The sale will be announced outside the membership tomorrow if any memberships are left at the discounted price. This will likely be the last sale before the Fund goes live and memberships to the current website will no longer be accepted. CLICK HERE

Also, I intended to post the May and June performance last night, but ran out of time. I should get it posted later this afternoon. Check back HERE. I have put together a page describing the basic investment philosophy and strategy underlying this site that some might find interesting: HERE

Reposted from pebblewriter.com...

Everything is going according to plan this morning, with all currency pairs approaching their targets from last week.

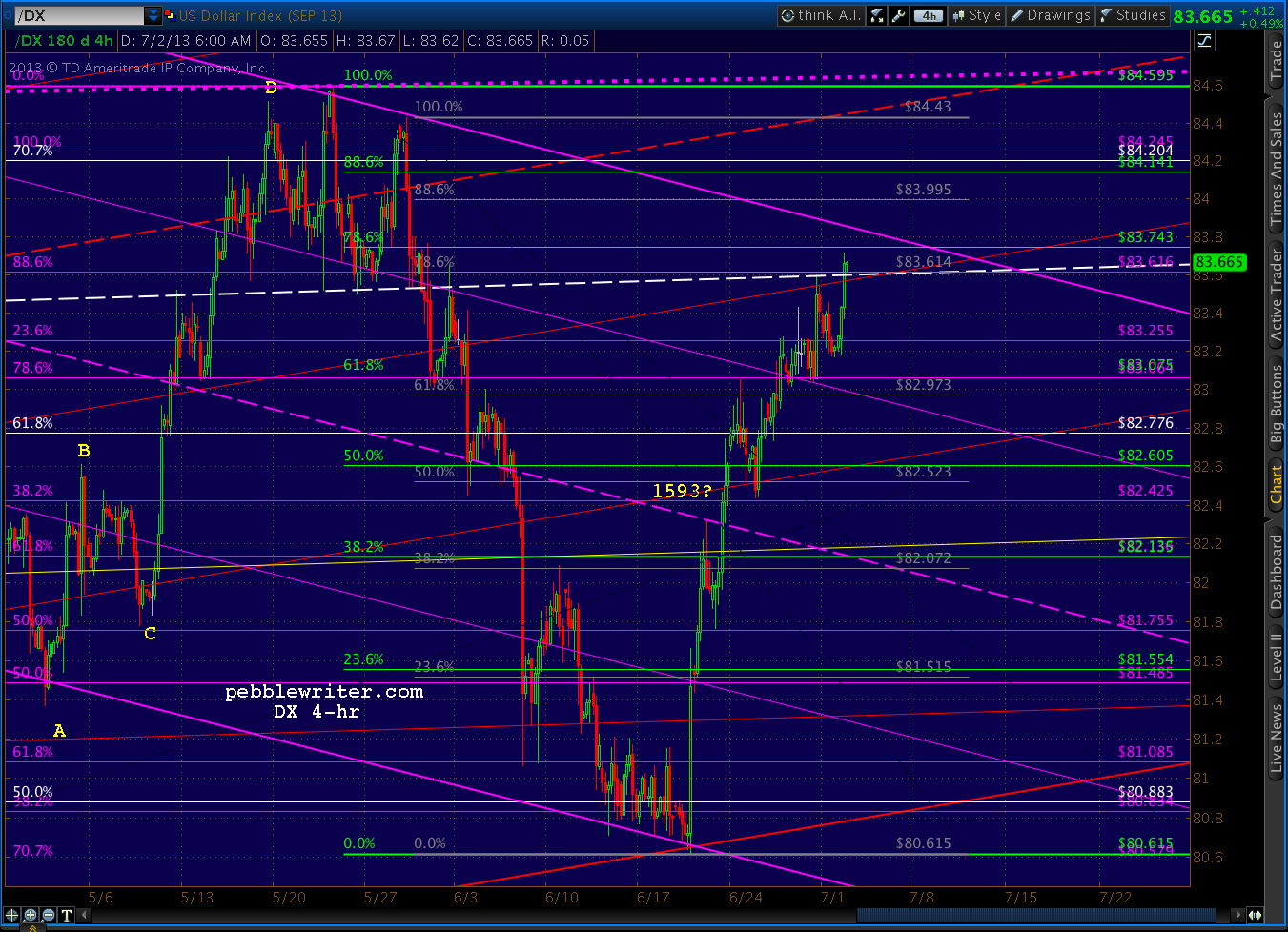

The dollar is back to the white channel midline where exciting things happen. The last squirt higher led to 84.595 on May 23, the day after SPX topped out at 1687.

This time, however, there's a falling purple channel and the .786 Fib line to consider.

While the EURUSD is approaching the .786 retracement of its rally from the 1.2795 low, the red channel midline and the bottom of the light blue channel.

A close up...

