~reposted from pebblewriter.com

As Ben Bernanke scolds Congress for how pitiful a job they've done on fiscal policy, SPX has staged an important break out.

Daily

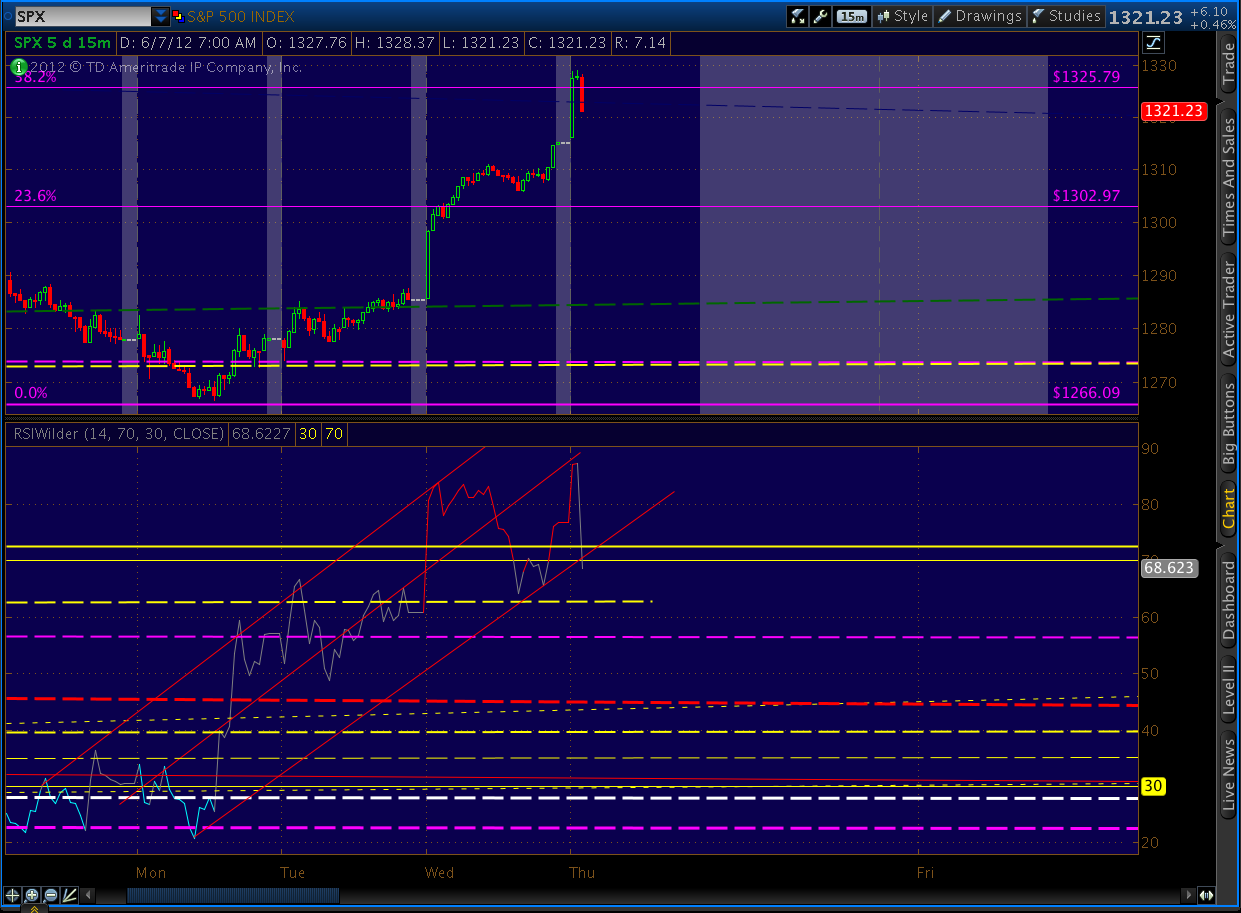

RSI broke out of the channel that goes back to January. It has done a

phenomenal job of providing guidance, and a clean break out is unlikely

to occur without at least a back test. If fact, don't be surprised if

RSI closes back within the channel, given that we've just reached the

.382 Fib level.

Of course, it's ALL up for grabs in the event Bernanke actually tips his hand -- beyond "we have lots of options" and "all options are on the table." Let's see if we can make some sense of the path forward.

A break of the shorter-term RSI channels/TLs will signal at least a tradeable pullback -- a logical place for traders to take short term profits and/or play the pause. Longer term investors and traders alike would do well to keep their stops at levels at which they can sleep at night. But, in general, a drop below 1300 would signal trouble for the upside.

I took profits this morning around 1325 based on the 15-minute chart and will watch for any pullback to run out of steam before jumping back in -- but will likely wait no later than 1328. My top case is a pullback to 1303.47 before heading higher, but it's entirely possible we won't make it that low before bouncing back.

BTW, if you're watching BB on CNBS but are tired of the constant commercial breaks, CSPAN has a wonderful, commercial-free broadcast streaming here.

UPDATE: 12:00 PM

Not much new in the Bernanke testimony. I did enjoy his exchange with Jim DeMint of South Carolina. DeMint opined that since the Fed has purchased about 75% of new debt issued by the federal government, we've had much lower interest rates than would otherwise be the case -- currently around 2%.

