ORIGINAL POST: Still long since 1331.

Because we have so many new members over the past week, I'd like to suggest you check out the post: How to Use Pebblewriter. It's a good general overview of how my process works. And, if Butterfly, Bat, Crab and Gartley Patterns sound like gibberish, check out the pages under Harmonics in the Learn tab on the main page. I will try to update the How to Use Pebblewriter page over the weekend.

There are still a handful of the 37 2nd quarter discounts available. These are annual memberships for $500, a 37% discount (in celebration of our 37% 2nd quarter results) to the new annual price ($800) which will go through tomorrow. Details here.

If you've recently signed up for a monthly or quarterly membership, consider upgrading while these are still available.

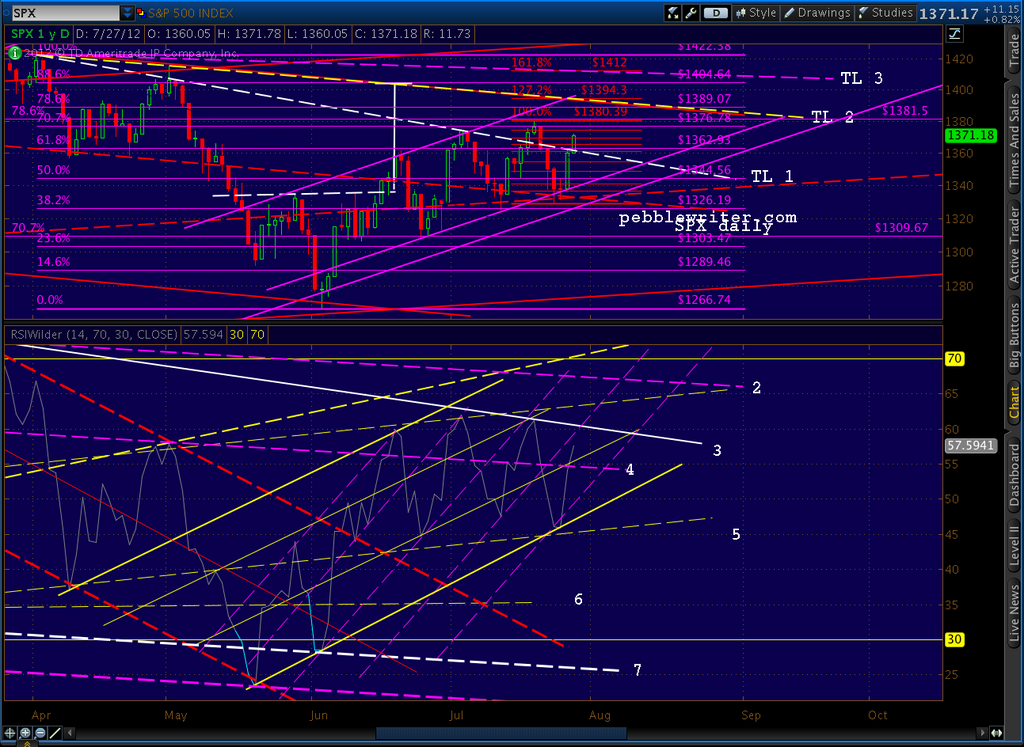

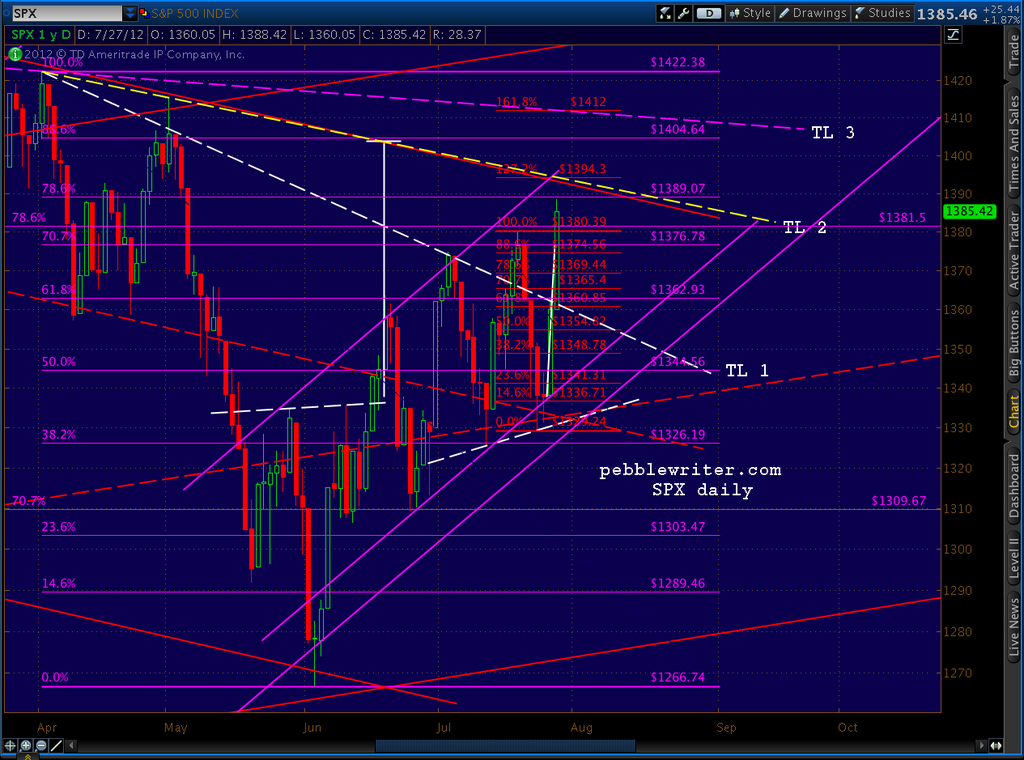

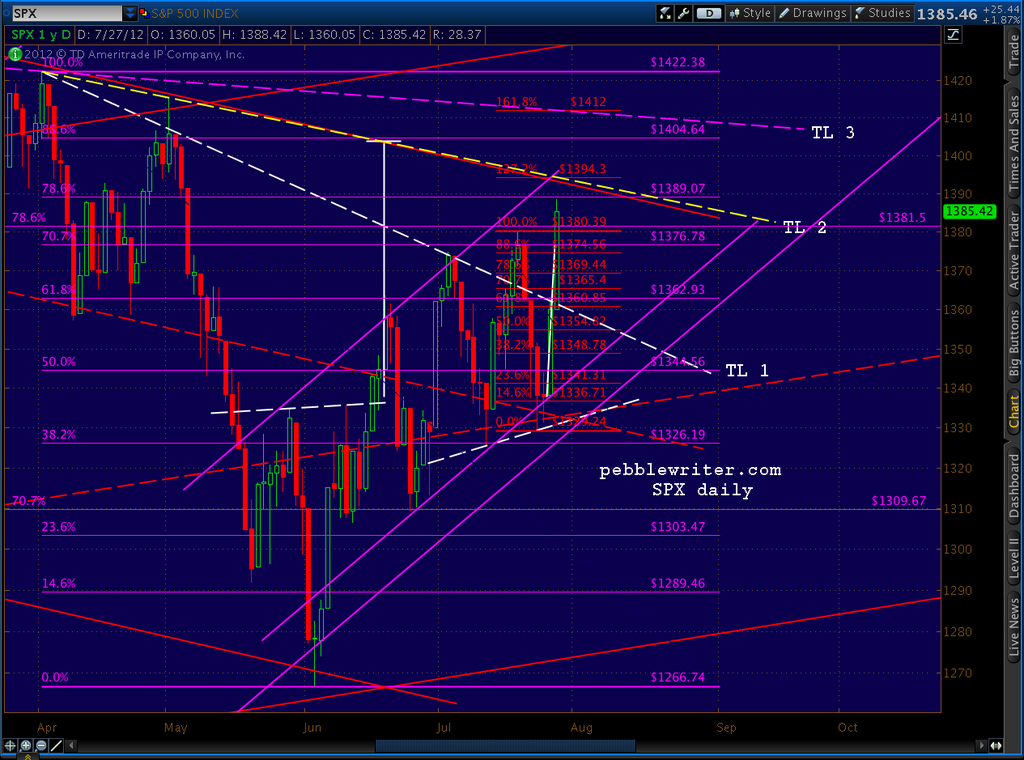

We just retraced a Fibonacci .786 of the 1380 to 1329 drop from last week. A pull back at 1369.44 to say, 1348 - 1360, would be helpful in establishing a small Butterfly Pattern (in red, below) to go with our larger Bat/Gartley (in purple.)

A Butterfly would work nicely here, as it completes at either the 1.272 (1394) or the 1.618 (1412) extension -- both in the vicinity of our other targets. The lower target of 1394 also lines up pretty well with TL 2.

If we don't pause here, look for a reversal at the .886 at 1374.56 in the construction of a Crab Pattern (also completes at the 1.618, or 1412.)