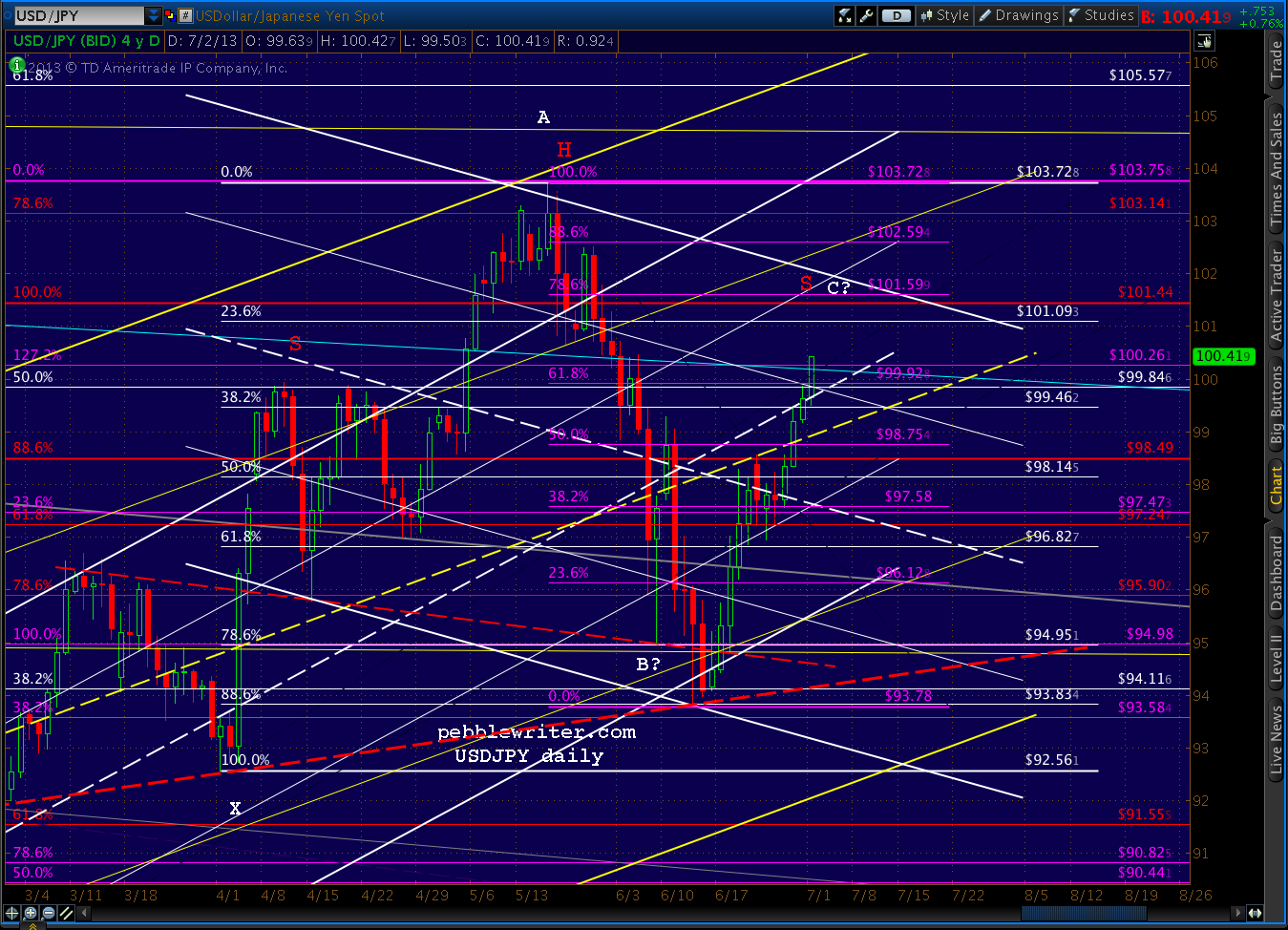

The USDJPY is closing in on our 101.59 target at the .786 Fib.

