reprinted from pebblewriter.com~

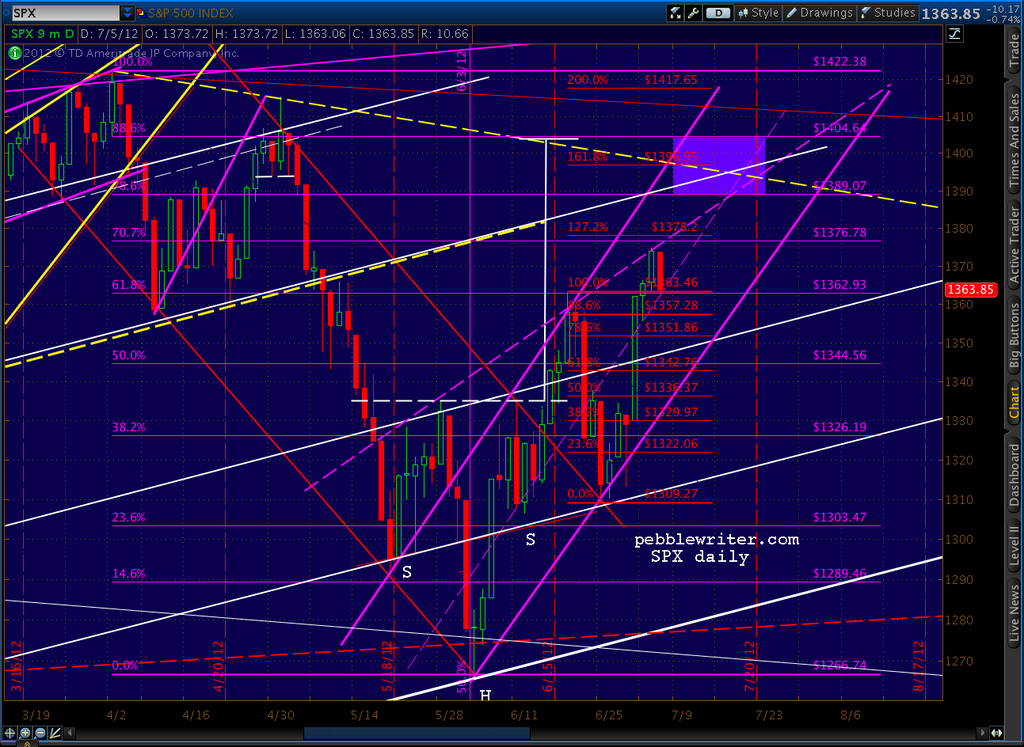

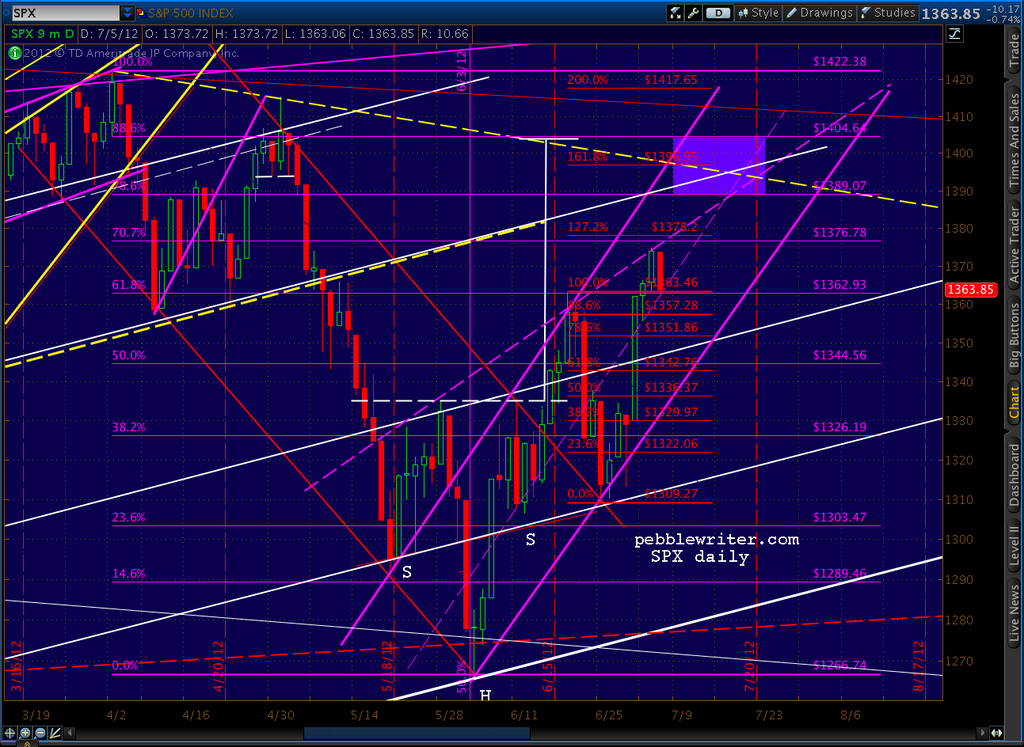

We're getting everything we anticipated on Tuesday, with the notable exception of that 1.272 tag at 1378.20 before a reversal to 1363 [see: Going For It.]

We only reached 1374.81 instead of 1378.20. But, as we discussed Tuesday, the close at 1374.02 (on the presumed rising wedge upper bound - purple, dashed line) strengthens the case for the rising wedge pattern.