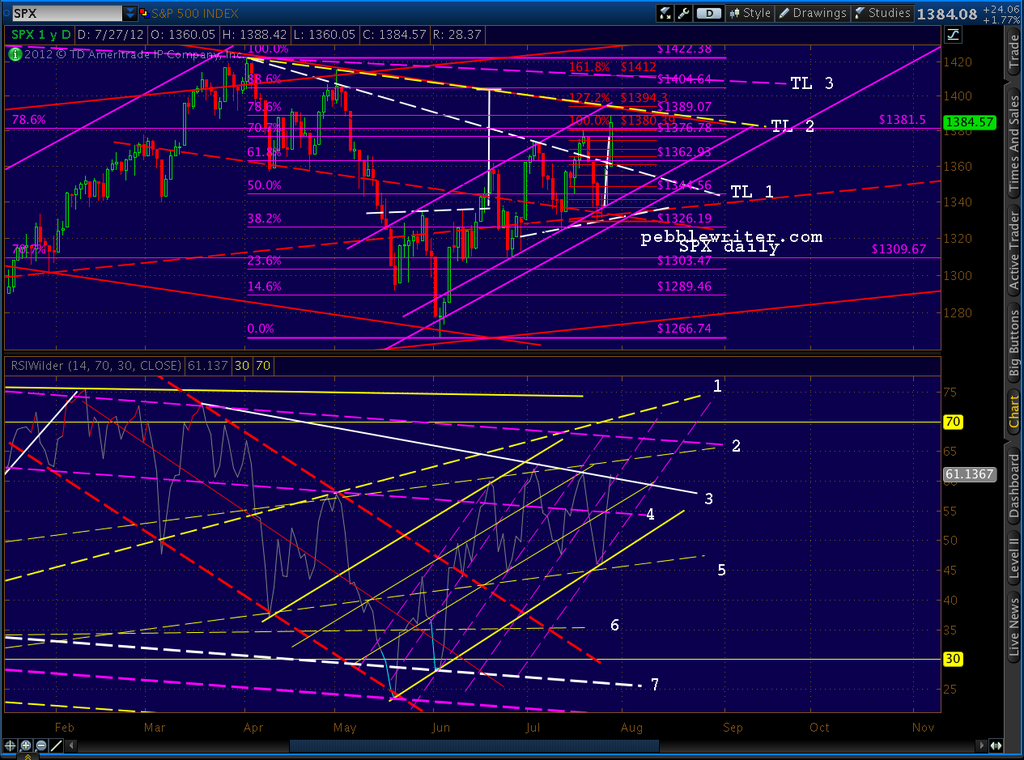

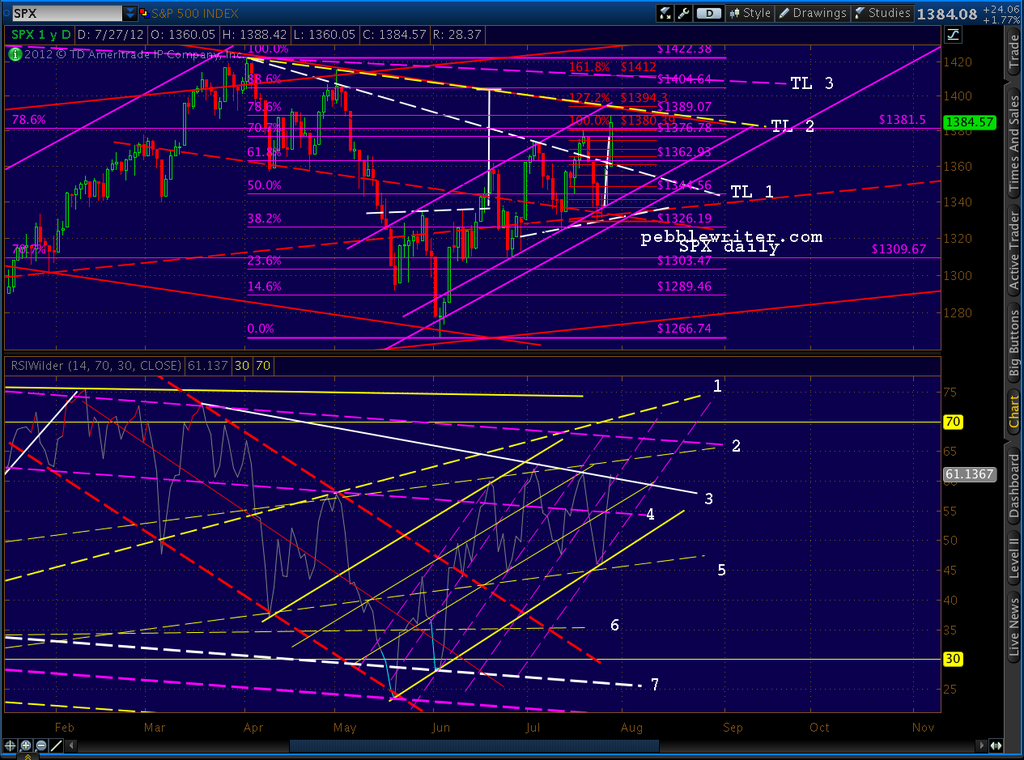

The RSI shows we have a ways to run before running into any serious opposition -- so my money is on the .886. The intersection of the white TL (3) and the purple dashed line should be our next hurdle -- probably at the .886 or higher.

