reposted from pebblewriter.com

It's hard to believe the numb nuts running the big show in the euro zone could be so stark-raving mad. Raising taxes on countries with 25% unemployment seems positively brilliant compared to the idea of confiscating 10% of bank deposits -- especially those that are supposedly insured.

Get ready for the media interpreters who assure us "it's only Cyprus" -- which reminds me an awful lot of "it's only Bear Stearns" or "it's only Lehman."

The issue, of course, isn't the size of the depositor base in Cyprus banks. It's the effect this action will have on depositors in Portugal, Spain and Italy.

By now, even the most clueless depositors have to be wondering just how safe their deposits are. The smart ones already know. And, the brilliant ones moved their money a long time ago.

This bone-headed action also calls into question the ECB's willingness and/or ability to support troubled nations/banks. If they can't float a lousy $13 billion to bail out Cyprus, how will they react when other, larger systemic risks pop back up?

And, last but certainly not least, what effect will this action have on the $700+ trillion derivatives market? It's a spiders nest of complicated agreements whereby one party guarantees another that credit quality/interest rates/etc. won't slip past a certain level.

These private contracts are bought and sold countless times, to the point where no one usually knows the true exposure of any given player until it's too late. When a bank fails, it's very difficult to discern how many counterparties will be affected. It quite rightly shakes confidence in the entire system.

Cyprus is a reminder that the euro zone is not "fixed." It's a reminder that much more is needed to fulfill the promise of "whatever it takes." And, it's a reminder that the Fed and the ECB either don't have as much control as they'd like us to think, or are losing interest in preventing every little hiccup along the way.

The dollar may have just completed the transformation we discussed at length Friday -- reverting back to the risk-off safe haven to which we're accustomed.

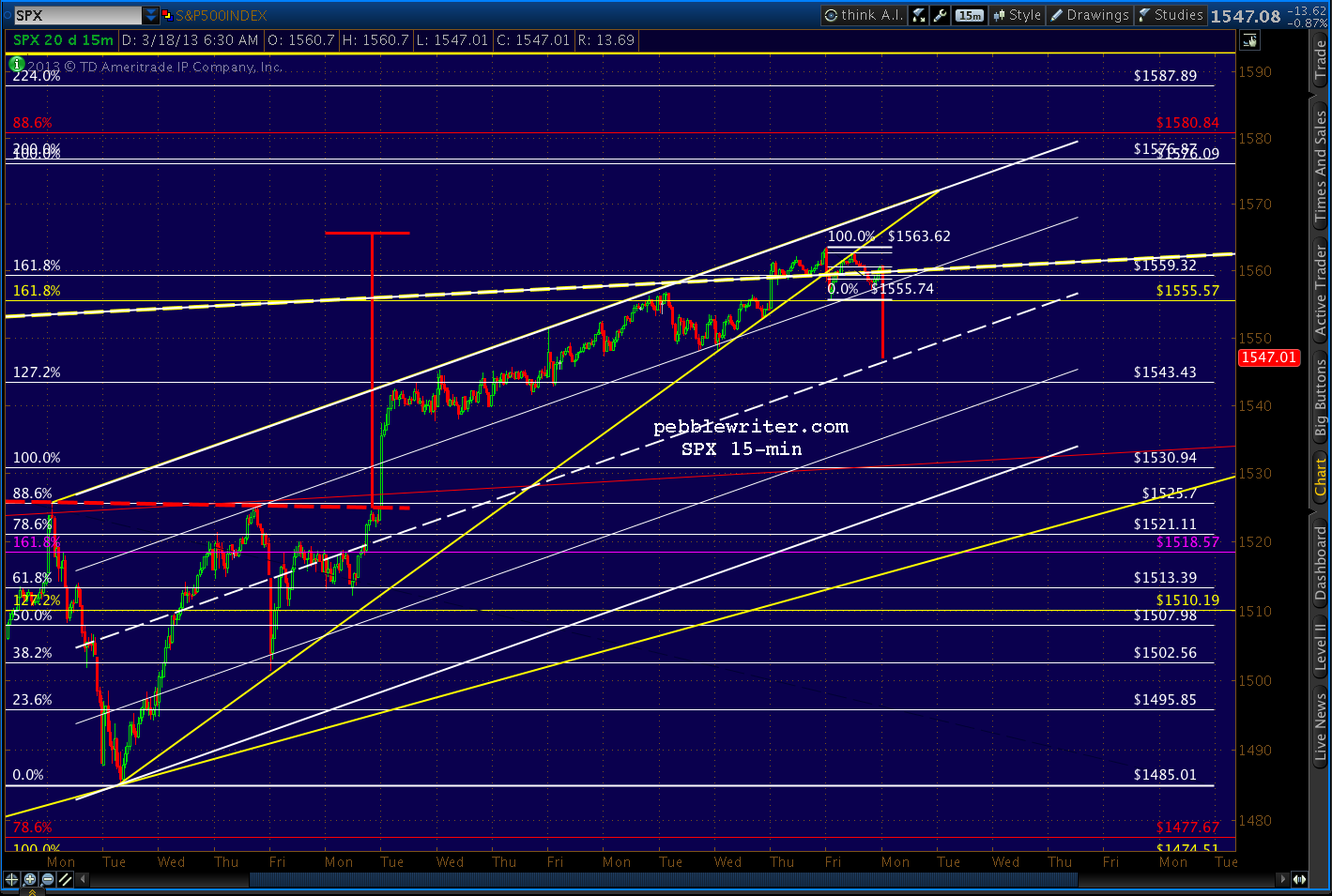

The smallest rising wedge on SPX has clearly broken down and should now try to establish a channel something like the one drawn below. Look for a playable bounce here around the midline between 1543.43 and 1546.

