Recently, a reader asked if I had an opinion on NFLX. As someone who wrote Reed Hastings not once, but twice, when he "improved" Netflix, I definitely had an opinion. But, I set aside my personal feelings and what I knew of the company's financial situation and focused instead on the charts.

The following is an excerpt from a post on July 18, a full week before their earnings were to be announced [see: Baby Steps.]

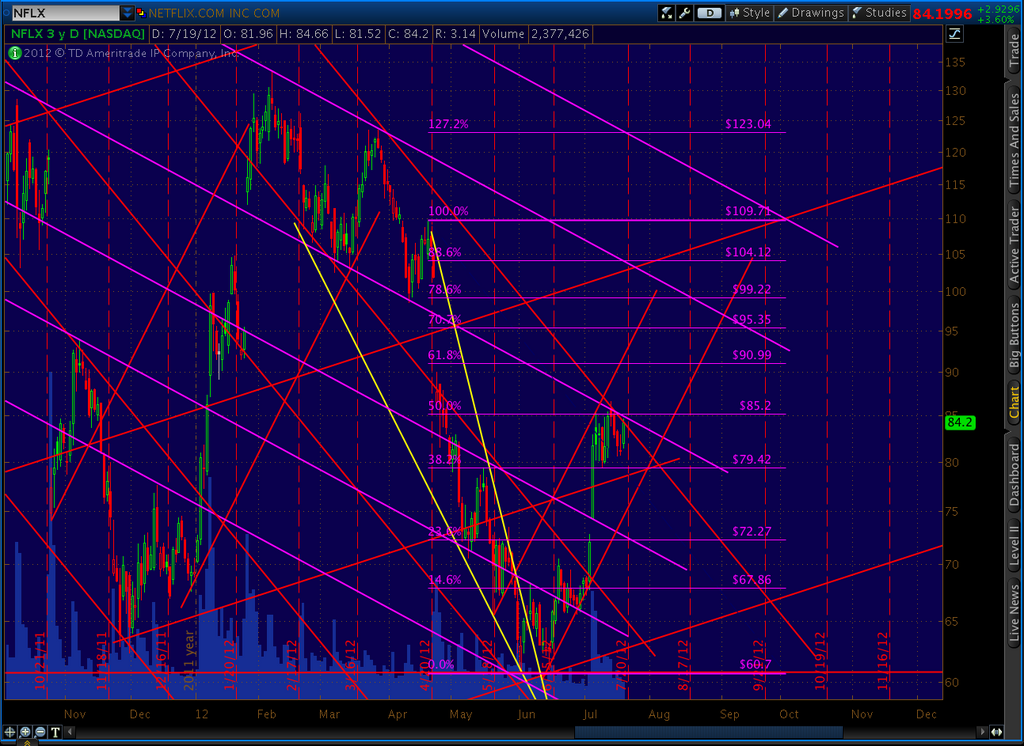

We turn our attention to NFLX. The stock rose from 2.40 to over 300 from 2002 to 2011. Then it fell spectacularly to 60 inside of 10 months. How do you forecast something like that? Well, as it turns out, NFLX has done an excellent job of obeying its long-term channel lines.

Whenever

it fell out of one channel, there was usually another TL exerting

influence, such as the parallel lines and the big descending triangle.

But, not every move was well-signaled.

It’s easier now, looking back at the major channels, but in the early days of the top and decline, these channels were in their infancy and not very discernible.

Presently, NFLX is at the intersection of three different channels. It’s meeting resistance from both the red and purple declining channels that are several years old, while moving upwards through a small bullish channel (also in red.)

In general, I favor older, bigger channels over the little whippersnappers. In a battle of wills, go with the brute. And, there’s obviously some consolidation going on right here at the .500 Fib level — not normally a trend stopper.

If I had to guess, I’d say NFLX is going to obey the large red channel and pull back here. There’s plenty of room to the downside that would require no special magic whatsoever. It could even stay in the little red channel (keeping the upside alive) and fall as far as 76.