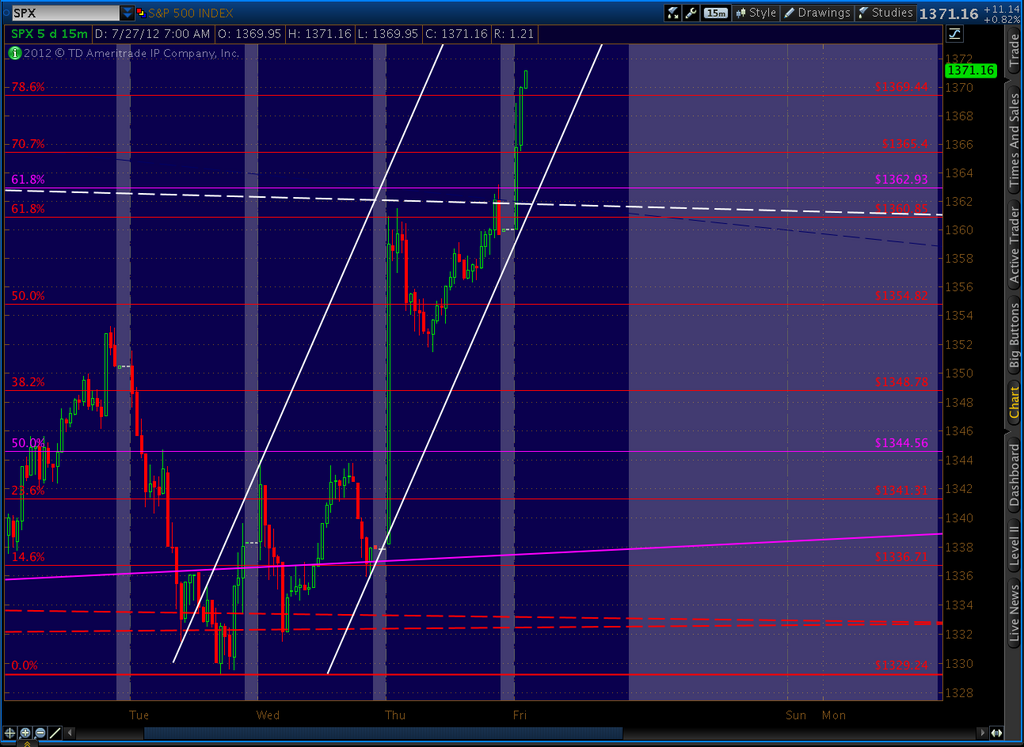

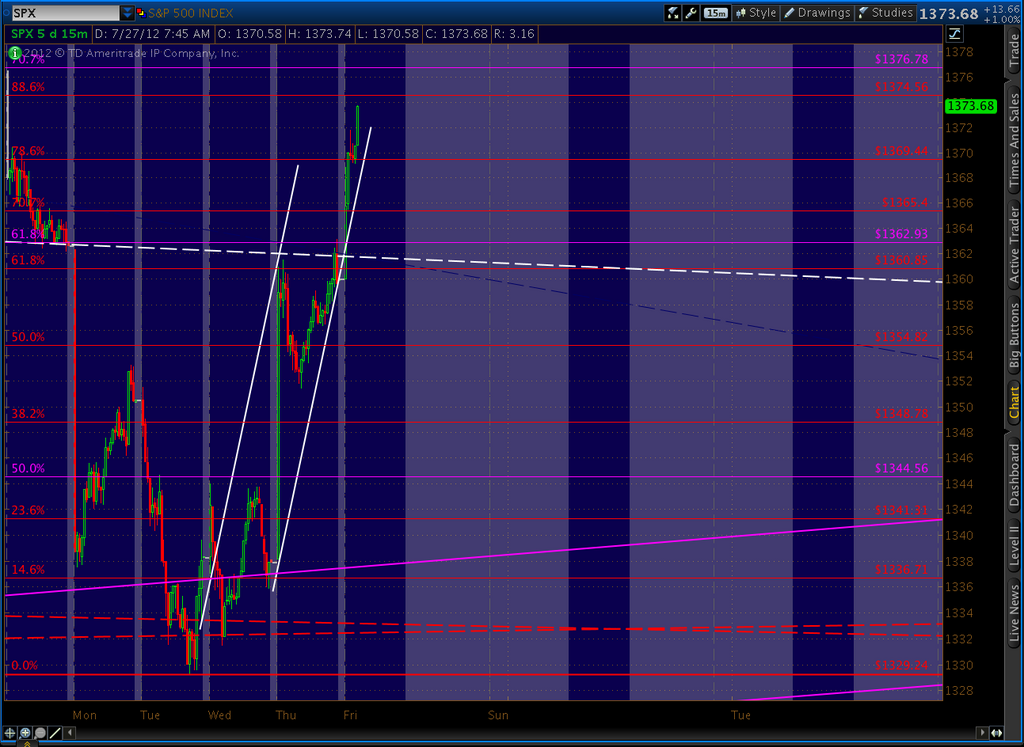

As always, when the market is ramping strongly, look at the 15 or 30 min charts for how the channels are behaving.

Any deviation from the general uptrend will appear here first. The harmonic levels clue us in as to the potential turning points.

UPDATE: 11:00 AM

The channel holding nicely as we approach the .886 at 1374.56. I expect a little pull back here, but keep an eye on the channel just to be on the safe side.

Some strong rallies barely pause, and it's always frustrating to watch the market continue to move after you've pulled out. An example was the rally between Jun 19 and July 3, which plowed right through all the usual suspects and didn't even take a breath until the previous high.

But, it had already made a strong reversal just shy of the .500 mark, and was working on a Crab Pattern when the channel and TL #1 applied the brakes.

An alternative to anticipating these turns (intra-day anyway) is to continue raising your stops. Just know that market makers know where your stops are, and love to push the market just enough in each direction to stop out those who aren't watching before letting the market resume its ramp.

More later.

UPDATE: 11:30

We're getting a nice reaction off the .886. I'm pulling some longs and will try a few shorts here at 1375 -- but will likely go long again immediately if we push through 1376. I view this as a very short-term trade, and it doesn't affect my view that we're going higher.

But, again, I'm watching the little channels for signs that it isn't working or is developing into something more. My target on the downside is the .786 at 1369, but it could go further to the .618 at 1360.

