~ reposted from pebblewriter.com

UPDATE: 11:30 AM

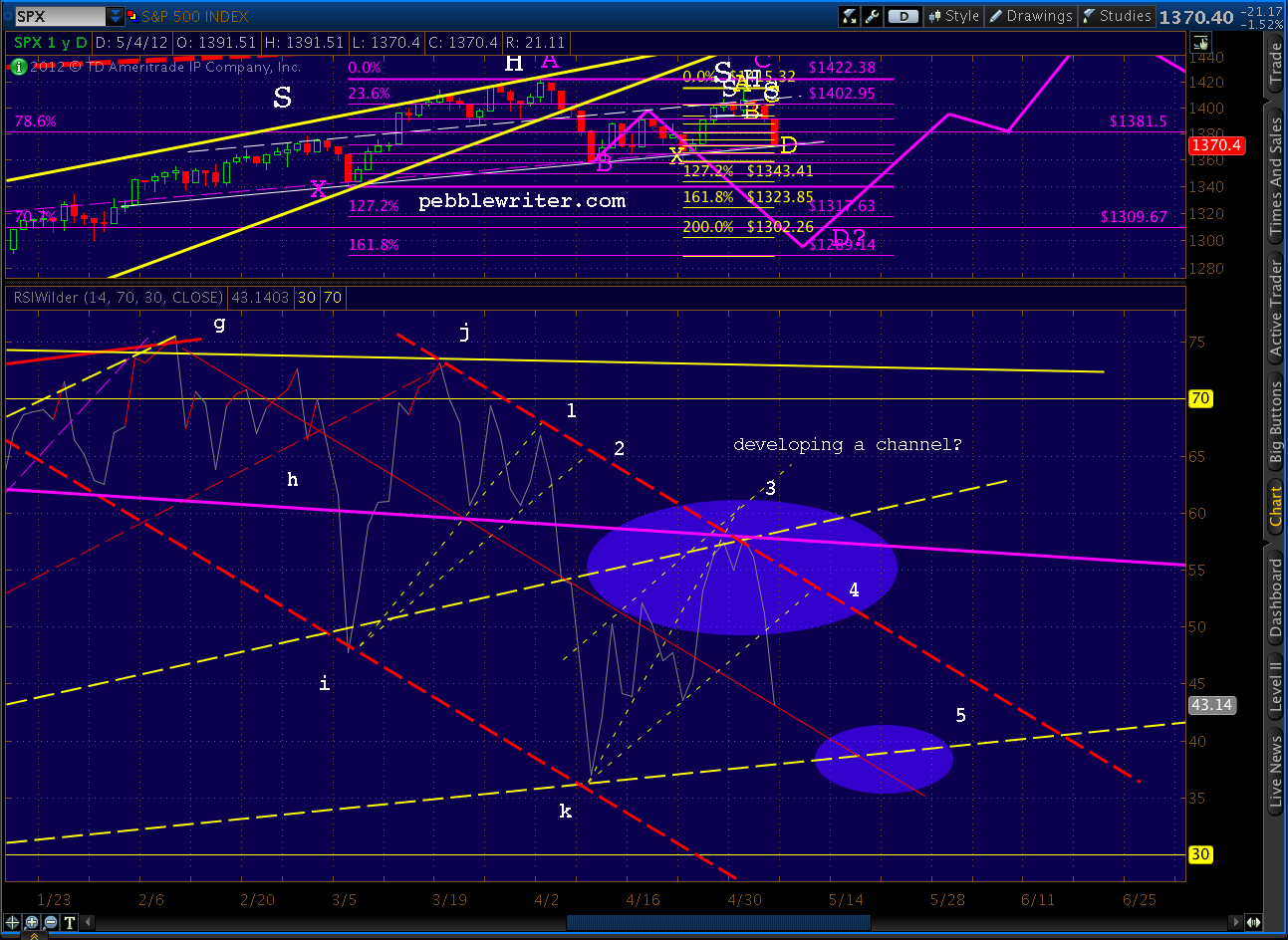

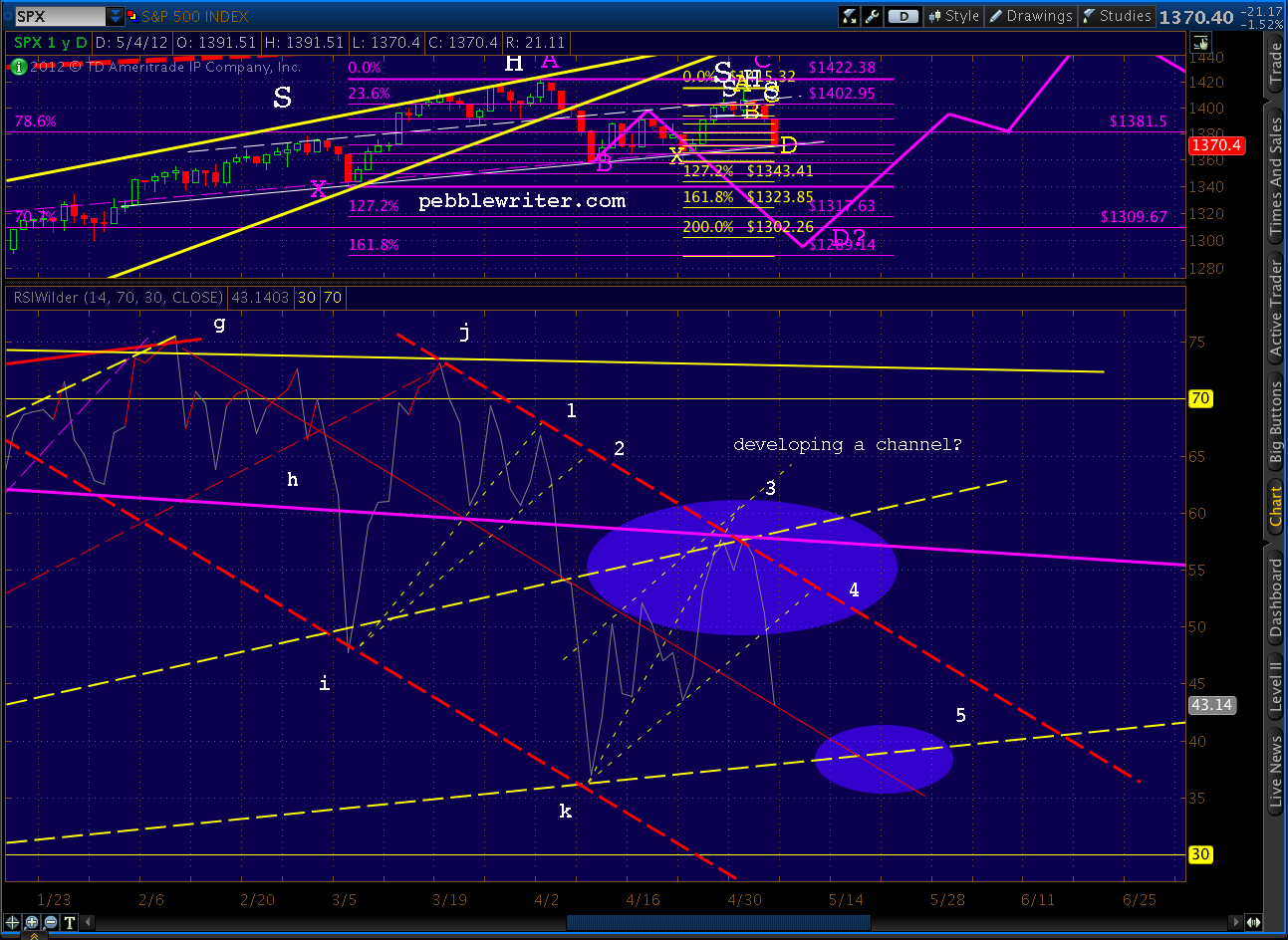

I feel pretty good about my downside (primary) case now that things are moving along. I mentioned back on April 25 [see: Bulls Fight Back] that we needed to start down by Wednesday in order for the larger H&S to maintain some time proportionality between shoulders. We got our reversal Tuesday, and have been moving down since.

Also, check out the RSI and MACD on the chart below. RSI broke the little fan line I threw up a few days ago, and has no support until it hits line k-5 -- presumably below 1370. MACD just saw a bearish cross and is approaching the center line. Note, also, that SPX has fallen below its 10, 20 and 50-day SMAs. The only remaining moving averages to offer support are the SMA100 (at 1342) and the 200, way down at 1276.

I've already seen a few Fed comments, talking up the economy, employment, etc. And, SPX is pausing here at the neckline. I assume that even the most fundamentally oriented and/or manipulative powers that be have a smart technical analyst on staff who explains to their bosses what happens when various patterns play out.

So, there's always a struggle at key moments like this. It's interesting, all the same, that if we look very hard at all, we can find chart patterns that provide rationale for the price movements. Here, at the neckline, we can see that RSI has also reached a midline of sorts in the channel we've been following.

If we break the neckline, look for that back test somewhere around 1364 mentioned below. After that, not much support till 1340, and then 1323.

