~reposted from pebblewriter.com

Financials play a pivotal role in the markets. They led the way as they enabled the previous run-ups and bubbles, and they led the way down when the house of cards was revealed for what it was. The survival of nearly all markets is hanging by a QE thread, so we'll take a fresh look at XLF to see what the charts are saying.

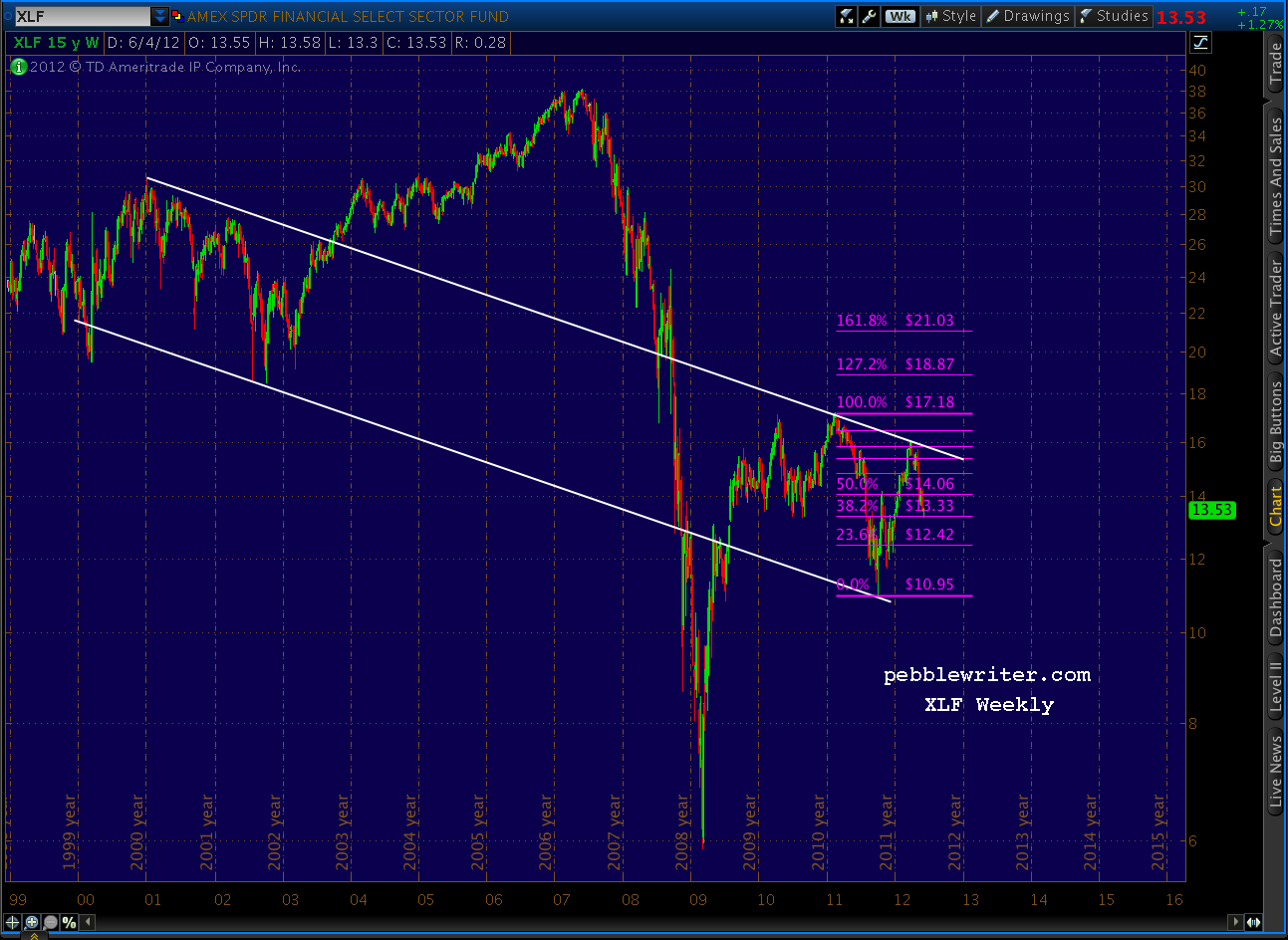

We'll start with the weekly chart going back to inception in December 1998 -- lot of water under the bridge with this ETF.

Fortunately, for us analyst types, it's been very amenable to chart patterns and Fibonacci analysis. Consider this chart, that helped me call a top in banking stocks in late March [see: End of the Line and Lots More Where That Came From.] Note the well-defined channel and the Gartley Pattern reaction at the .786 Fibonacci level.

I've put together a series of charts that, I think tell a pretty compelling story regarding XLF's future. For more, go to pebblewriter.com.

***************

Note: due to popular demand, monthly memberships to pebblewriter.com are now available. Sign up for an annual membership within the first 30 days, and I'll rebate your first month's dues. For more info, click here.

Financials play a pivotal role in the markets. They led the way as they enabled the previous run-ups and bubbles, and they led the way down when the house of cards was revealed for what it was. The survival of nearly all markets is hanging by a QE thread, so we'll take a fresh look at XLF to see what the charts are saying.

We'll start with the weekly chart going back to inception in December 1998 -- lot of water under the bridge with this ETF.

Fortunately, for us analyst types, it's been very amenable to chart patterns and Fibonacci analysis. Consider this chart, that helped me call a top in banking stocks in late March [see: End of the Line and Lots More Where That Came From.] Note the well-defined channel and the Gartley Pattern reaction at the .786 Fibonacci level.

I've put together a series of charts that, I think tell a pretty compelling story regarding XLF's future. For more, go to pebblewriter.com.

***************

Note: due to popular demand, monthly memberships to pebblewriter.com are now available. Sign up for an annual membership within the first 30 days, and I'll rebate your first month's dues. For more info, click here.