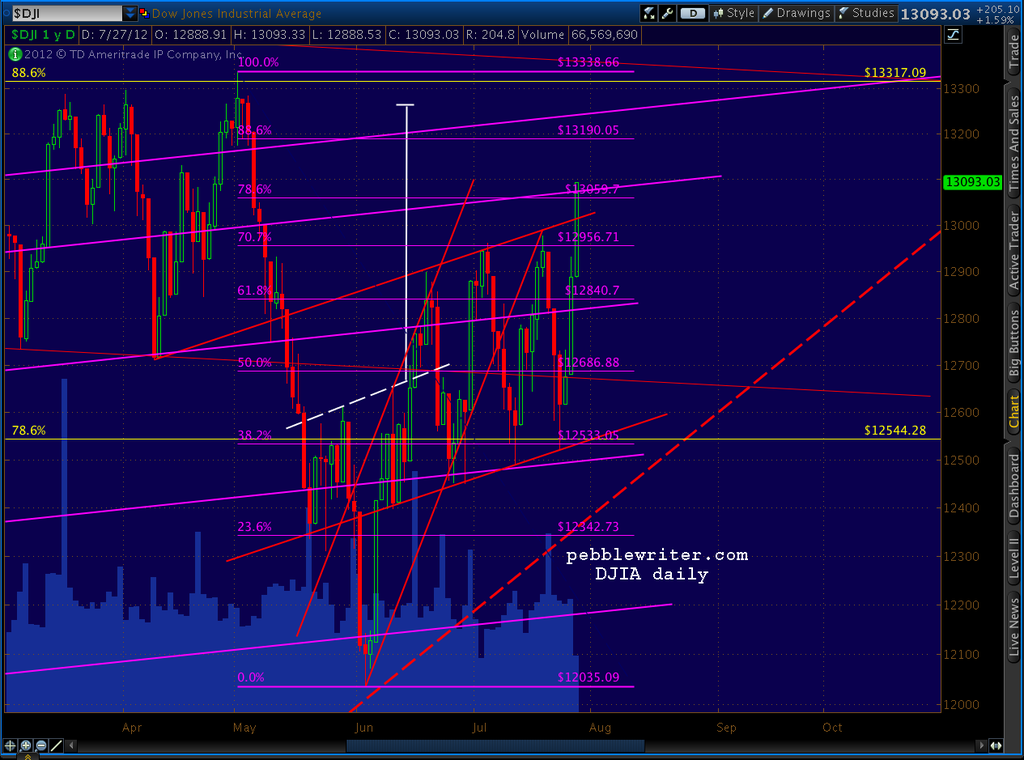

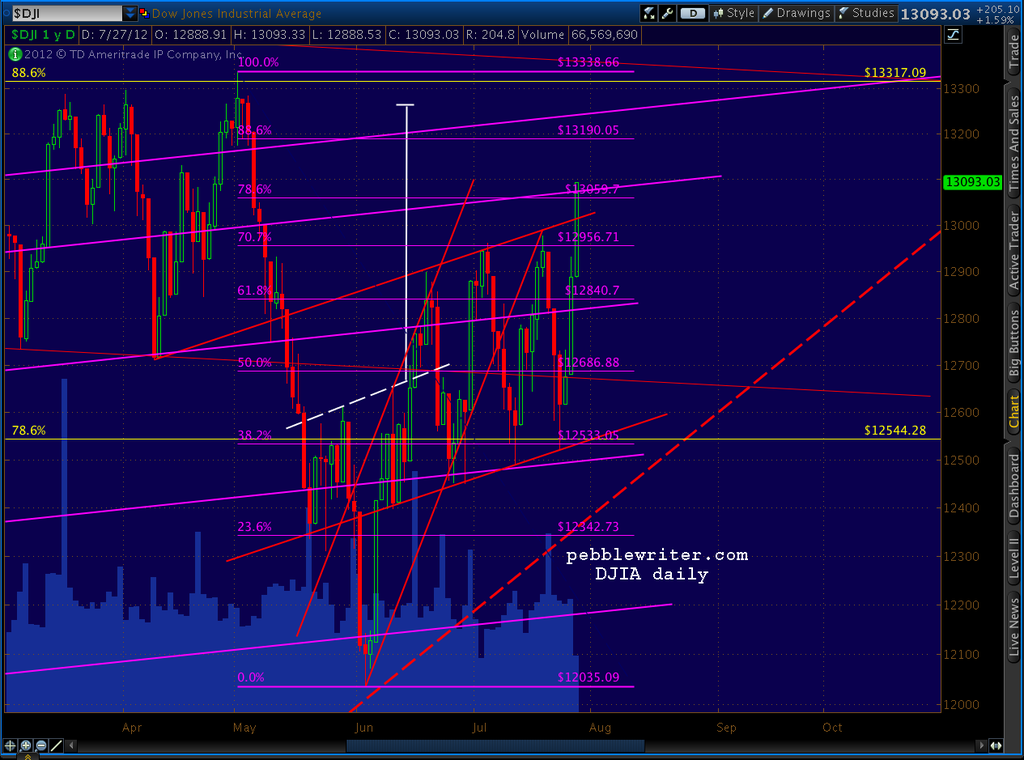

DJIA's high for the day is 12,999.75. How cute is that? Interestingly, it is bumping up against its channel line on the daily chart. Can't tell exactly, because there's a little wiggle room in this chart, but there could be some resistance between 13,000 and 13,015.

Re SPX: Since we already had a 10-point reversal at the .618 of this latest pattern, there is no reason to think that we must have a reversal here at the .886. Bat and Crab Patterns form around .618 Point B's all the time, completing at the .886 and .1.618 respectively. But, a reversal at the .886 helps create ambiguity -- a hallmark of the recent market action.

More later.

