It's entirely likely the market will remain comatose for the next two

days until the German constitutional court decision on the 12th and/or

the FOMC announcements/press conference on the 13th. IMHO, QE3 is very

much baked into current prices; though, we should get at least a nice

little pop if the central planners deliver as expected.

If not,

expect a sizable sell-off unless Bernanke is able to let us down so easy

as keep hopes very high ("we are postponing QE until October 12, at

which point we will buy every POS bond in sight.") It's really that

simple -- which, of course, renders both fundamental and technical

analysis meaningless in the short run and turns any long/short decisions

made today into a veritable coin toss.

The

German court situation is similar. Draghi's jawboning worked

exceptionally well last week, producing a single-day 2.5 cent euro-bump

versus the dollar that left it

at least short-term overbought. If, after adjusting their hats, the BVerfG reign (sic) on Draghi's

parade, look for the overbought euro to become oversold

sehr schnell.

I

have no special insight into either event. Though, as I wrote last

week, Dow Jones put out an interesting statistic last week regarding

employment data: over the past 28 years, the August NFP stats have

missed expectations 3/4 of the time. For the past 10 years, the average

adjustment after the fact is 62K.

Not that I think the Fed

harbors any illusions about QE actually addressing the stifling

unemployment in this country (yes, I'm cynical), but if they're

attempting to at least make it look good...this

might play into

their decision. Their vastly greater concern is a stock market running

on fumes and unbelievably leveraged banks whose solvency hinges on

perpetuating the myth that their trillions in derivatives aren't a bad

hair day away from implosion [see:

The Wipeout Ratio.]

Then,

there's the small matter of the election only eight weeks away from

tomorrow. The Republicans have stepped up Fed-centric rhetoric of late,

practically guaranteeing an Eccles Building house cleaning if elected

(though I suspect they're only trying to entice Paulies into the tent.)

At

the end of the day, the Fed is at least as concerned with

self-preservation as any other body politic. After throwing "We the

People" under the bus for their friends on Wall Street, it's hard to

imagine them falling on their swords

now for the sake of the economy (did I mention I'm a cynical bastard?)

As

I perused the financial press over the weekend (anything to avoid doing

my taxes), the euro zone's financial melt-down dominated. Criticism

abounded, with a common theme being how much better America has handled

the crisis. While our friends across the Atlantic face many structural

and governance challenges, the real difference between our fates has

been the willingness of our politicians to spend $16 trillion more than

they've taken in and our central bankers to stymie the natural market

response -- i.e., soaring interest rates.

Then, there's the minor

fact that the USD is still the world's reserve currency. As a wise

friend of mine likes to say, until we go full barter and I start making

your kids shoes in exchange for your extra chicken, it'll remain so --

even after we tumble over the fiscal cliff (we can't really expect them

to "fix" that in the months leading up to an election, can we?)

This

is where things get really interesting. The stock market's ramp to new

highs has taken our collective minds off the calamitous impact that a

severe spending decrease and/or tax increase will have on our economy.

As our predicament comes home to roost, the (continuing) recession will

finally be obvious to all. Even if, by some miracle, Bernanke can

muster enough spit and bailing wire to keep the markets from crashing,

it's not entirely up to him.

George Soros argued earlier today

that Germany and the rest of the euro zone are heading for a Depression

within the next six months. Draghi and Merkel's solid Eddie Murphy

impression notwithstanding (

Keep it together! Keep it together! Keep it together!),

the weakened and over-leveraged US economy will no doubt follow suit.

Maybe the Fed will go down swinging, throwing good money after bad, and

maybe not. But, it will make a difference only in when and how -- not

whether -- the markets will collapse.

In

1923, Dr. W. Frederick Gerhardt, head of Aeronautical Engineering at

the University of Michigan reasoned that since wings provide lift, more

wings would provide more lift. He built a beautiful aircraft known as

the Cycleplane that featured a total of seven wings. It even flew a few

times. But, it's best known for the time it was being pushed along the ground and the

contraption collapsed under its own weight.

