~reposted from pebblewriter.com

After a scary drop in equity futures overnight, the market looks to open soft...but not exactly panicked. I remain short since 1525.34 on the 28th, but will continue to play any significant bounces that come our way.

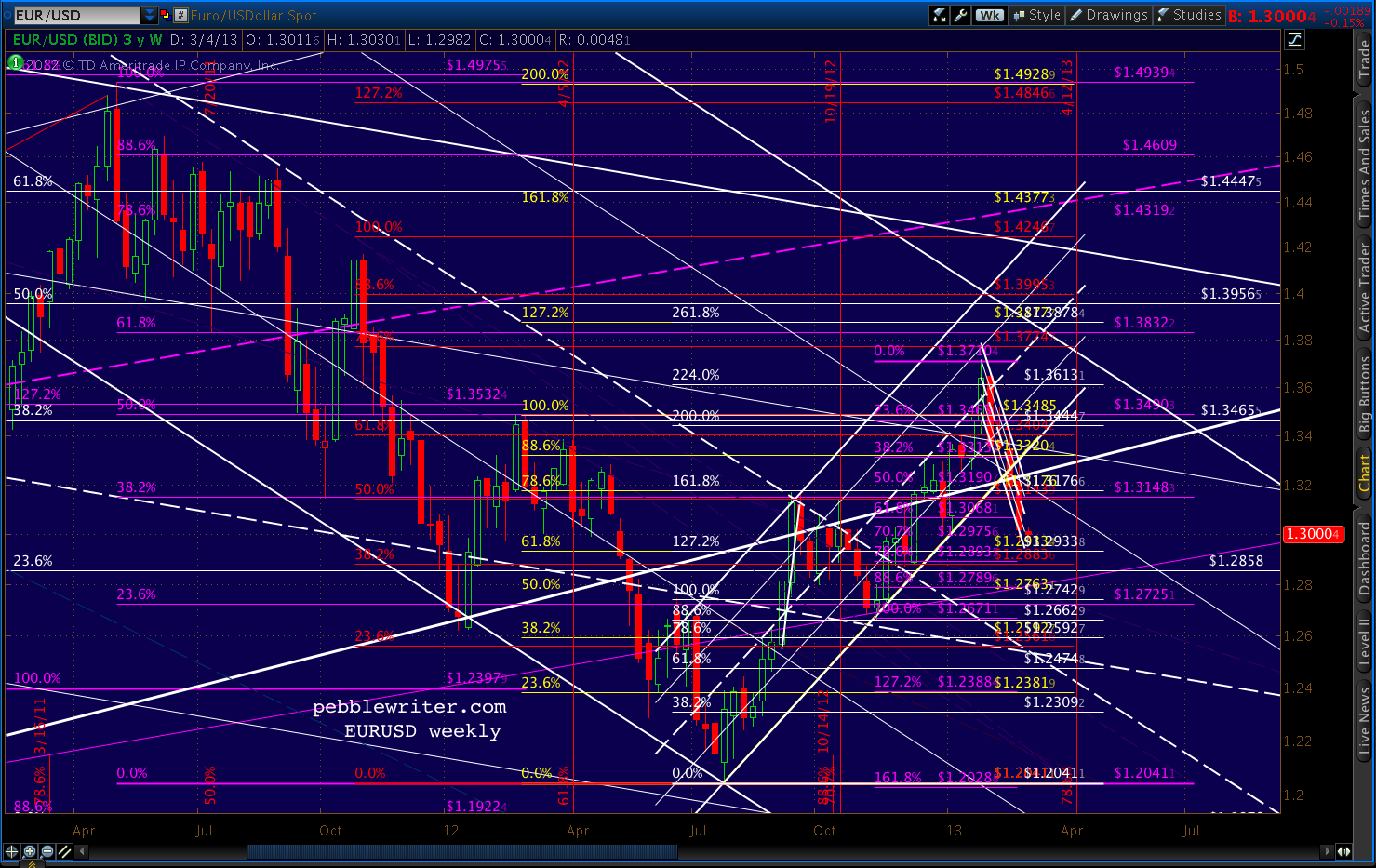

The

dollar is still looking strong, reflecting both plenty of fear and euro

weakness. Note, DX reached our intermediate target range from last

month (the red .618 @ 82.22 & white 1.618 at 82.28.)

The

next level of resistance is the red .786 at 83.064 where it intersects

with the purple 1.618 at 83.122. The acceleration channel that's

carried prices skyward since Feb 1 intersects that nexus this week.

Also

intersecting there are two channel lines -- the large white midline and

the much larger yellow midline -- seen here on the weekly chart.

Daily

RSI still shows plenty of upside potential, though we've also seen some

negative divergence start to creep into the picture.

As

noted back on Feb 21, the EURUSD has broken down from its rising

channel (white) and has accelerated to the downside, breaking the Jan 4

1.2996 low and the psychologically important 1.30 level.

The

intersection of the purple .618 and two white channels at 1.38 will

have to wait (until my next visit across The Pond, no doubt.)

Losing

the rising white channel hurts momentum quite a bit, but it's the drop

back through the 75% line on the falling white channel that represents

the bigger problem for the pair.

This

channel dates all the way back to Dec 06. Reaching the top for the

third time is still possible, of course, but it's that much harder now

that the pair needs to retake the higher channel line and mount a fresh

attack.

I've

redrawn the falling white channel as red and will lower its top (for

now) to reflect the brick wall it ran into. I've also sketched in a

more relaxed rising channel (light blue) that reflects potential channel

support at current prices (the intersection of the falling red .75 and

the rising light blue .25.)

I

don't know whether the pair needs to retest the falling white midline

or not. The bottom of the new light blue channel intersects with the

red .75 in mid-March. Also there is the .25 of the very large rising

purple channel, which provided a huge bounce in Jun 2010. It's easier

to see in the LT chart below.

Recall

that we closed a long position and last went short at 1525.34. From

there, SPX fell nearly to our initial target (1496-1500), reaching

1501.48 Friday morning before the bounce to 1519.99.

As

we discussed last week, the reversal at the red .786 could be the full

extent of a corrective wave on the way lower (the B wave in an A-B-C)

that is meant to test the bottom of the white or purple channels. But,

it could also be the Point B in a Butterfly Pattern targeting 1531 or

1540.