UPDATE: 1:30 PM

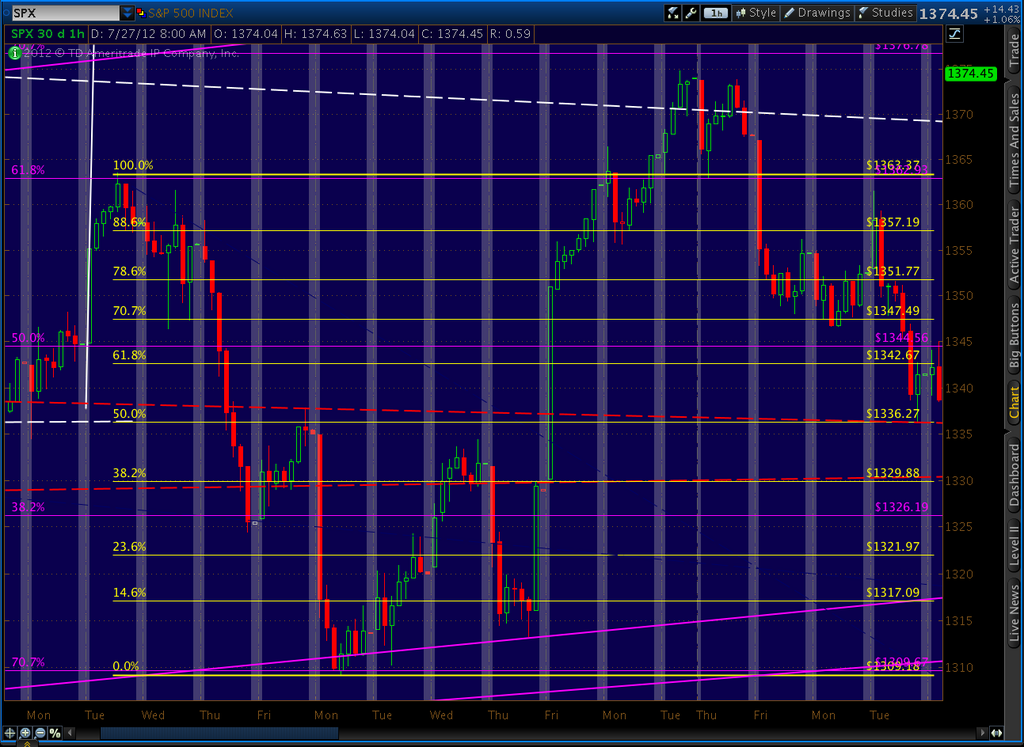

DJIA had a nice break out of its channel - very bullish. Even though it's likely to back test either the channel or at least put in a little reversal at the .786 and the purple channel line, this is positive for equities.

SPX is closing in on its .786 at 1389, which has been the lower end of our target range since early June. Look for a reaction there.

If we're still going strong, TL 2, the 1.272 of the smaller Crab Pattern and the purple channel are all just above at 1394.

Is it worth going short at these levels? The daily RSI has slightly exceeded #3, and will mostly likely close right on it. A tag of #2 probably means either 1394 or 1404 -- depending on how much of a reaction we get at 1389.

I suspect getting back to #1 will mean a new high such as 1433. But, again, it depends on how much of a reaction we get at 1389.

German Finance Minister Wolfgang Schaeuble and Wall Street spokesmodel Timothy Geithner are due to meet on the island of Sylt in far northern Germany. It's somehow appropriate that these two lovebirds will be kanoodling on a remote island of shifting sands as far away from Southern European trouble-makers as possible (without slipping over the border into neighboring Denmark, which has wisely clung to the Krone.

What pillow talk can we expect? They've already scheduled a press conference, which means it's something good, right? Or at least we're supposed to perceive whatever they say is positive... like mom and dad explaining how the divorce will be a good thing.

We also have the FOMC meeting coming up next Tuesday and Wednesday. While it's not inconceivable, this equity rally does make it marginally tougher for them to announce a full-on QE3. At 1389, we're only 2.3% off the highs of the year and 11.8% off the all-time highs (the Dow, less than 8% off.)

More on this over the weekend...

BTW, congratulations to all of our new members. If you went long at 1331 this past Tuesday with at least $11,500, you've earned back your annual membership fee in only 3 days!

If you've followed our lead since the beginning back in March, you're up almost 50% by now.

Because we have so many new members over the past week, I'd like to suggest you check out the post: How to Use Pebblewriter. It's a good general overview of how my process works. And, if Butterfly, Bat, Crab and Gartley Patterns sound like gibberish, check out the pages under Harmonics in the Learn tab on the main page. I will try to update the How to Use Pebblewriter page over the weekend.

There are still a handful of the 37 2nd quarter discounts available. These are annual memberships for $500, a 37% discount (in celebration of our 37% 2nd quarter results) to the new annual price ($800) which will go through tomorrow. Details here.

If you've recently signed up for a monthly or quarterly membership, consider upgrading while these are still available.

