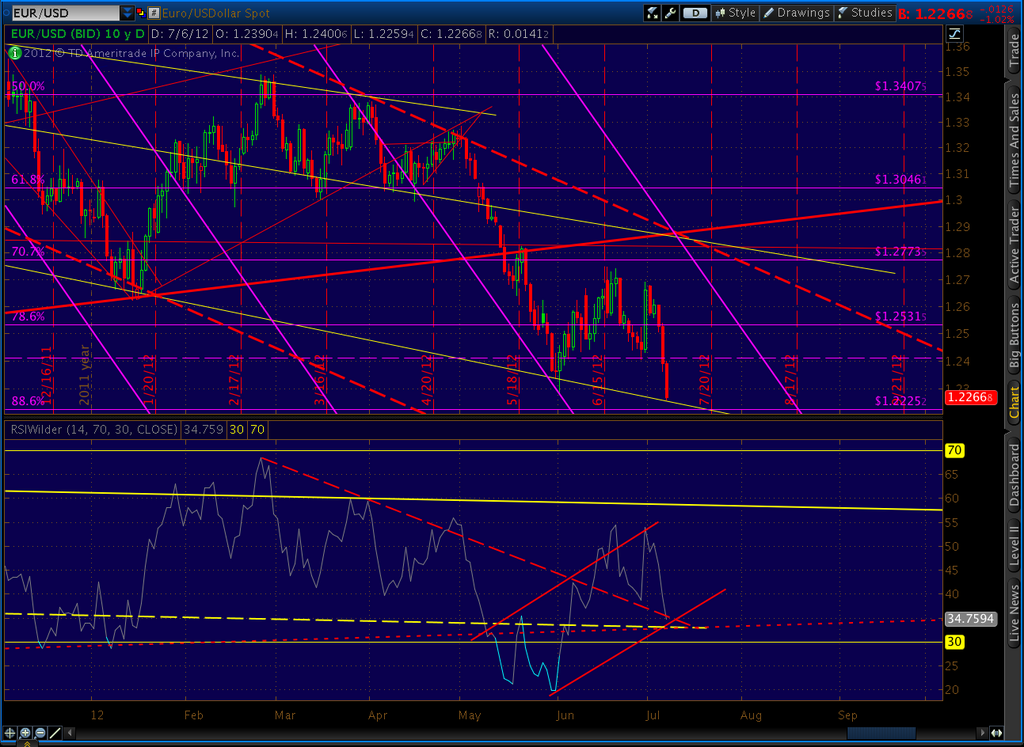

A reaction up to test the red channel line around 1.28-1.29 would sync up nicely with our current forecast for equities.

This forecast is obviously a very contrarian view. Just look at the positive divergence on the daily chart. But, I’m trying as best I can to ignore my bias.

The list of things that can go wrong with the euro dwarfs the list of things that might suddenly go right. But, gauging from level of negativism out there (including my own!) any seemingly positive development in the next few days could trap an awful lot of bears. And that, my friends, has been a hallmark of this market ever since last October.

GLTA.

* * * * * * * *

Get current forecasts as they're posted on pebblewriter.com.

Negative Yields In France For First Time, Record Negative Rates in Germany;

ReplyDelete10-Year Yield Back Above 7% in Spain, Above 6% in Italy

http://globaleconomicanalysis.blogspot.com/2012/07/negative-yields-in-france-for-first.html

why should nations with no common language stay together when their fiscal trajectories are so divergent?