Which brings us back to QE... As we've discussed many times in these pages over the past year, the solution for too much debt isn't more debt and higher inflation. There

will

be a point of recognition, sometime between now and December 31, when

capital markets begin to reflect this very simple math. And, the economic shock will

be too great for even the Fed to mitigate.

When that happens, the

rush to the exits will be swift and severe. But, until then, we'll do

our best to navigate the twists and turns -- making the best of markets

that are showing few signs of rational behavior.

Stay tuned.

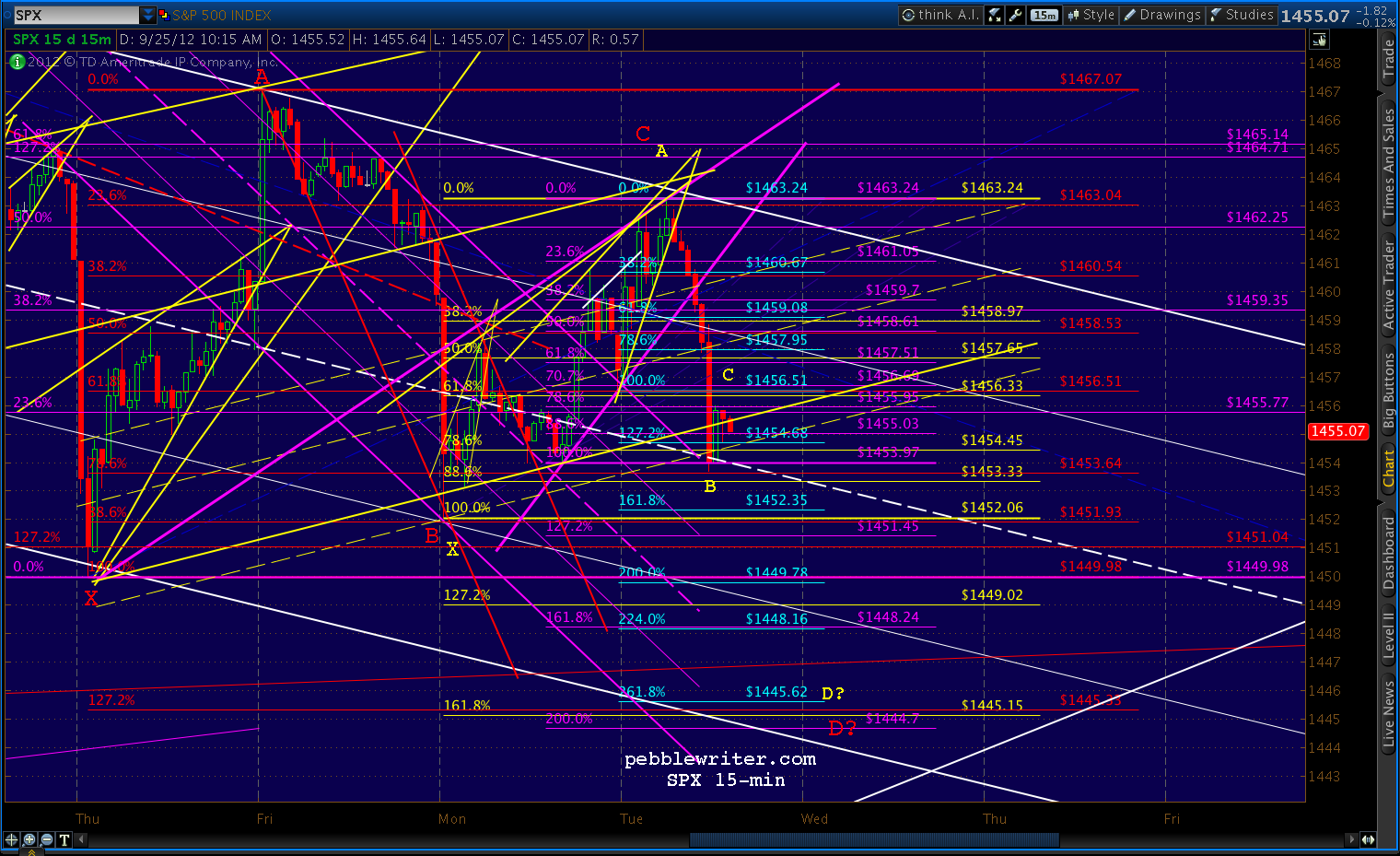

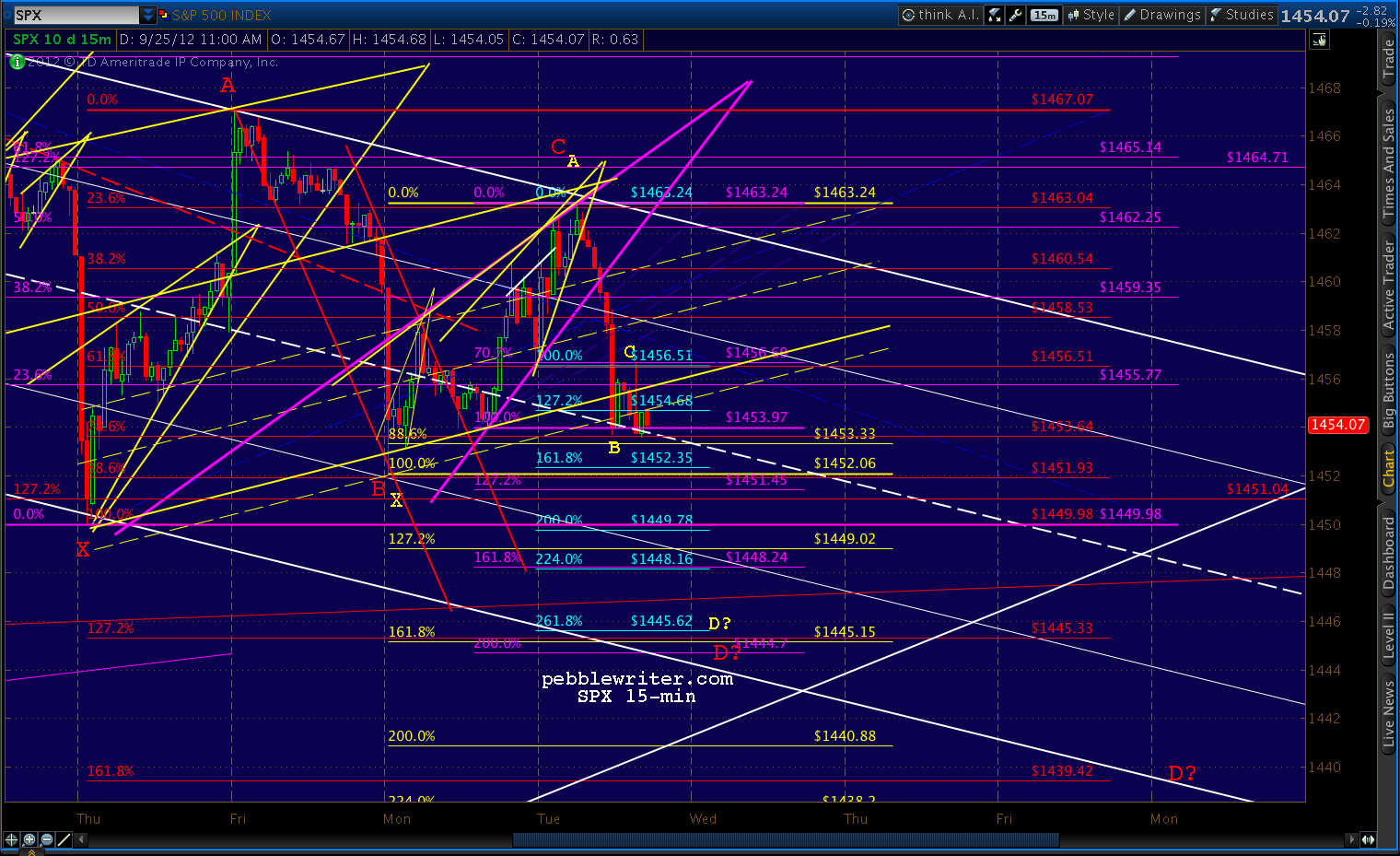

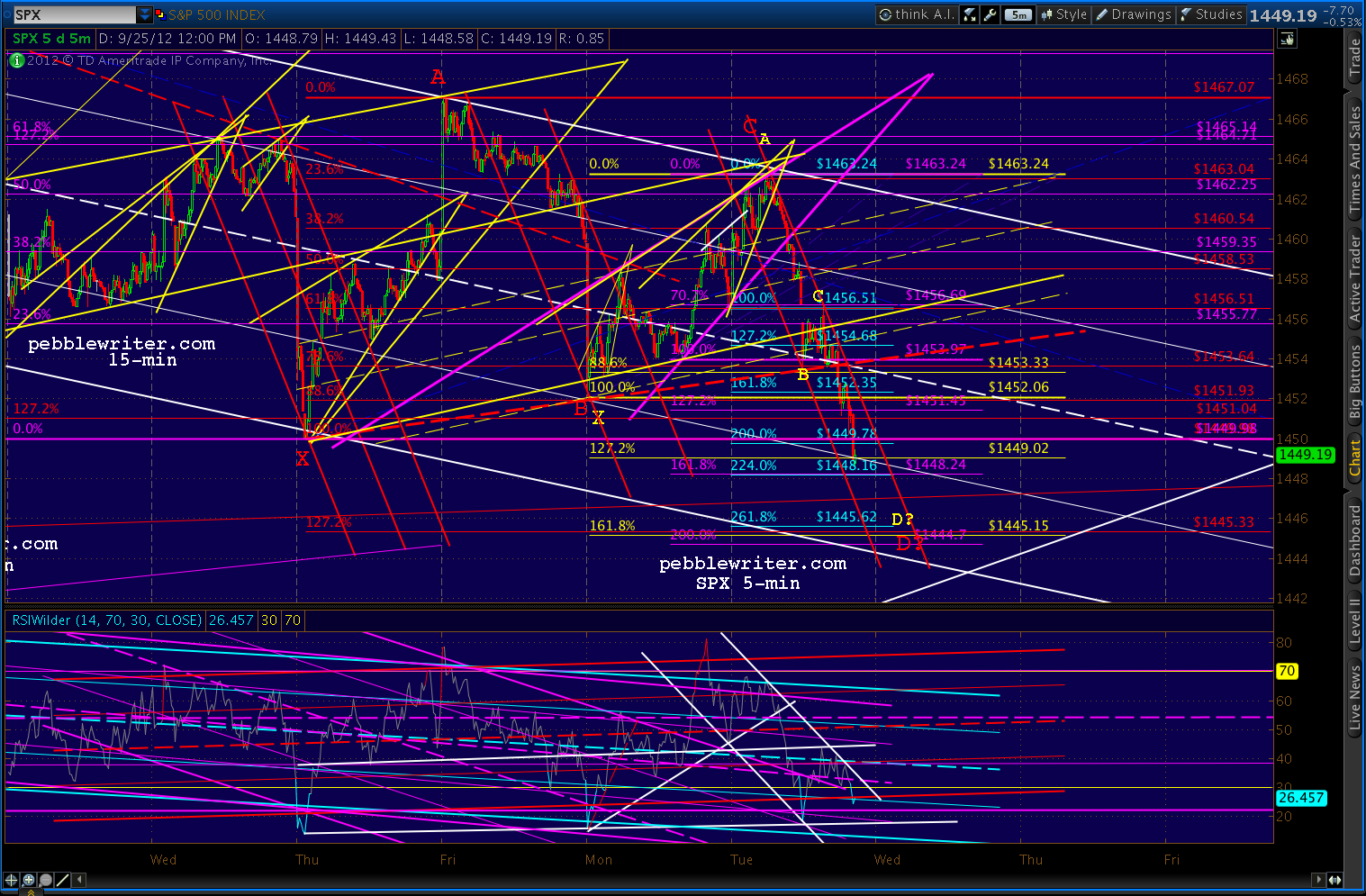

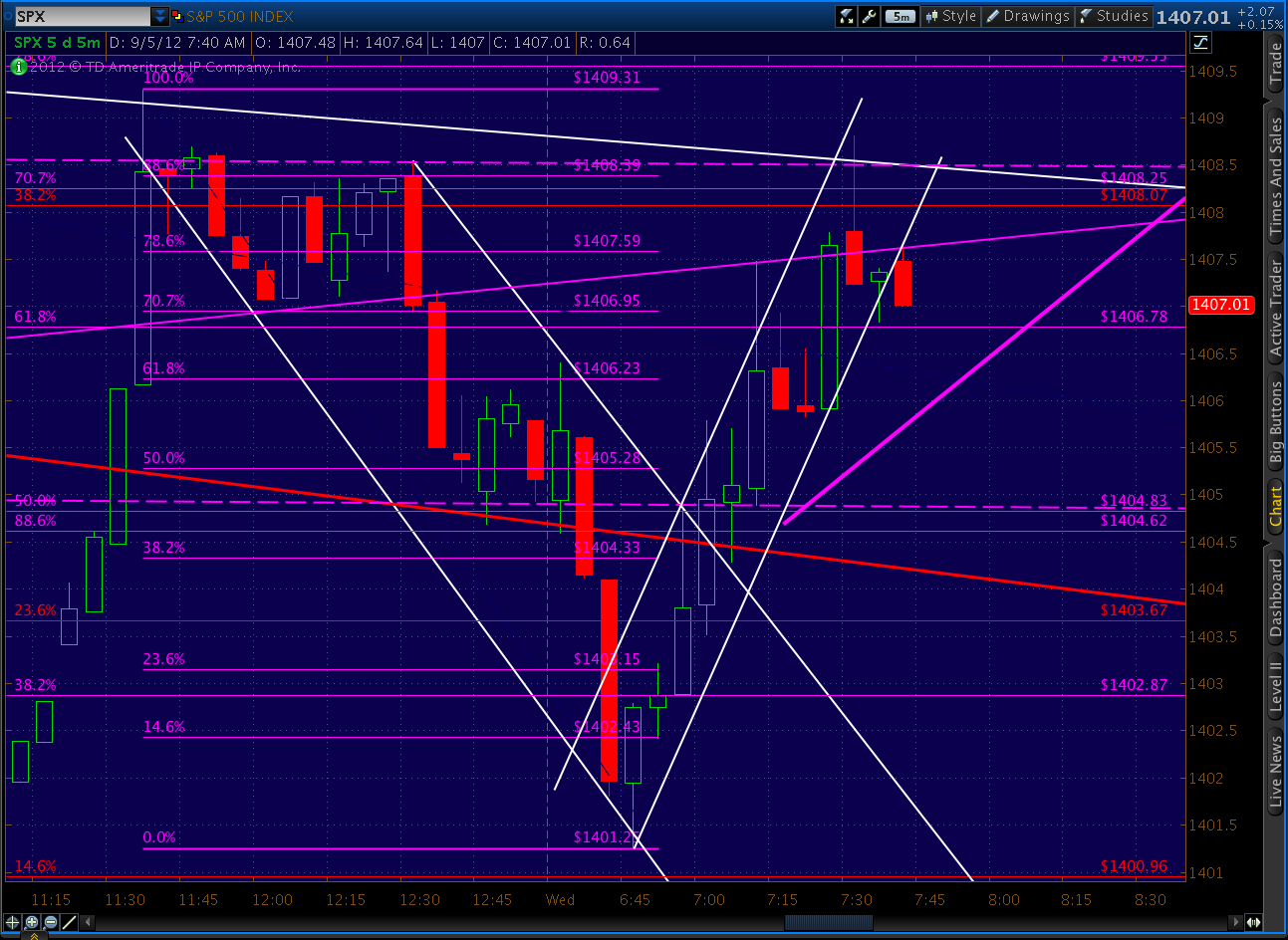

UPDATE: 12:00 PM

Taking

a little short position here at 1235, with a trailing stop of 1235 if

the break of the 60-min RSI TL plays out. Probably won't go anywhere,