* * * * * * * *

We just retraced a Fibonacci .786 of the 1380 to 1329 drop from last week. A pull back at 1369.44 to say, 1348 - 1360, would be helpful in establishing a small Butterfly Pattern (in red, below) to go with our larger Bat/Gartley (in purple.)

A Butterfly would work nicely here, as it completes at either the 1.272 (1394) or the 1.618 (1412) extension -- both in the vicinity of our other targets. The lower target of 1394 also lines up pretty well with TL 2.

If we don't pause here, look for a reversal at the .886 at 1374.56 in the construction of a Crab Pattern (also completes at the 1.618, or 1412.)

The RSI shows we have a ways to run before running into any serious opposition -- so my money is on the .886. The intersection of the white TL (3) and the purple dashed line should be our next hurdle -- probably at the .886 or higher.

As always, when the market is ramping strongly, look at the 15 or 30 min charts for how the channels are behaving.

Any deviation from the general uptrend will appear here first. The harmonic levels clue us in as to the potential turning points.

UPDATE: 11:00 AM

The channel holding nicely as we approach the .886 at 1374.56. I expect a little pull back here, but keep an eye on the channel just to be on the safe side.

Some strong rallies barely pause, and it's always frustrating to watch the market continue to move after you've pulled out. An example was the rally between Jun 19 and July 3, which plowed right through all the usual suspects and didn't even take a breath until the previous high.

But, it had already made a strong reversal just shy of the .500 mark, and was working on a Crab Pattern when the channel and TL #1 applied the brakes.

An alternative to anticipating these turns (intra-day anyway) is to continue raising your stops. Just know that market makers know where your stops are, and love to push the market just enough in each direction to stop out those who aren't watching before letting the market resume its ramp.

More later.

UPDATE: 11:30

We're getting a nice reaction off the .886. I'm pulling some longs and will try a few shorts here at 1375 -- but will likely go long again immediately if we push through 1376. I view this as a very short-term trade, and it doesn't affect my view that we're going higher.

But, again, I'm watching the little channels for signs that it isn't working or is developing into something more. My target on the downside is the .786 at 1369, but it could go further to the .618 at 1360.

DJIA's high for the day is 12,999.75. How cute is that? Interestingly, it is bumping up against its channel line on the daily chart. Can't tell exactly, because there's a little wiggle room in this chart, but there could be some resistance between 13,000 and 13,015.

Re SPX: Since we already had a 10-point reversal at the .618 of this latest pattern, there is no reason to think that we must have a reversal here at the .886. Bat and Crab Patterns form around .618 Point B's all the time, completing at the .886 and .1.618 respectively. But, a reversal at the .886 helps create ambiguity -- a hallmark of the recent market action.

More later.

UPDATE: 1:30 PM

DJIA had a nice break out of its channel - very bullish. Even though it's likely to back test either the channel or at least put in a little reversal at the .786 and the purple channel line, this is positive for equities.

SPX is closing in on its .786 at 1389, which has been the lower end of our target range since early June. Look for a reaction there.

If we're still going strong, TL 2, the 1.272 of the smaller Crab Pattern and the purple channel are all just above at 1394.

Is it worth going short at these levels? The daily RSI has slightly exceeded #3, and will mostly likely close right on it. A tag of #2 probably means either 1394 or 1404 -- depending on how much of a reaction we get at 1389.

I suspect getting back to #1 will mean a new high such as 1433. But, again, it depends on how much of a reaction we get at 1389.

German Finance Minister Wolfgang Schaeuble and Wall Street spokesmodel Timothy Geithner are due to meet on the island of Sylt in far northern Germany. It's somehow appropriate that these two lovebirds will be kanoodling on a remote island of shifting sands as far away from Southern European trouble-makers as possible (without slipping over the border into neighboring Denmark, which has wisely clung to the Krone.

What pillow talk can we expect? They've already scheduled a press conference, which means it's something good, right? Or at least we're supposed to perceive whatever they say is positive... like mom and dad explaining how the divorce will be a good thing.

We also have the FOMC meeting coming up next Tuesday and Wednesday. While it's not inconceivable, this equity rally does make it marginally tougher for them to announce a full-on QE3. At 1389, we're only 2.3% off the highs of the year and 11.8% off the all-time highs (the Dow, less than 8% off.)

More on this over the weekend...

BTW, congratulations to all of our new members. If you went long at 1331 this past Tuesday with at least $11,500, you've earned back your annual membership fee in only 3 days!

If you've followed our lead since the beginning back in March, you're up almost 50% by now.