UPDATE: 11:15 AM

Here's the big picture, again. The larger H&S, which completed but didn't play out on Apr 23, is back in play. If we can close beneath 1370, we'll have a crack at a complex H&S pattern (two shoulders on each side) that targets the low 1300s.

The harmonic picture supports this, by the way. If the H&S plays out, the little Bat pattern (yellow) under construction becomes a Crab pattern. These typically extend to the 1.618, but can go further (2.000, 2.24, 2.618, etc.)

The larger purple pattern - a Butterfly - completes at 1317 (the 1.272) or 1289 (the 1.618.) Hence, my call for a downside of 1295-1323.

ORIGINAL POST: 10:30AM

The Bat, Crab and H&S patterns are doing their thing, and we're fast approaching the target we set yesterday of 1372. That was an interim target of course, because if we complete the larger Head & Shoulders target (again), the potential downdraft is to 1295-1323.

I'm refining the larger H&S completion target to 1370.73 and the nominal target to 1300.

The .886 Bat pattern retracement of the 1358-1415 rise from Apr 20 to May 1 indicates a turn at 1365.23. So, if the pattern is to play out, that would be an excellent place for a back test to commence.

Of course, TPTB will attempt to turn it again. Cue the talking heads, or QEeak from deep inside the Fed that will attempt to turn the tide before it's too late.

UPDATE: 11:30 AM

I feel pretty good about my downside (primary) case now that things are moving along. I mentioned back on April 25 [see: Bulls Fight Back] that we needed to start down by Wednesday in order for the larger H&S to maintain some time proportionality between shoulders. We got our reversal Tuesday, and have been moving down since.

Also, check out the RSI and MACD on the chart below. RSI broke the little fan line I threw up a few days ago, and has no support until it hits line k-5 -- presumably below 1370. MACD just saw a bearish cross and is approaching the center line. Note, also, that SPX has fallen below its 10, 20 and 50-day SMAs. The only remaining moving averages to offer support are the SMA100 (at 1342) and the 200, way down at 1276.

I've already seen a few Fed comments, talking up the economy, employment, etc. And, SPX is pausing here at the neckline. I assume that even the most fundamentally oriented and/or manipulative powers that be have a smart technical analyst on staff who explains to their bosses what happens when various patterns play out.

So, there's always a struggle at key moments like this. It's interesting, all the same, that if we look very hard at all, we can find chart patterns that provide rationale for the price movements. Here, at the neckline, we can see that RSI has also reached a midline of sorts in the channel we've been following.

If we break the neckline, look for that back test somewhere around 1364 mentioned below. After that, not much support till 1340, and then 1323.

UPDATE: 11:15 AM

Here's the big picture, again. The larger H&S, which completed but didn't play out on Apr 23, is back in play. If we can close beneath 1370, we'll have a crack at a complex H&S pattern (two shoulders on each side) that targets the low 1300s.

The harmonic picture supports this, by the way. If the H&S plays out, the little Bat pattern (yellow) under construction becomes a Crab pattern. These typically extend to the 1.618, but can go further (2.000, 2.24, 2.618, etc.)

The larger purple pattern - a Butterfly - completes at 1317 (the 1.272) or 1289 (the 1.618.) Hence, my call for a downside of 1295-1323.

ORIGINAL POST: 10:30AM

The Bat, Crab and H&S patterns are doing their thing, and we're fast approaching the target we set yesterday of 1372. That was an interim target of course, because if we complete the larger Head & Shoulders target (again), the potential downdraft is to 1295-1323.

I'm refining the larger H&S completion target to 1370.73 and the nominal target to 1300.

The .886 Bat pattern retracement of the 1358-1415 rise from Apr 20 to May 1 indicates a turn at 1365.23. So, if the pattern is to play out, that would be an excellent place for a back test to commence.

Of course, TPTB will attempt to turn it again. Cue the talking heads, or QEeak from deep inside the Fed that will attempt to turn the tide before it's too late.

Looking good from the bear bunker ;)

ReplyDelete--

I would think the only issue is how well can the bears time an exit..or at least use 'reasonable' stops to get kicked out before the next main up cycle.

Surely 1340 is now a given, easy money for the bears. Tricky issue is whether anything lower than 1325/00. I am looking at that 200 day MA too..it certainly would be the natural flash/level - much like May '2010. Just something to keep in mind, in case the algo-bots get upset.

I'm really looking forward to Monday, I realise you're not going to be here much anymore, but...if we get down to sp'1150/00 sometime this summer...I'd hope for a hello around there :)

Have a good weekend!