DeMint mangled the question, but Bernanke's answer came very close to the truth that the politicians seem to be ignoring.

Bernanke's answer was that interest costs were the least of our problems when we're adding over a trillion dollars per year to the outstanding balance.

They're both right, and they're both wrong.

DeMint's math is correct; higher rates would be a problem. Because, the $100 billion annual interest we now pay would soar to $400 billion if rates returned to long-term averages. An annual expense of $400 billion starts to crowd out such line items as medicare, social security and the national defense.

But, his grasp of markets is not so hot. Sure, it helps to have a committed buyer with unlimited funds when you're peddling debt of any kind. But, it helps even more to have a dearth of acceptable alternatives. You and I can bury money in the back yard, but that's not really an option when you're a bank, insurance company or pension plan with tens or hundreds of billions to invest.

Bernanke is quite right in that the size of our budget deficit is so huge that $100 billion isn't going to make us or break us. Of course, $200 billion is a little worse. And, $500 billion is worse yet. And, so forth and so on. As any frog lounging in a pot of boiling water will tell you, there will come a moment of truth.

UPDATE: 3:45 PM

The sell call at 1325 proved timely, and we scored a quick 39-pt gain since our last buy signal.

As suggested in this morning's first post, SPX pulled back to the point where RSI is back within the daily channel -- a very significant development.

The question now is "what's next?" For timely analysis as it happens, log on to pebblewriter.com.

Not a member yet? No worries. Due to popular demand, monthly memberships are now available. Convert to an annual membership within the first 30 days, and we'll rebate your first month's dues. For more info, click here.

As Ben Bernanke scolds Congress for how pitiful a job they've done on fiscal policy, SPX has staged an important break out.

Of course, it's ALL up for grabs in the event Bernanke actually tips his hand -- beyond "we have lots of options" and "all options are on the table." Let's see if we can make some sense of the path forward.

A break of the shorter-term RSI channels/TLs will signal at least a tradeable pullback -- a logical place for traders to take short term profits and/or play the pause. Longer term investors and traders alike would do well to keep their stops at levels at which they can sleep at night. But, in general, a drop below 1300 would signal trouble for the upside.

I took profits this morning around 1325 based on the 15-minute chart and will watch for any pullback to run out of steam before jumping back in -- but will likely wait no later than 1328. My top case is a pullback to 1303.47 before heading higher, but it's entirely possible we won't make it that low before bouncing back.

BTW, if you're watching BB on CNBS but are tired of the constant commercial breaks, CSPAN has a wonderful, commercial-free broadcast streaming here.

UPDATE: 12:00 PM

Not much new in the Bernanke testimony. I did enjoy his exchange with Jim DeMint of South Carolina. DeMint opined that since the Fed has purchased about 75% of new debt issued by the federal government, we've had much lower interest rates than would otherwise be the case -- currently around 2%.

DeMint mangled the question, but Bernanke's answer came very close to the truth that the politicians seem to be ignoring.

"I would question whether or not low interest rates are, in some way, enabling fiscal deficits. The deficit over the past few years has been over a trillion dollars a year, as you know, about 9% of GDP. If we were to raise interest rates by a full percentage point, and ignoring the fact that most debt is of longer duration and would not reprice, that would still only raise the annual deficit by something a little over $100 billion....The deficits are so large, particularly going out the next few years, irrespective of the level of interest rates, I would think that Congress would have plenty of motivation to try and address that. And, whether interest rates are currently 1 1/2% for ten years or 2 1/2% just doesn't make that much difference."DeMint was trying to say that if interest rates were not suppressed by the Fed's actions, treasury yields would be much higher. And, then, we'd really be up a creek.

Bernanke's answer was that interest costs were the least of our problems when we're adding over a trillion dollars per year to the outstanding balance.

They're both right, and they're both wrong.

DeMint's math is correct; higher rates would be a problem. Because, the $100 billion annual interest we now pay would soar to $400 billion if rates returned to long-term averages. An annual expense of $400 billion starts to crowd out such line items as medicare, social security and the national defense.

But, his grasp of markets is not so hot. Sure, it helps to have a committed buyer with unlimited funds when you're peddling debt of any kind. But, it helps even more to have a dearth of acceptable alternatives. You and I can bury money in the back yard, but that's not really an option when you're a bank, insurance company or pension plan with tens or hundreds of billions to invest.

Bernanke is quite right in that the size of our budget deficit is so huge that $100 billion isn't going to make us or break us. Of course, $200 billion is a little worse. And, $500 billion is worse yet. And, so forth and so on. As any frog lounging in a pot of boiling water will tell you, there will come a moment of truth.

UPDATE: 3:45 PM

The sell call at 1325 proved timely, and we scored a quick 39-pt gain since our last buy signal.

As suggested in this morning's first post, SPX pulled back to the point where RSI is back within the daily channel -- a very significant development.

Not a member yet? No worries. Due to popular demand, monthly memberships are now available. Convert to an annual membership within the first 30 days, and we'll rebate your first month's dues. For more info, click here.

No comments:

Post a Comment