It's important. While either the rising wedge or the channel could get us to our price targets, it has huge implications for what happens next.

Rising wedges spell the end of an uptrend. Channels can go on for a long, long time. So, which is it?

Note our price target -- the highlighted rectangle that ranges from 1389 to 1404. The channel can get there quite easily -- as early as Monday or Tuesday of next week. The rising wedge doesn't reach those prices until the 17th or so.

I suspect the biggest deciding factor will be the upcoming summit of European Finance Ministers on July 9-10. There are several issues at play.

The recent Spanish bailout announcement boosted markets because, in a nutshell, banks would get up to $100 billion directly (asset purchases) from the ESM. Importantly, existing debt would not be subordinated to the new debt and the ECB would gain more control over the various sovereign central banks.

Now, with Eurogroup/ECOFIN only a few days away, some serious problems remain with the "solution." First, the ESM doesn't officially exist yet. As the effective successor to the ESFS, its existence requires approval by member states representing 90% of the capital base. So far, Finland, the Netherlands and Slovakia (combined, about 9%) are balking. As long as everyone else is aboard, this should not be an issue. But, if not...

Second, Germany is balking. Not Angela Merkel, of course, but seemingly everyone else is dead set against backstopping failing foreign governments and banks. They are justified, as we discussed at length when Greece was in the cross hairs. Why should Germany, with a retirement age of 67, put itself on the line for countries whose retirement benefits kick in at age 60?

Pulling out now would be a no-brainer, if not for the fact that so much of the German economy relies on its less fortunate neighbors. Sales, production, suppliers, investment, etc -- it's a tangled web. The $64 billion question is whether Germany would suffer more pain/expense from pulling out now or from seeing the whole mess through to the bitter end.

Germany's constitutional court is considering an injunction that would impede ESM ratification. Oral proceedings are scheduled for July 10. German Finance Minister Martin Kotthaus has been quoted as saying he doubts whether the troika (EC, ECB and IMF) can approve the ESM by Monday.

Last, even if the ESM survives the various challenges, will it be enough to do the trick? Nearly 40% of the fund's capital contributions would presumably come from Italy, Spain, Greece, Portugal and Ireland. Add in France, and the total is closer to 60%. Can the ESM maintain its value if 40-60% of its guarantors are in or near insolvency?

This situation is very fluid, and has potentially devastating consequences. I highly recommend staying on top of the steady flow of news from sources such as Zerohedge.

More charts for members will be available in the next hour or so.

We're getting everything we anticipated on Tuesday, with the notable exception of that 1.272 tag at 1378.20 before a reversal to 1363 [see: Going For It.]

"Note that the 1.272 of 1378.20 is very close to the larger (purple) pattern’s .707 of 1376.78 — lending credence to the idea of an interim reversal there. The likely target is the Fib level around 1363 — the larger pattern’s .618 and our previous high."

We only reached 1374.81 instead of 1378.20. But, as we discussed Tuesday, the close at 1374.02 (on the presumed rising wedge upper bound - purple, dashed line) strengthens the case for the rising wedge pattern.

It's important. While either the rising wedge or the channel could get us to our price targets, it has huge implications for what happens next.

Rising wedges spell the end of an uptrend. Channels can go on for a long, long time. So, which is it?

Note our price target -- the highlighted rectangle that ranges from 1389 to 1404. The channel can get there quite easily -- as early as Monday or Tuesday of next week. The rising wedge doesn't reach those prices until the 17th or so.

I suspect the biggest deciding factor will be the upcoming summit of European Finance Ministers on July 9-10. There are several issues at play.

The recent Spanish bailout announcement boosted markets because, in a nutshell, banks would get up to $100 billion directly (asset purchases) from the ESM. Importantly, existing debt would not be subordinated to the new debt and the ECB would gain more control over the various sovereign central banks.

Now, with Eurogroup/ECOFIN only a few days away, some serious problems remain with the "solution." First, the ESM doesn't officially exist yet. As the effective successor to the ESFS, its existence requires approval by member states representing 90% of the capital base. So far, Finland, the Netherlands and Slovakia (combined, about 9%) are balking. As long as everyone else is aboard, this should not be an issue. But, if not...

Second, Germany is balking. Not Angela Merkel, of course, but seemingly everyone else is dead set against backstopping failing foreign governments and banks. They are justified, as we discussed at length when Greece was in the cross hairs. Why should Germany, with a retirement age of 67, put itself on the line for countries whose retirement benefits kick in at age 60?

Pulling out now would be a no-brainer, if not for the fact that so much of the German economy relies on its less fortunate neighbors. Sales, production, suppliers, investment, etc -- it's a tangled web. The $64 billion question is whether Germany would suffer more pain/expense from pulling out now or from seeing the whole mess through to the bitter end.

Germany's constitutional court is considering an injunction that would impede ESM ratification. Oral proceedings are scheduled for July 10. German Finance Minister Martin Kotthaus has been quoted as saying he doubts whether the troika (EC, ECB and IMF) can approve the ESM by Monday.

Last, even if the ESM survives the various challenges, will it be enough to do the trick? Nearly 40% of the fund's capital contributions would presumably come from Italy, Spain, Greece, Portugal and Ireland. Add in France, and the total is closer to 60%. Can the ESM maintain its value if 40-60% of its guarantors are in or near insolvency?

This situation is very fluid, and has potentially devastating consequences. I highly recommend staying on top of the steady flow of news from sources such as Zerohedge.

More charts for members will be available in the next hour or so.

No comments:

Post a Comment