I'm traveling over the balance of the week, so posts will be a bit spotty.

After bouncing around quite a bit, SPX ended the day on a solid down note. We closed below the rising wedge, but not quite enough to put a fork in Wave 2 just yet. I'm looking for a close below 1340 (Tuesday's low) for starters.

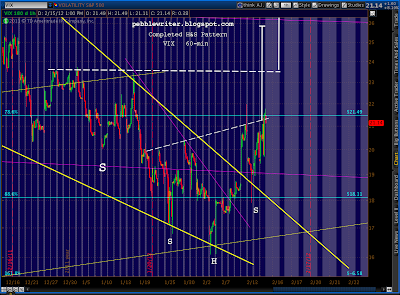

Ideally, we'll see a bounce up to 1350 to back test the wedge and complete a small H&S pattern before heading south. Given that Friday is OPEX, I think it's actually fairly likely -- unless we have the massive sell-off that's entirely possible with a market that's this far stretched on the upside.

Daily RSI broke its trend line, and has a ways to go before finding support. My gut tells me 1355.87 was the Wave 2 top, so I've added some short positions. I'm long puts on SPY (tight stops), SBUX, AAPL, XLF and MSFT and calls on VIX on the IHS completion.

I'm also long the dollar and short the euro and gold. I'm expecting the euro situation to worsen over the next few days, and at least a .05 move in EURUSD in near term. Look at the past patterns and you can get an idea what can happen when EURUSD jumps channels.

|

| Weekly |

|

| Daily |

Gold continues to come under pressure, although prices have been choppy. I expect it to sell off with the rest of the market next week, if not sooner; but, I'd bail at a move over 1765.

I'll add to positions if/when the downside gets going, but am the equivalent of about 40% net short, with options comprising about half of that.

One thing I'm considering doing on the new website is posting actual trades in a model portfolio. If this interests you, let me know. The only tricky aspect is putting on trades that the average investor would feel comfortable following: ETF's, long puts and calls, spreads, straddles (nothing fancy). I would stay away from futures and most individual stock names. Please give me your thoughts.

Good luck to all.

I'm for the "model portfolio" page as long as it include the trades that go bad as well as the trades that go good... I've come to believe that you're the real deal but I know some people only post the trades that make them look like a rock start :) ...love your work by the way

ReplyDeleteAgree with kgmoney! Thanks for all you do!

ReplyDeleteCount me third. Like the idea of a "model portfolio". Can't wait to see the new site. Keep up the great work.

ReplyDeleteyes, pebble, i appreciate your work very much. very much so. whether you post your trades or not, you have to decide. some sort of trade-signal-history though would be cool for learning purpose so one can go back and try to figure out.

ReplyDeleteAgree with Stillwater--having an actionable trade history would be helpful for everyone involved. If a subscription would be required, so much the better.

ReplyDeleteWith new high in spx, is the HS pattern busted? ES didnt make new high today. Negative div? Dollar got creamed today, vix held up until midday...short dollar seems to be the easy trade..until it is not

ReplyDeleteI too would be interested in a model portfolio. I am learning a lot from reading books and blogs. Many great looking charts can be found with many ideas expressed - but fewer portfolios. Since most people at these sites, me included, seem to be swing traders that might be an area to target.

ReplyDelete