UPDATE: 10:10 AM

We got the expected bounce at 1545.13. If the bears can keep the trend going, it should fail before the next higher channel line -- currently around 1558 -- or the yellow TL up at 1560. But, of course, there's no reason it has to be more than 1553.39 (the 1.618 extension of the 1370-1074 correction in 2011) or 1552.19 (the .382 retracement of the move down from 1563.32.)

As legitimate as the little white channel above appears, it's merely a conjecture. A pitch. If Cramer & Co. can convince the average small investor to ignore the implications of Cyprus and embrace a market selling near all-time highs, the channel is proof of the absence of risk in the markets.

It coincides nicely with the midline of the larger purple channel that's guided SPX's upside since November. To bulls, this morning's dip looks like nothing more than a successful test of the midline.

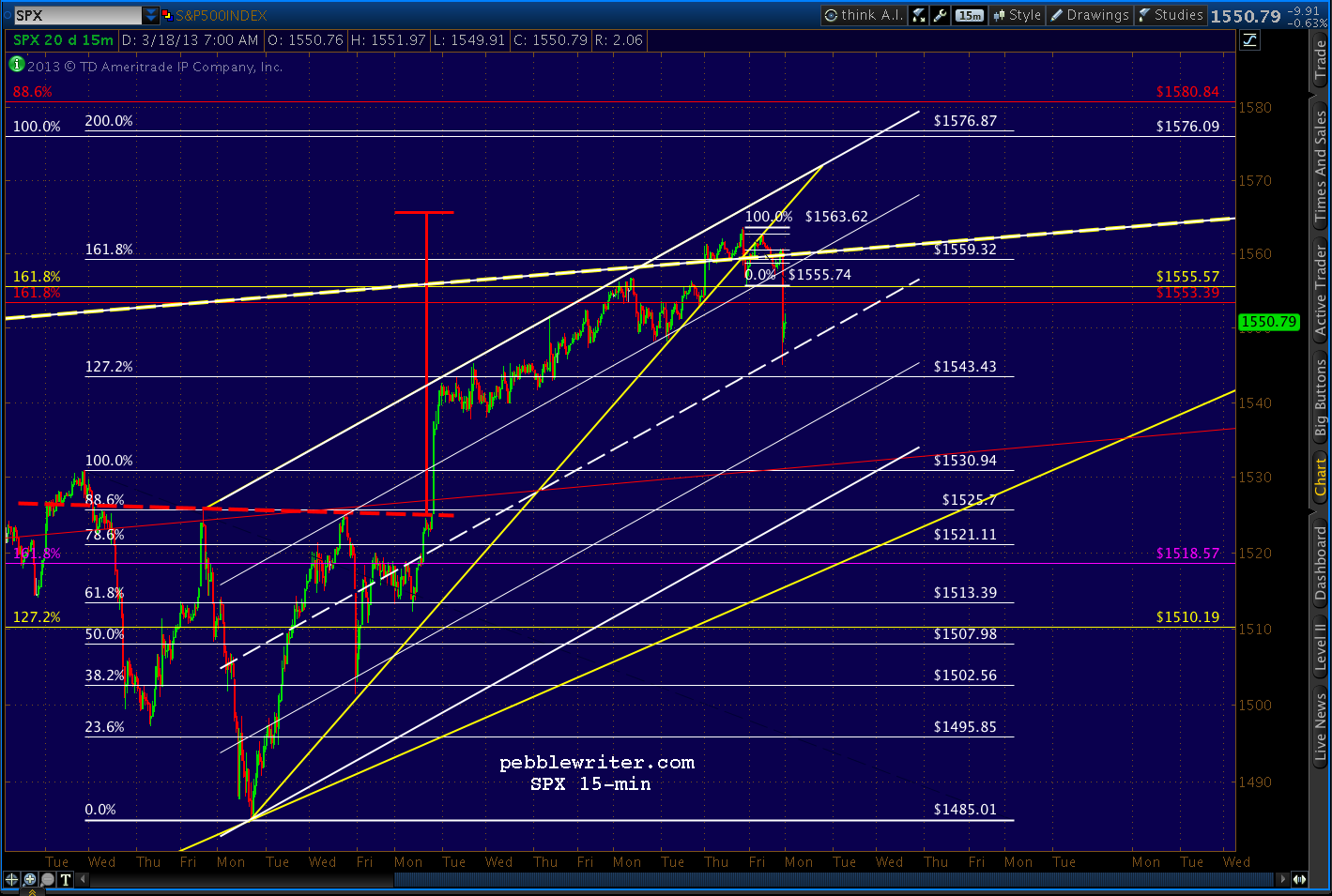

Here's a close-up, showing the tag of the .236 Fib (red) and slight push below the purple midline. Important for the bullish case: (1) the white 1.272 is even still intact, and (2) prices are re-testing the 1.618 Fib at 1553.39.