but you never know. Maybe the Soros comments will rattle some folks.

Made

an interesting discovery in EURUSD this morning. The RSI level of

73.108 reached Friday is relatively rare. It presaged several decent

corrections over the years -- the most recent being April 28 - May 3,

2011 when the market topped at 1370.

Eight out of the past 10 instances were followed by SPX drops of 50 points or more -- typically within 2-3 weeks.

UPDATE: 3:20 PM

Adjusting my stop to 1434.

UPDATE: 3:55 PM

Taking profits on the bulk of my shorts at 1439.30; will leave a small flyer position in place.

UPDATE: EOD

What

a crazy day! As I was writing about the inevitable demise of the

economy as we know it, the market started slipping. Pretty soon we had

broken an important supportive TL on the 60-min RSI -- usually a clear

sign of at least a little slide in prices.

I paused my

pontificating to put out a trade alert, and found out that apparently

everyone at GoDaddy went out to lunch at the same time, leaving no one

to pedal the generator that keeps millions of sites open.

No

sooner had I sent an email version of the post and trade alert re my

short at 1435, when I realized the email servers were down, too. I

switched to an old Gmail account and sent it out via email; hopefully,

everyone got one. I was a tad early, as it took a while for investors

to believe that a dip was being allowed in the days leading up to

Bernanke's press conference (Thursday.)

Fortunately, there was

plenty of remaining movement over the next hour or so and we were able

to ring up another 6 points to the good. Any other time, I'd stay

full-on short into the close and overnight. There is a strong case for

continued weakness. But, given the proximity of the German court

decision on the ESM and the FOMC meeting, I'm continuing to play it

safe. I kept a smallish position overnight, but took profits on the