It would make a great place from which to start a fresh drive upwards and potentially out of the bigger channels — perhaps driving toward a Bat pattern completion at the .886 Fib level of 104. But, if the market falls apart, it would simply continue on down with just about every other stock.

So, if I were inclined to play NFLX, I’d be thinking about a downside bet here -- but would definitely put in a stop just above the previous high of 86.65. I’d probably take some profits at the bottom of the little channel and let the rest ride — especially if the overall market is melting down — utilizing trailing stops along the way.

Fundamental analysts will attribute NFLX's plunge to a poor earnings report. But, in actuality, NFLX had already shown its hand via these chart patterns a full week in advance.

Those who read the writing on the wall (or on pebblewriter.com) and bought puts or shorted at 84 made a lot of money. How do I know? As one member wrote a few minutes after the announcement:

p.s. to anyone else who also made a lot of money on that call and wants to send a thank-you note... just engrave "thanks, pebblewriter!" on the back of a black iPad with retina display and ultrafast 4G LTE, 64GB of memory and wifi/cellular and send it my way.

p.p.s. in case you thought I was kidding...

p.p.p.p.s. why in the world are you still reading this drivel? Go sign up, already!

The following is an excerpt from a post on July 18, a full week before their earnings were to be announced [see: Baby Steps.]

* * * * * * * *

We turn our attention to NFLX. The stock rose from 2.40 to over 300 from 2002 to 2011. Then it fell spectacularly to 60 inside of 10 months. How do you forecast something like that? Well, as it turns out, NFLX has done an excellent job of obeying its long-term channel lines.

It’s easier now, looking back at the major channels, but in the early days of the top and decline, these channels were in their infancy and not very discernible.

Presently, NFLX is at the intersection of three different channels. It’s meeting resistance from both the red and purple declining channels that are several years old, while moving upwards through a small bullish channel (also in red.)

In general, I favor older, bigger channels over the little whippersnappers. In a battle of wills, go with the brute. And, there’s obviously some consolidation going on right here at the .500 Fib level — not normally a trend stopper.

If I had to guess, I’d say NFLX is going to obey the large red channel and pull back here. There’s plenty of room to the downside that would require no special magic whatsoever. It could even stay in the little red channel (keeping the upside alive) and fall as far as 76.

It would make a great place from which to start a fresh drive upwards and potentially out of the bigger channels — perhaps driving toward a Bat pattern completion at the .886 Fib level of 104. But, if the market falls apart, it would simply continue on down with just about every other stock.

So, if I were inclined to play NFLX, I’d be thinking about a downside bet here -- but would definitely put in a stop just above the previous high of 86.65. I’d probably take some profits at the bottom of the little channel and let the rest ride — especially if the overall market is melting down — utilizing trailing stops along the way.

* * * * * * * *

Fundamental analysts will attribute NFLX's plunge to a poor earnings report. But, in actuality, NFLX had already shown its hand via these chart patterns a full week in advance.

Those who read the writing on the wall (or on pebblewriter.com) and bought puts or shorted at 84 made a lot of money. How do I know? As one member wrote a few minutes after the announcement:

You, sir, just made me a lot of money!

Anyone with an internet connection can get daily access to pebblewriter.com for the price of a latte. But, there's a catch. The deal is only good through Friday, when the celebration is over and higher annual prices kick in.

We're celebrating our 2nd quarter success (+37%) by offering a 37% discount on annual memberships to the next 37 folks who join up. As of this afternoon, there are only 11 left. To join up, simply head over to pebblewriter.com and click on the annual membership button. Be sure to enter the discount code SAVE37 when you join.

p.s. to anyone else who also made a lot of money on that call and wants to send a thank-you note... just engrave "thanks, pebblewriter!" on the back of a black iPad with retina display and ultrafast 4G LTE, 64GB of memory and wifi/cellular and send it my way.

p.p.s. in case you thought I was kidding...

p.p.p.s. okay, I didn't actually cancel. It was an empty threat. I assumed he wouldn't care one way or the other. But, I made enough money buying puts to pay for a subscription for many, many years!

p.p.p.p.s. why in the world are you still reading this drivel? Go sign up, already!

No comments:

New comments are not allowed.