Financials have had a great run ever since we called the June 4, 2012 bottom [see: So Crazy, It Just Might Work]. But, all good things must come to an end. I'd give them another few days/points at most.

I had jumped on the short side Mar 27, 2012 [see: End of the Line and Lots More], riding GS, MS and JPM down around 30%.

It only ever recovered 7.95% of its 2007-2009 plunge from 570 to 9.70 (adjusted for reverse splits) and is struggling to reach the .786 of its swan dive from Jan to Oct 2011: 51.50 to 21.4. If the .786 at 45.06 doesn't do the trick, the .886 at 48.07 should.

I had jumped on the short side Mar 27, 2012 [see: End of the Line and Lots More], riding GS, MS and JPM down around 30%.

On June 5, we loaded up on the long side. Our targets, as posted that day:JPM: 46 – 32 = 31%

GS: 127 – 92 = 28%

MS: 20 – 12.50 = 38%

JPM: today’s close = 31.99, price target = 38.69 (+21%)

C: today’s close = 25.75; price target = 34.79 (+35%)

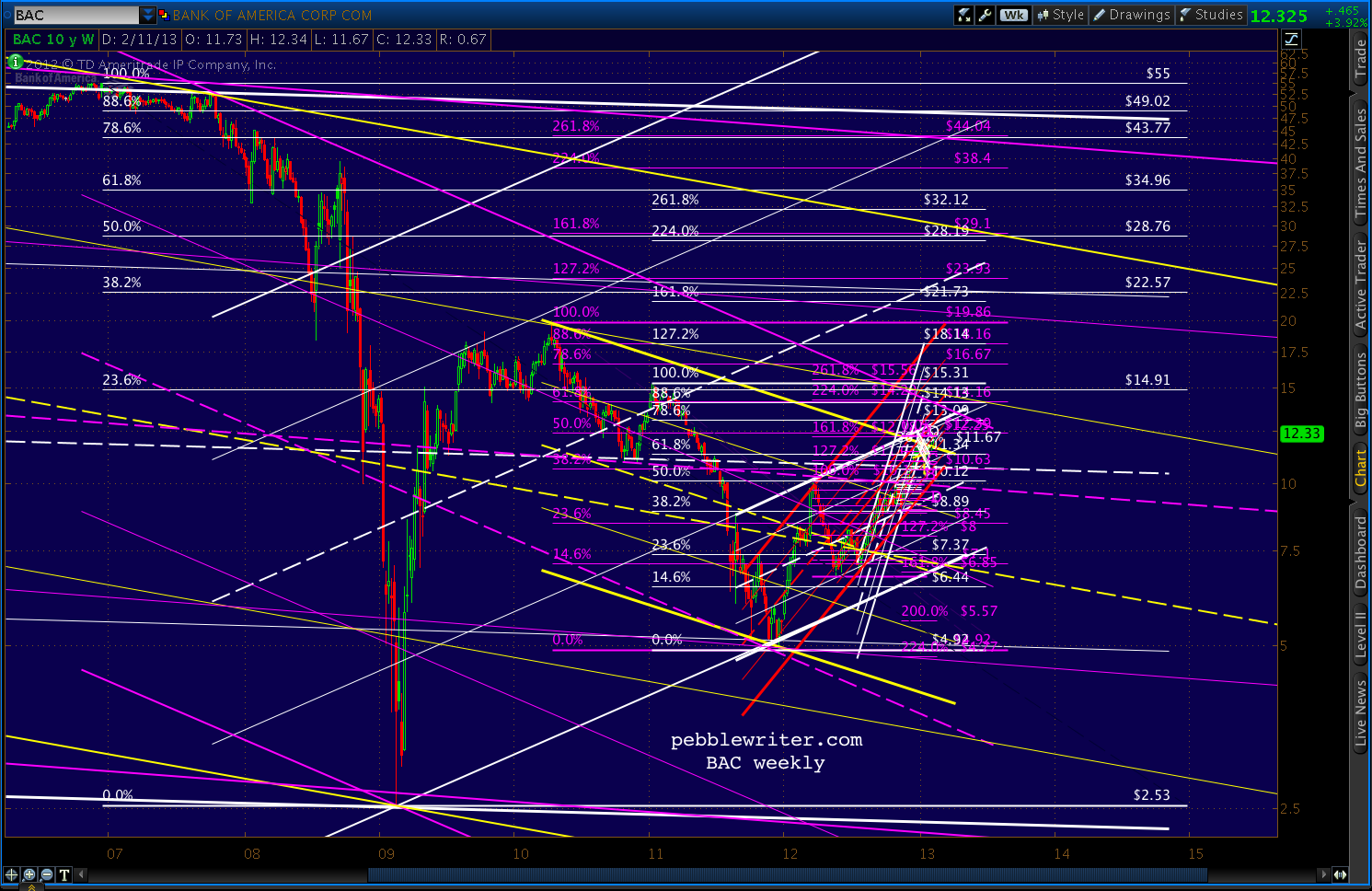

BAC: today’s close = 7.10; price target = 11.34 (+60%)

Obviously,

those targets proved to be a little conservative. JPM reached its

target by Aug 21, consolidated for 2 weeks, then zoomed even higher -

reaching 49.31 today and finally (after 4 near misses) reaching the .886 retracement of its 53 to 14 plunge.

C

reached its 34.79 target on QE3 day (Sep 14 -- lovely being able to

dump all those crappy MBS on the Fed) backed off a few points, then

proceeded to rally up to today's high of 44.50.

It only ever recovered 7.95% of its 2007-2009 plunge from 570 to 9.70 (adjusted for reverse splits) and is struggling to reach the .786 of its swan dive from Jan to Oct 2011: 51.50 to 21.4. If the .786 at 45.06 doesn't do the trick, the .886 at 48.07 should.

And,

just today, BAC came within a nickel of the 50% retracement (12.39) of

its post-2009 high. It reached our 11.34 target in mid-December.

If it gets past 12.67, it could still take a run at 14.13. But, it won't be easy.

Most

of the financials are in a similar situation -- at or near major

resistance either from Harmonic or Chart Pattern targets. But, it's XLF

itself that looks shakiest.

continued on pebblewriter.com...