majority of my shorts. Unless something changes, I'll resume

directional/swing trading again after Bernanke's speech on the 13th.

Regarding the GoDaddy issue: it continues to go down periodically. As of a few

minutes ago, the mail servers are still down but the others are up. There's

nothing I can do in the short run other than send out email versions of

each post and repost to the old pebblewriter.blogspot.com address on

Blogger.

* * * * * * * *

THE CONTEST

Just for grins, lets give away

some

pebblewriter.com memberships. Since we're likely to have some fireworks this week,

I'm curious as to what folks are expecting. From now through 6pm EDT

on the 11th, submit your best guess as to the closing quote for the SPX

on September 13th. One entry only, please, and verified Disqus ID's

only. Use

this link for all entries.

Prizes are as follows:

closest to the mark: one year membership

2nd closest: semi-annual membership

3rd closest: quarterly membership

First come, first served. Once a particular number is posted, no one else may chose it. I'll do my best to police these, but it's up to you to do your homework first.

And, while you're at it, impress us with the logic behind your

reasoning. I have some monthly membership awards to hand out for

overwhelming brilliance, creativity or humor.

If you're

already a member, you may use your award to extend your current

membership or give it away to your favorite charity or a close friend.

All winners are responsible for any taxes, etc. on their winnings, and

entries are void where prohibited.

If Disqus eats your entry,

use the "contact me" form in the menu above and I'll post it for you as

soon as I notice it. Just to be on the safe side, you could also copy

me at pebblescribe at gmail dot com. Who knows when/if GoDaddy will get

things going again?

Good luck to all.

p.s. remember, make all entries

here.