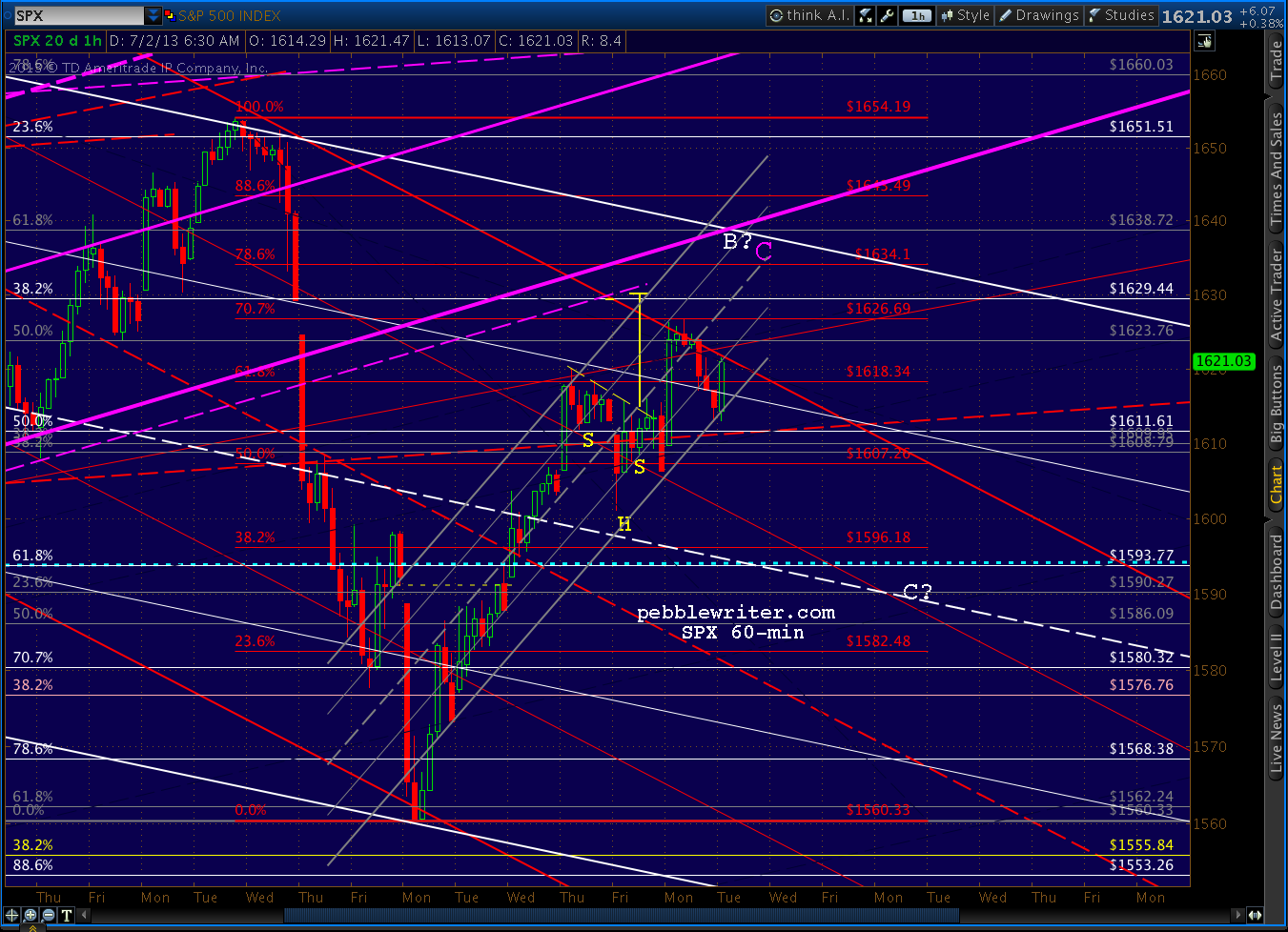

The e-minis, which back-tested the bottom of their purple channel at the white .500 Fib yesterday, took another run overnight but fell short -- reaching only the top of the falling red channel.

We'll see if SPX has enough juice left to take its own shot. The first test this morning will be pushing through the top of the red channel -- at least intra-day -- at about 1621.50.

UPDATE: 9:52 AM

SPX reached the red channel and is debating whether to push through or take a breather.

Recall, the cluster of targets we discussed last week includes:

SPX came within 3 points of filling the gap yesterday, but ran into the same channel top and fell back to close at the bottom of the grey channel in the 5th such stop-clearing exercise in a week and the 9th close at or near the daily low in a fortnight.

- the gap fill at 1629.22

- the IH&S target at 1631.67

- the red .786 Fib at 1634.10

- the grey .618 at 1638.72

It also tagged the .500 grey Fib (of 1687-1560) yesterday, where it (so far) reacted less than it did at the red .618.

So, the red pattern is assumed to be the one in charge, with a Gartley Pattern completion at the red .786 (1634.10) the next major Fib target on the radar.

UPDATE: 10:15 AM

A close up shows two smaller patterns also pointing to the 1631-1635 range if SPX can poke through the red channel top. Note also the presence of the pink .618 here -- contributing to the pause.

We've had a few pieces of economic news this morning. First, the Fed is set to vote on Basel III this morning. While significantly watered down, it could still be construed as a speed bump on the road to global financial domination.

Also, Census released the factory orders survey for May. The managed (a.k.a. seasonally adjusted) version came in slightly higher than expected, at +2.1% versus 2.0% consensus and 1.3% for April.

There is bound to be some concern that the slight beat undermines support for QE (does anything else matter?)

This explains why the less-managed, de-emphasized, and not seasonally adjusted number, at +5.4% month-over-month, is the better number for a change. Remember the good old days when they massaged the numbers to make things look better?