If SPX pushes higher than 1553.39, it reinforces the idea that the Crab Pattern set up by 2011's plunge from 1370 to 1074 is going to fail (8 points would be a failure.) If it drops below, then the push up to 1563 can be characterized as a momentary blip of irrational exuberance.

The technical elephant in the room, of course, is whether or not SPX will continue to take a run at the previous high of 1576. It's not as though bulls will throw in the towel over Cyprus. Take the move down from 1563, for instance.

If this bounce from 1545 retraces all the way to the .786 at 1559.66, it will have set up a potential Butterfly Pattern that targets 1575. Look for the little white channel to turn by the .500 (1554.38) in order to construct another leg up.

UPDATE: 1:25 PM

Where does this morning's dump fit in with yesterday's LT charts from the last post [see: Do or Die]?

continued on pebblewriter.com...

It's hard to believe the numb nuts running the big show in the euro zone could be so stark-raving mad. Raising taxes on countries with 25% unemployment seems positively brilliant compared to the idea of confiscating 10% of bank deposits -- especially those that are supposedly insured.

Get ready for the media interpreters who assure us "it's only Cyprus" -- which reminds me an awful lot of "it's only Bear Stearns" or "it's only Lehman."

The issue, of course, isn't the size of the depositor base in Cyprus banks. It's the effect this action will have on depositors in Portugal, Spain and Italy.

By now, even the most clueless depositors have to be wondering just how safe their deposits are. The smart ones already know. And, the brilliant ones moved their money a long time ago.

This bone-headed action also calls into question the ECB's willingness and/or ability to support troubled nations/banks. If they can't float a lousy $13 billion to bail out Cyprus, how will they react when other, larger systemic risks pop back up?

And, last but certainly not least, what effect will this action have on the $700+ trillion derivatives market? It's a spiders nest of complicated agreements whereby one party guarantees another that credit quality/interest rates/etc. won't slip past a certain level.

These private contracts are bought and sold countless times, to the point where no one usually knows the true exposure of any given player until it's too late. When a bank fails, it's very difficult to discern how many counterparties will be affected. It quite rightly shakes confidence in the entire system.

Cyprus is a reminder that the euro zone is not "fixed." It's a reminder that much more is needed to fulfill the promise of "whatever it takes." And, it's a reminder that the Fed and the ECB either don't have as much control as they'd like us to think, or are losing interest in preventing every little hiccup along the way.

* * * * * * * *

The dollar may have just completed the transformation we discussed at length Friday -- reverting back to the risk-off safe haven to which we're accustomed.

The smallest rising wedge on SPX has clearly broken down and should now try to establish a channel something like the one drawn below. Look for a playable bounce here around the midline between 1543.43 and 1546.

UPDATE: 10:10 AM

We got the expected bounce at 1545.13. If the bears can keep the trend going, it should fail before the next higher channel line -- currently around 1558 -- or the yellow TL up at 1560. But, of course, there's no reason it has to be more than 1553.39 (the 1.618 extension of the 1370-1074 correction in 2011) or 1552.19 (the .382 retracement of the move down from 1563.32.)

As legitimate as the little white channel above appears, it's merely a conjecture. A pitch. If Cramer & Co. can convince the average small investor to ignore the implications of Cyprus and embrace a market selling near all-time highs, the channel is proof of the absence of risk in the markets.

It coincides nicely with the midline of the larger purple channel that's guided SPX's upside since November. To bulls, this morning's dip looks like nothing more than a successful test of the midline.

Here's a close-up, showing the tag of the .236 Fib (red) and slight push below the purple midline. Important for the bullish case: (1) the white 1.272 is even still intact, and (2) prices are re-testing the 1.618 Fib at 1553.39.

If SPX pushes higher than 1553.39, it reinforces the idea that the Crab Pattern set up by 2011's plunge from 1370 to 1074 is going to fail (8 points would be a failure.) If it drops below, then the push up to 1563 can be characterized as a momentary blip of irrational exuberance.

The technical elephant in the room, of course, is whether or not SPX will continue to take a run at the previous high of 1576. It's not as though bulls will throw in the towel over Cyprus. Take the move down from 1563, for instance.

If this bounce from 1545 retraces all the way to the .786 at 1559.66, it will have set up a potential Butterfly Pattern that targets 1575. Look for the little white channel to turn by the .500 (1554.38) in order to construct another leg up.

UPDATE: 1:25 PM

Where does this morning's dump fit in with yesterday's LT charts from the last post [see: Do or Die]?

continued on pebblewriter.com...